Question: I only need answer to part B A comparative balance sheet for Sheridan Corporation is presented as follows. Additional information: 1. Net income for 2025

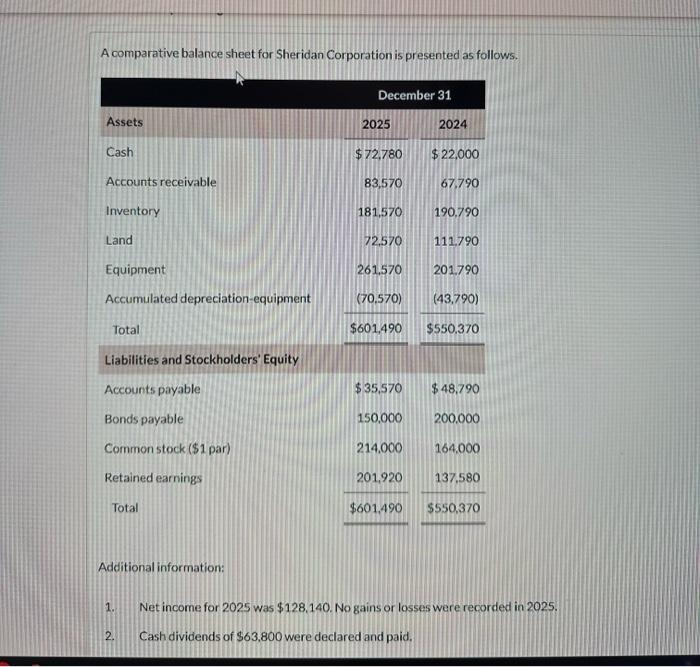

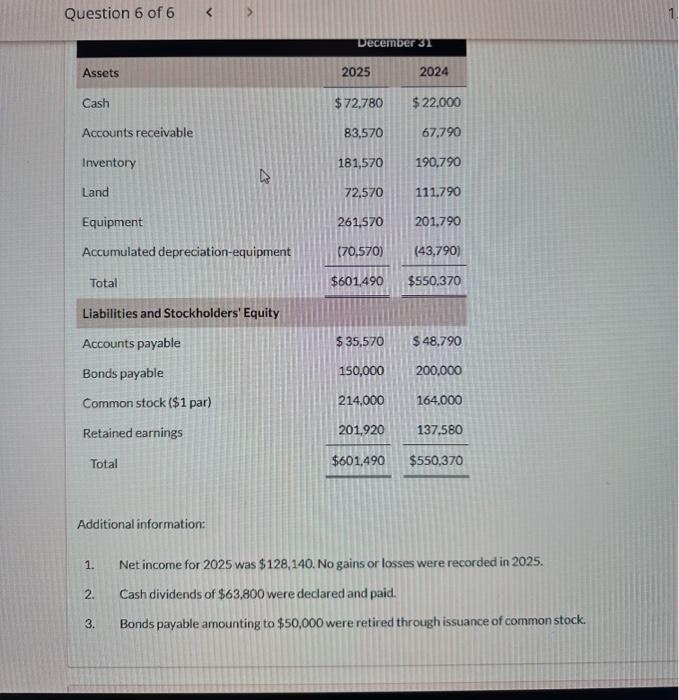

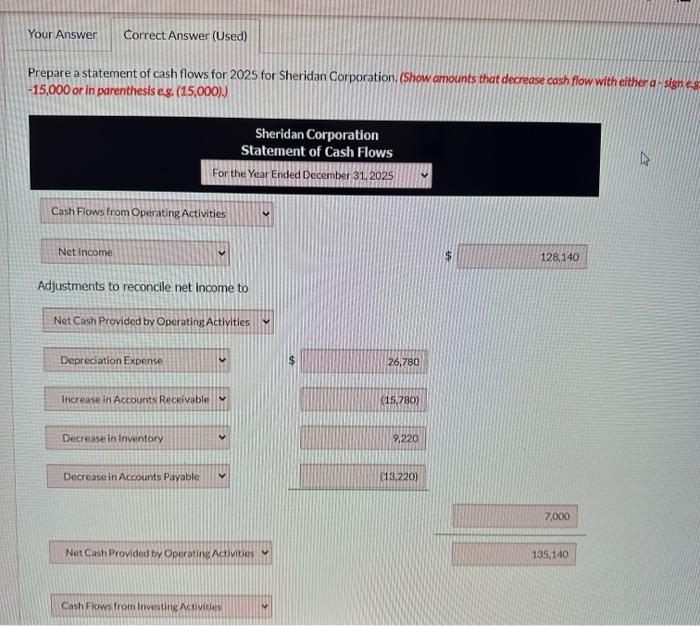

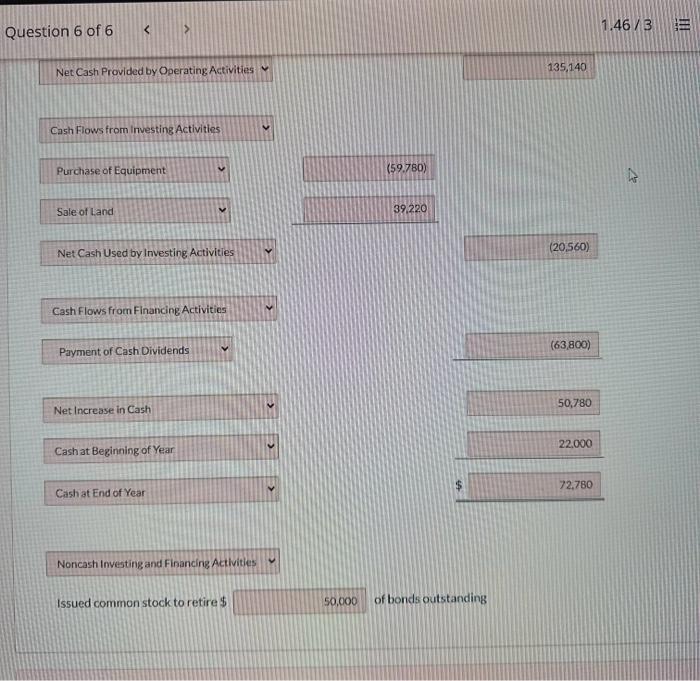

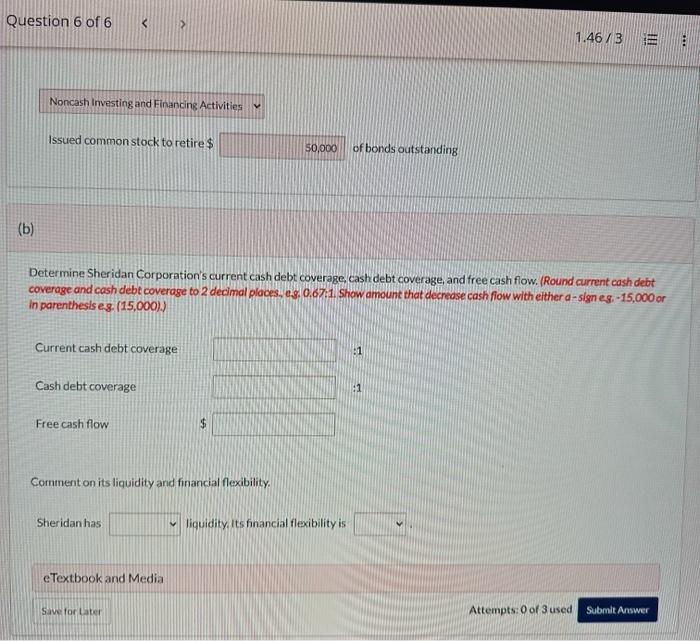

A comparative balance sheet for Sheridan Corporation is presented as follows. Additional information: 1. Net income for 2025 was $128,140. No gains or losses were recorded in 2025. 2. Cash dividends of $63,800 were declared and paid. Additional information: 1. Net income for 2025 was $128,140. No gains or losses were recorded in 2025. 2. Cash dividends of $63,800 were declared and paid. 3. Bonds payable amounting to $50,000 were retired through issuance of common stock Prepare a statement of cash flows for 2025 for Sheridan Corporation. (Show amounts that decrease cash flow with either a 15,000 or in parenthesises. (15,000) ) Question 6 of 6 1.46/3 Net Cash Provided by Operating Activities 135,140 Cash Flows from investing Activities Purchase of Equipment (59.780) Sale of Land 39,220 Net Cash Used by Investing Activities (20,560) Cash Flows from Financing Activities Payment of Cash Dividends (63,800) Net Increase in Cash Cash at Beginning of Year \begin{tabular}{|l|l|} \hline & 22,000 \\ \hline$ & \\ \hline & 72,780 \\ \hline \end{tabular} Cash at End of Year \begin{tabular}{|l|l|} \hline & 50,780 \\ \hline & \\ \hline$ & 22,000 \\ \hline & 72,780 \\ \hline \end{tabular} Noricash Investing and Financing Activities Issued common stock to retire\$ 50,000 of bonds outstanding Issued common stock to retire\$ of bonds outstanding (b) Determine Sheridan Corporation's current cash debt coverage, cash debt coverage, and free cash flow. (Round current cosh debt coverage and cash debt coverage to 2 decimal places, es. 0.67:1. Show amount that decrease cash fiow with either a-sign eg, 15,000 or in parenthesis es: (15,000) ) Comment on its liquidity and financial flexibility. Sheridanhas liquidity, Its financial flexibility is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts