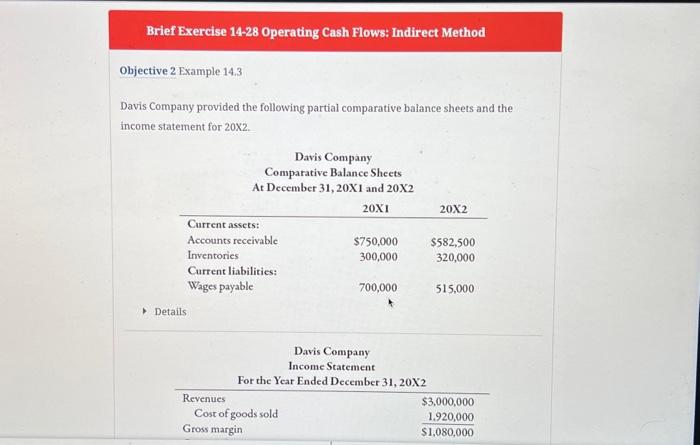

Question: i only need 14-31 only. Objective 2 Example 14.3 Davis Company provided the following partial comparative balance sheets and the income statement for 202. Required:

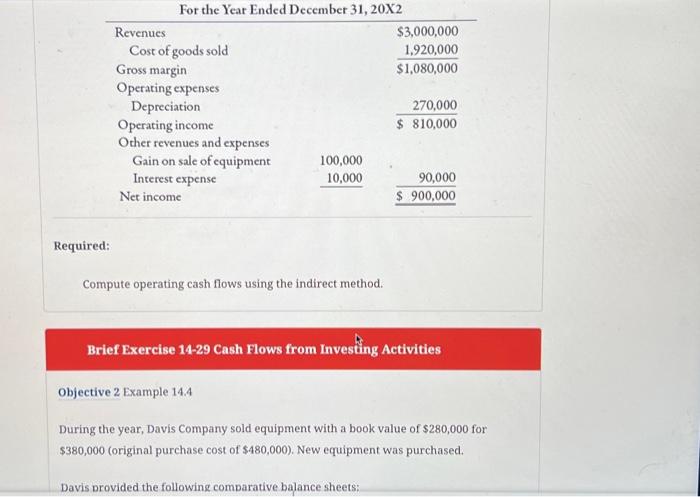

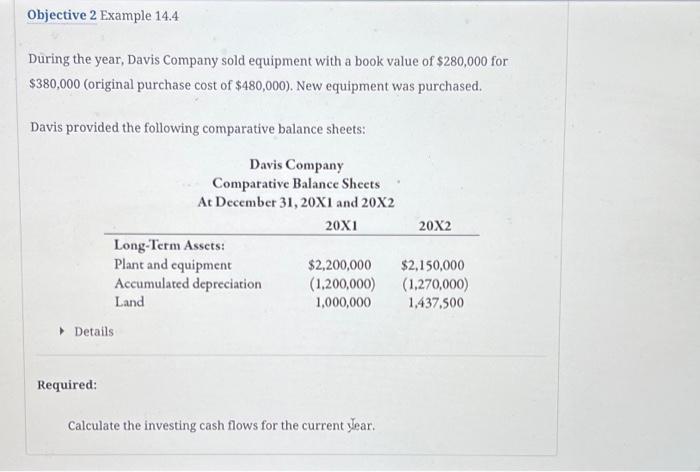

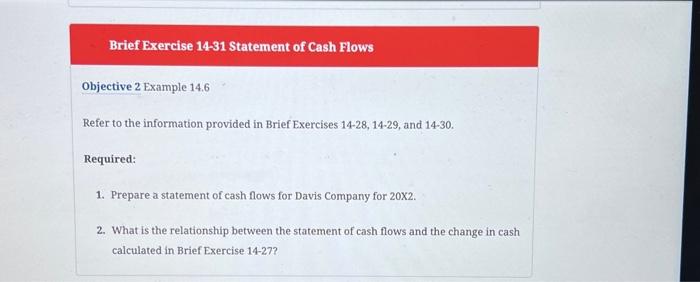

Objective 2 Example 14.3 Davis Company provided the following partial comparative balance sheets and the income statement for 202. Required: Compute operating cash flows using the indirect method. Brief Exercise 14-29 Cash Flows from Investing Activities Objective 2 Example 14.4 During the year, Davis Company sold equipment with a book value of $280,000 for $380,000 (original purchase cost of $480,000 ). New equipment was purchased. Davis provided the following comparative balance sheets: During the year, Davis Company sold equipment with a book value of $280,000 for $380,000 (original purchase cost of $480,000 ). New equipment was purchased. Davis provided the following comparative balance sheets: Detaus Required: Calculate the investing cash flows for the current year. Davis Company earned net income of $900,000 in 202. Davis provided the following information: Davis Company Comparative Balance Sheets Details Required: Compute the financing cash flows for the current year. Brief Exercise 14-31 Statement of Cash Flows Objective 2 Example 14.6 Refer to the information provided in Brief Exercises 14-28, 14-29, and 14-30. Required: 1. Prepare a statement of cash flows for Davis Company for 202. 2. What is the relationship between the statement of cash flows and the change in cash calculated in Brief Exercise 14-27

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts