Question: I ONLY NEED A8!!! Please show work step by step, thank you b. What is the exercise value of the fire insurance put option if

I ONLY NEED A8!!!

Please show work step by step, thank you

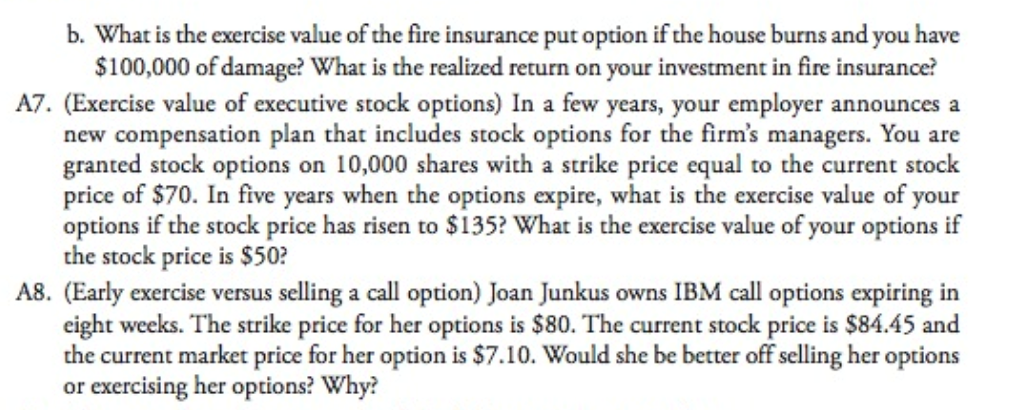

b. What is the exercise value of the fire insurance put option if the house burns and you have $100,000 of damage? What is the realized return on your investment in fire insurance? A7. (Exercise value of executive stock options) In a few years, your employer announces a new compensation plan that includes stock options for the firm's managers. You are granted stock options on 10,000 shares with a strike price equal to the current stock price of $70. In five years when the options expire, what is the exercise value of your options if the stock price has risen to $135? What is the exercise value of your options if the stock price is $50? A8. (Early exercise versus selling a call option) Joan Junkus owns IBM call options expiring in eight weeks. The strike price for her options is $80. The current stock price is $84.45 and the current market price for her option is $7.10. Would she be better off selling her options or exercising her options? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts