Question: I Normal 1 No Spac... Heading 1 Heading Styles Paragraph Place Letter of the Correct Answer in the Column Right of the Question A. Liquidity

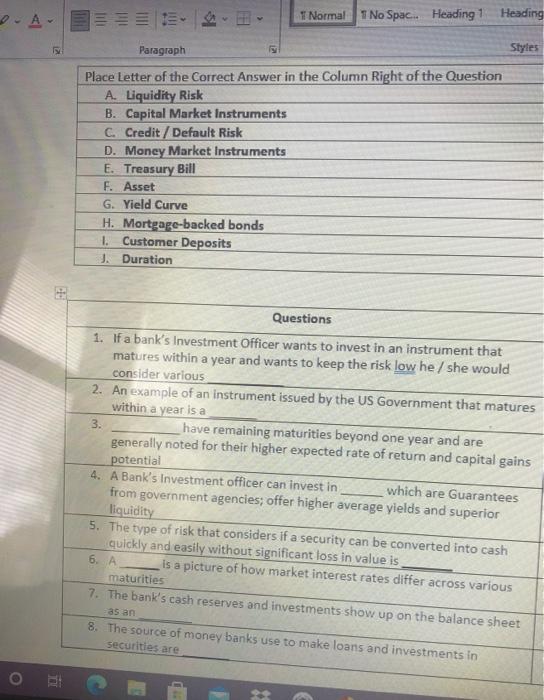

I Normal 1 No Spac... Heading 1 Heading Styles Paragraph Place Letter of the Correct Answer in the Column Right of the Question A. Liquidity Risk B. Capital Market Instruments C. Credit / Default Risk D. Money Market Instruments E. Treasury Bill F. Asset G. Yield Curve H. Mortgage-backed bonds 1. Customer Deposits J. Duration Questions 1. If a bank's Investment Officer wants to invest in an instrument that matures within a year and wants to keep the risk low he/she would consider various 2. An example of an instrument issued by the US Government that matures within a year is a 3. have remaining maturities beyond one year and are generally noted for their higher expected rate of return and capital gains potential 4. A Bank's Investment officer can invest in which are Guarantees from government agencies; offer higher average yields and superior liquidity 5. The type of risk that considers if a security can be converted into cash quickly and easily without significant loss in value is 6. A is a picture of how market interest rates differ across various maturities 7. The bank's cash reserves and investments show up on the balance sheet as an 8. The source of money banks use to make loans and investments in securities are

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts