Question: I only need #6. 4 and 5 are for context. Lisa and David have been married for two years. They have just decided that summer

I only need #6. 4 and 5 are for context.

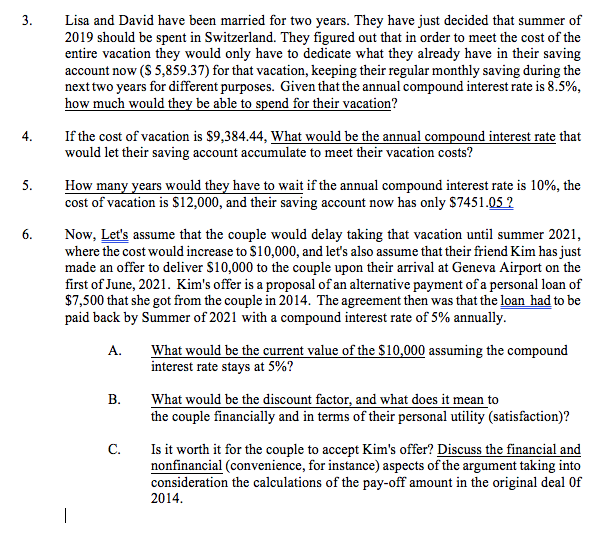

Lisa and David have been married for two years. They have just decided that summer of 2019 should be spent in Switzerland. They figured out that in order to meet the cost of the entire vacation they would only have to dedicate what they already have in their saving account now (S 5,859.37) for that vacation, keeping their regular monthly saving during the next two years for different purposes. Given that the annual compound interest rate is 8.5%. how much would they be able to spend for their vacation? 4.If the cost of vacation is $9,384.44, What would be the annual compound interest rate that would let their saving account accumulate to meet their vacation costs? How many years would they have to wait if the annual compound interest rate is 10%, the cost of vacation is S12,000, and their saving account now has only $7451.05 ? 6 Now, Let's assume that the couple would delay taking that vacation until summer 2021, where the cost would increase to S10,000, and let's also assume that their friend Kim has just made an offer to deliver S10,000 to the couple upon their arrival at Geneva Airport on the first of June, 2021. Kim's offer is a proposal of an alternative payment ofa personal loan of $7,500 that she got from the couple in 2014. The agreement then was that the loan had to be paid back by Summer of 2021 with a compound interest rate of 5% annually A. What would be the current value of the $10,000 assuming the compound interest rate stays at 5%? What would be the discount factor, and what does it mean to the couple financially and in terms of their personal utility (satisfaction)? C.Is it worth it for the couple to accept Kim's offer? Discuss the financial and nonfinancial (convenience, for instance) aspects of the argument taking into consideration the calculations of the pay-off amount in the original deal 0f 2014 Lisa and David have been married for two years. They have just decided that summer of 2019 should be spent in Switzerland. They figured out that in order to meet the cost of the entire vacation they would only have to dedicate what they already have in their saving account now (S 5,859.37) for that vacation, keeping their regular monthly saving during the next two years for different purposes. Given that the annual compound interest rate is 8.5%. how much would they be able to spend for their vacation? 4.If the cost of vacation is $9,384.44, What would be the annual compound interest rate that would let their saving account accumulate to meet their vacation costs? How many years would they have to wait if the annual compound interest rate is 10%, the cost of vacation is S12,000, and their saving account now has only $7451.05 ? 6 Now, Let's assume that the couple would delay taking that vacation until summer 2021, where the cost would increase to S10,000, and let's also assume that their friend Kim has just made an offer to deliver S10,000 to the couple upon their arrival at Geneva Airport on the first of June, 2021. Kim's offer is a proposal of an alternative payment ofa personal loan of $7,500 that she got from the couple in 2014. The agreement then was that the loan had to be paid back by Summer of 2021 with a compound interest rate of 5% annually A. What would be the current value of the $10,000 assuming the compound interest rate stays at 5%? What would be the discount factor, and what does it mean to the couple financially and in terms of their personal utility (satisfaction)? C.Is it worth it for the couple to accept Kim's offer? Discuss the financial and nonfinancial (convenience, for instance) aspects of the argument taking into consideration the calculations of the pay-off amount in the original deal 0f 2014

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts