Question: I ONLY NEED ANSWER FOR 'e' and 'f' !!! Thank You! Richard Price, Inc., produces high performance manifold intakes, and has these aggregate demand requirements

I ONLY NEED ANSWER FOR 'e' and 'f' !!! Thank You!

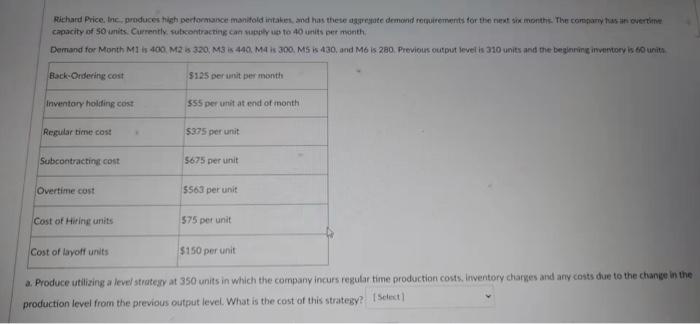

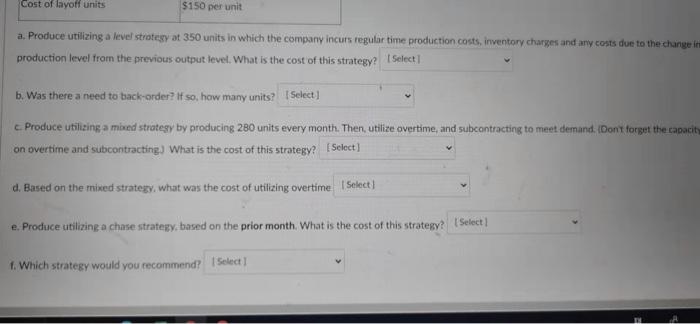

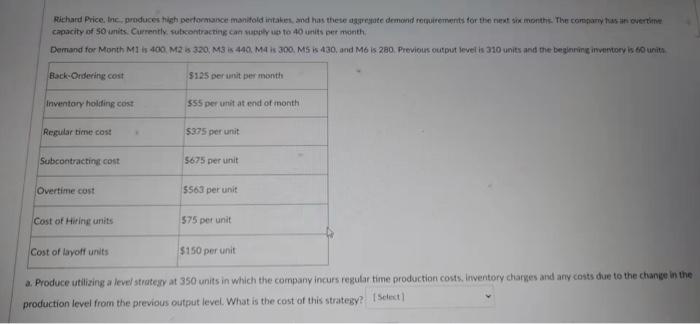

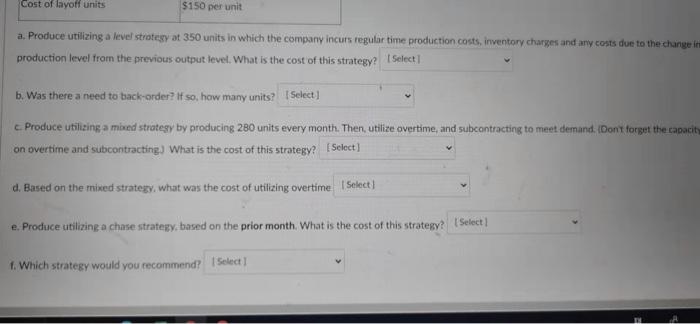

Richard Price, Inc., produces high performance manifold intakes, and has these aggregate demand requirements for the next six months. The company has an overtime capacity of 50 units. Currently subcontracting can supply up to 40 units per month Demand for Month M1 is 400 M2 is 320 M3 is 440, M4 is 300. MS is 430, and M6 is 280. Previous output level is 310 units and the beginning inventory is 60 units Back-Ordering cost $125 per unit per month Inventory holding cost $55 per unit at end of month Regular time cost $375 per unit Subcontracting cost 5675 per unit Overtime cost 5563 per unit Cost of Hiring units 575 per unit Cost of layoff units - $150 per unit a. Produce utilizing a level strategy at 350 units in which the company incurs regular time production costs, inventory charges and any costs due to the change in the production level from the previous output level. What is the cost of this strategy? [Select] Cost of layoff units $150 per unit a. Produce utilizing a level strategy at 350 units in which the company incurs regular time production costs, inventory charges and any costs due to the change in production level from the previous output level. What is the cost of this strategy? [Select] b. Was there a need to back-order? If so, how many units? [Select] c. Produce utilizing a mixed strategy by producing 280 units every month. Then, utilize overtime, and subcontracting to meet demand. (Don't forget the capacity on overtime and subcontracting) What is the cost of this strategy? [Select] d. Based on the mixed strategy, what was the cost of utilizing overtime [Select] e. Produce utilizing a chase strategy, based on the prior month. What is the cost of this strategy? [Select] f. Which strategy would you recommend? | Select] Richard Price, Inc., produces high performance manifold intakes, and has these aggregate demand requirements for the next six months. The company has an overtime capacity of 50 units. Currently subcontracting can supply up to 40 units per month Demand for Month M1 is 400 M2 is 320 M3 is 440, M4 is 300. MS is 430, and M6 is 280. Previous output level is 310 units and the beginning inventory is 60 units Back-Ordering cost $125 per unit per month Inventory holding cost $55 per unit at end of month Regular time cost $375 per unit Subcontracting cost 5675 per unit Overtime cost 5563 per unit Cost of Hiring units 575 per unit Cost of layoff units - $150 per unit a. Produce utilizing a level strategy at 350 units in which the company incurs regular time production costs, inventory charges and any costs due to the change in the production level from the previous output level. What is the cost of this strategy? [Select] Cost of layoff units $150 per unit a. Produce utilizing a level strategy at 350 units in which the company incurs regular time production costs, inventory charges and any costs due to the change in production level from the previous output level. What is the cost of this strategy? [Select] b. Was there a need to back-order? If so, how many units? [Select] c. Produce utilizing a mixed strategy by producing 280 units every month. Then, utilize overtime, and subcontracting to meet demand. (Don't forget the capacity on overtime and subcontracting) What is the cost of this strategy? [Select] d. Based on the mixed strategy, what was the cost of utilizing overtime [Select] e. Produce utilizing a chase strategy, based on the prior month. What is the cost of this strategy? [Select] f. Which strategy would you recommend? | Select]

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock