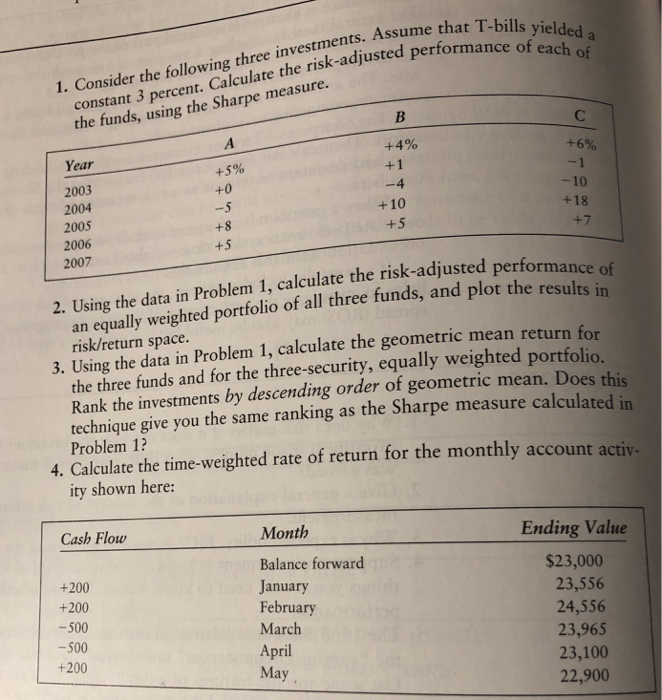

Question: I only need help for question 1 and 4 only. Thanks:) T-bills yielded a of each of 1. Consider the following three investments. Assume that

T-bills yielded a of each of 1. Consider the following three investments. Assume that T constant 3 percent. Calculate the risk-adjusted perfo the funds, using the Sharpe measure. Year +4% 6% +5% +0 2003 2004 2005 2006 2007 10 +18 +10 2. Using the data in Problem 1, calculate the risk-adjusted performance of an equally weighted portfolio of all three funds, and plot the results risk/return space. for 3. Using the data in Problem 1, calculate the geometric mean return the three funds and for the three-security, equally weighted portfolio Rank the investments by descending order of geometric mean. Does this technique give you the same ranking as the Sharpe measure calculated in Problem 1 4. Calculate the time-weighted rate of return for the monthly account activ- ity shown here: Cash Flow Month +200 +200 -500 500 +200 Balance forward January February March April May Ending Value $23,000 23,556 24,556 23,965 23,100 22,900

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts