Question: I never claimed tax because I never work and from that I claimed with my parents 5 years ago until now (we came to US

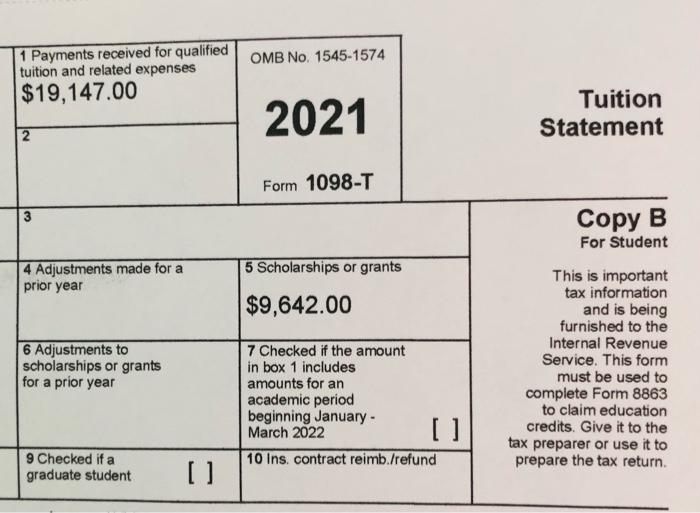

OMB No. 1545-1574 1 Payments received for qualified tuition and related expenses $19,147.00 2021 Tuition Statement 2 Form 1098-T 3 4 Adjustments made for a prior year 5 Scholarships or grants $9,642.00 Copy B For Student This is important tax information and is being furnished to the Internal Revenue Service. This form must be used to complete Form 8863 to claim education credits. Give it to the tax preparer or use it to prepare the tax return. 6 Adjustments to scholarships or grants for a prior year 7 Checked if the amount in box 1 includes amounts for an academic period beginning January - March 2022 0 10 Ins, contract reimb./refund 9 Checked if a graduate student []

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts