Question: I only need help finding the answers for Instructions 1 on the 2nd page. - Determine the missing amounts associated with each letter. Provide supporting

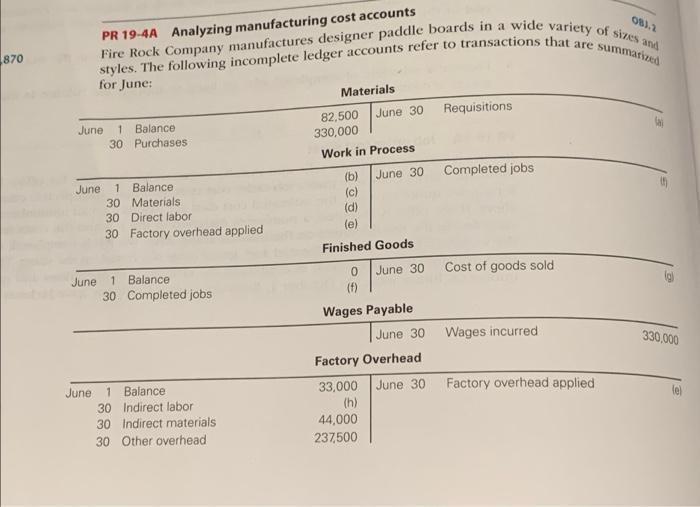

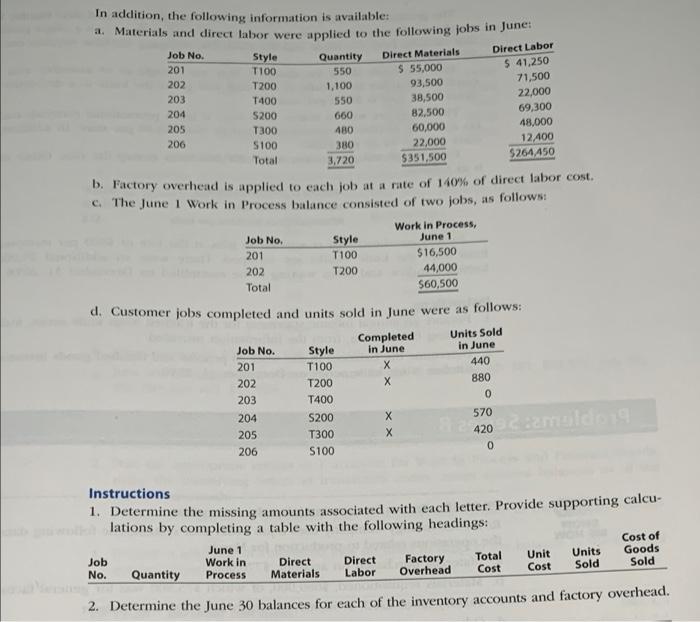

06). PR 19-4A Analyzing manufacturing cost accounts 870 Fire Rock Company manufactures designer paddle boards in a wide variety of sizes and styles. The following incomplete ledger accounts refer to transactions that are summarized for June: Requisitions June 1 Balance 30 Purchases Materials 82,500 June 30 330,000 Work in Process June 30 Completed jobs June 1 Balance 30 Materials 30 Direct labor 30 Factory overhead applied (b) (c) (d) le) Finished Goods June 1 Balance 30 Completed jobs 330,000 0 June 30 Cost of goods sold (f) Wages Payable June 30 Wages incurred Factory Overhead 33,000 June 30 Factory overhead applied (h) 44,000 237,500 June 1 Balance 30 Indirect labor 30 Indirect materials 30 Other overhead In addition, the following information is available: a. Materials and direct labor were applied to the following jobs in June Job No. Style Quantity Direct Materials Direct Labor 201 T100 550 $ 55,000 $ 41,250 202 T200 1,100 93,500 71,500 203 T400 550 38,500 22,000 204 5200 660 82.500 69,300 205 T300 480 60,000 48,000 206 5100 380 22,000 12400 Total 3,720 $351,500 $264.450 b. Factory overhead is applied to each job at a rate of 140% of direct labor cost. The June 1 Work in Process balance consisted of two jobs, as follows: Work in Process, Job No. Style June 1 201 T100 $16,500 202 T200 44,000 Total $60,500 d. Customer jobs completed and units sold in June were as follows: Completed Units Sold Job No. Style in June in June 201 T100 440 202 T200 X 880 203 T400 0 204 S200 570 420 205 T300 206 S100 0 420 Camale Instructions 1. Determine the missing amounts associated with each letter. Provide supporting calcu- lations by completing a table with the following headings: June 1 Cost of Job Work in Direct Direct Factory Total Unit Units Goods No. Quantity Process Materials Labor Overhead Cost Cost Sold Sold 2. Determine the June 30 balances for each of the inventory accounts and factory overhead

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts