Question: i neet help with these questions.. Startech Surveillance Services had the following adjustments as of the end of the year. (Click the icon to view

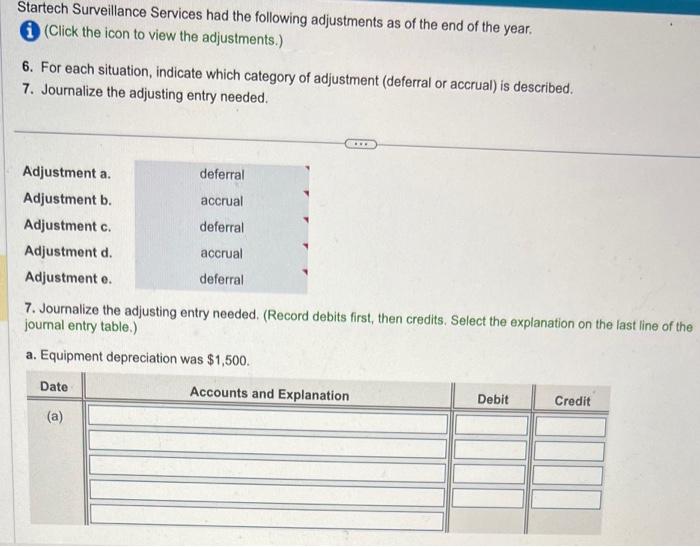

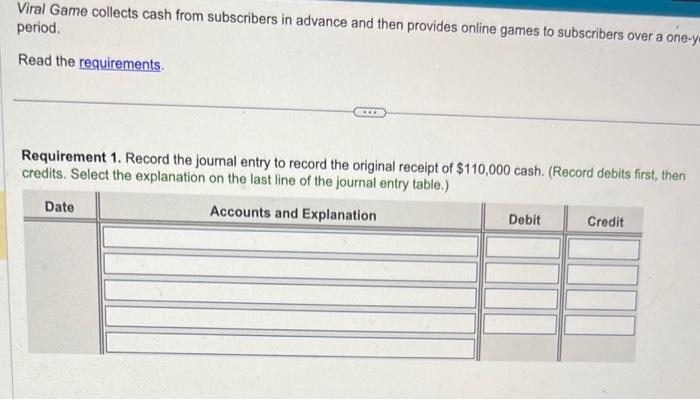

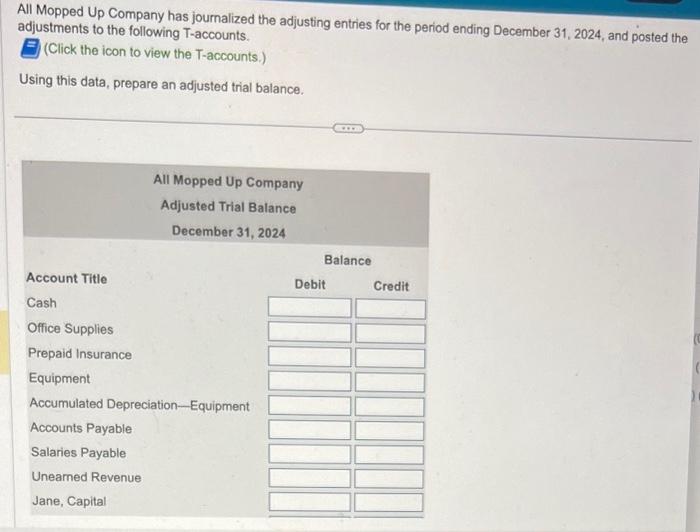

Startech Surveillance Services had the following adjustments as of the end of the year. (Click the icon to view the adjustments.) 6. For each situation, indicate which category of adjustment (deferral or accrual) is described. 7. Journalize the adjusting entry needed. 7. Journalize the adjusting entry needed. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) a. Equipment depreciation was $1,500. Viral Game collects cash from subscribers in advance and then provides online games to subscribers over a one-y period. Read the requirements. Requirement 1. Record the joumal entry to record the original receipt of $110,000 cash. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) All Mopped Up Company has journalized the adjusting entries for the period ending December 31,2024, and posted the adjustments to the following T-accounts. (Click the icon to view the T-accounts.) Using this data, prepare an adjusted trial balance. Startech Surveillance Services had the following adjustments as of the end of the year. (Click the icon to view the adjustments.) 6. For each situation, indicate which category of adjustment (deferral or accrual) is described. 7. Journalize the adjusting entry needed. 7. Journalize the adjusting entry needed. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) a. Equipment depreciation was $1,500. Viral Game collects cash from subscribers in advance and then provides online games to subscribers over a one-y period. Read the requirements. Requirement 1. Record the joumal entry to record the original receipt of $110,000 cash. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) All Mopped Up Company has journalized the adjusting entries for the period ending December 31,2024, and posted the adjustments to the following T-accounts. (Click the icon to view the T-accounts.) Using this data, prepare an adjusted trial balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts