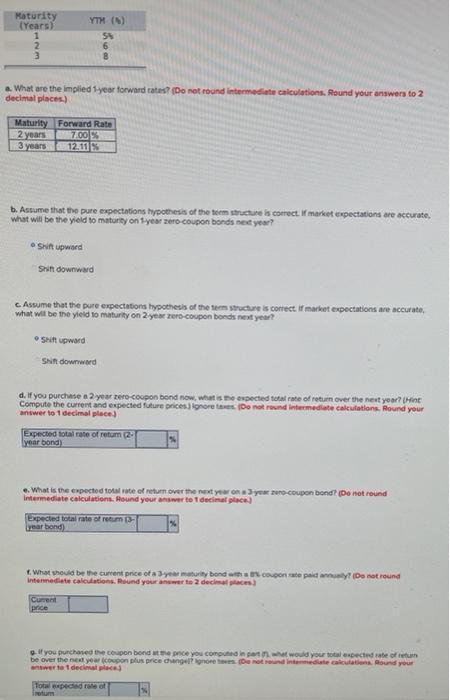

Question: I only need assitance with D, E, F, and G. A-C I have already answered. Thanks! Maturity (Years) 1 2 3 YTH (N) 5 6

Maturity (Years) 1 2 3 YTH (N) 5 6 8 a. What are the implied 1-year forward rates? Do not found intermediate calculations. Round your answers to 2 decimal places.) Maturity Forward Rate 2 years 7.001% 12.11 b. Assume that the pure expectations hypothesis of the term structure is correct. If market expectations are accurate, What will be the yield to maturity on year zero-coupon bonds next year? Swift upward Shit downward c. Assume that the pure expectations hypothesis of the term structure is correct market expectations are accurate, what will be the yield to maturity on 2 year zero-coupon bonds next year? Swift upward SNA downward d. If you purchase a 2 year zero coupon bond now what is expected total rate of return over the next year? (Hint Compute the current and expected future prices portes (Do not own intermediate calculations. Round your answer to 1 decimal place! Expected total rate of retum 2. year bond) e. What is the expected to rate of return over the next year on your coupon bond (Do not round Intermediate calculations. Found your answer to 1 decimal place) Expected total rate of retum 13- year bond) What should be the current price of a year maturity bond with coupon paidan (Do not round Intermediate calculations. Round your answer to 2 decimales Current price o if you purchased the coupon bondence you comodino would your toespected rate of retum be over the year con plus price changeronorees on intermediate clout Mound your werta decimal place Total medias Maturity (Years) 1 2 3 YTH (N) 5 6 8 a. What are the implied 1-year forward rates? Do not found intermediate calculations. Round your answers to 2 decimal places.) Maturity Forward Rate 2 years 7.001% 12.11 b. Assume that the pure expectations hypothesis of the term structure is correct. If market expectations are accurate, What will be the yield to maturity on year zero-coupon bonds next year? Swift upward Shit downward c. Assume that the pure expectations hypothesis of the term structure is correct market expectations are accurate, what will be the yield to maturity on 2 year zero-coupon bonds next year? Swift upward SNA downward d. If you purchase a 2 year zero coupon bond now what is expected total rate of return over the next year? (Hint Compute the current and expected future prices portes (Do not own intermediate calculations. Round your answer to 1 decimal place! Expected total rate of retum 2. year bond) e. What is the expected to rate of return over the next year on your coupon bond (Do not round Intermediate calculations. Found your answer to 1 decimal place) Expected total rate of retum 13- year bond) What should be the current price of a year maturity bond with coupon paidan (Do not round Intermediate calculations. Round your answer to 2 decimales Current price o if you purchased the coupon bondence you comodino would your toespected rate of retum be over the year con plus price changeronorees on intermediate clout Mound your werta decimal place Total medias

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts