Question: I ONLY NEED HELP MAKING A JOURNAL ENTRY FOR #4! THANK YOU! Required information [The following information applies to the questions displayed below.] Residents of

I ONLY NEED HELP MAKING A JOURNAL ENTRY FOR #4! THANK YOU!

I ONLY NEED HELP MAKING A JOURNAL ENTRY FOR #4! THANK YOU!

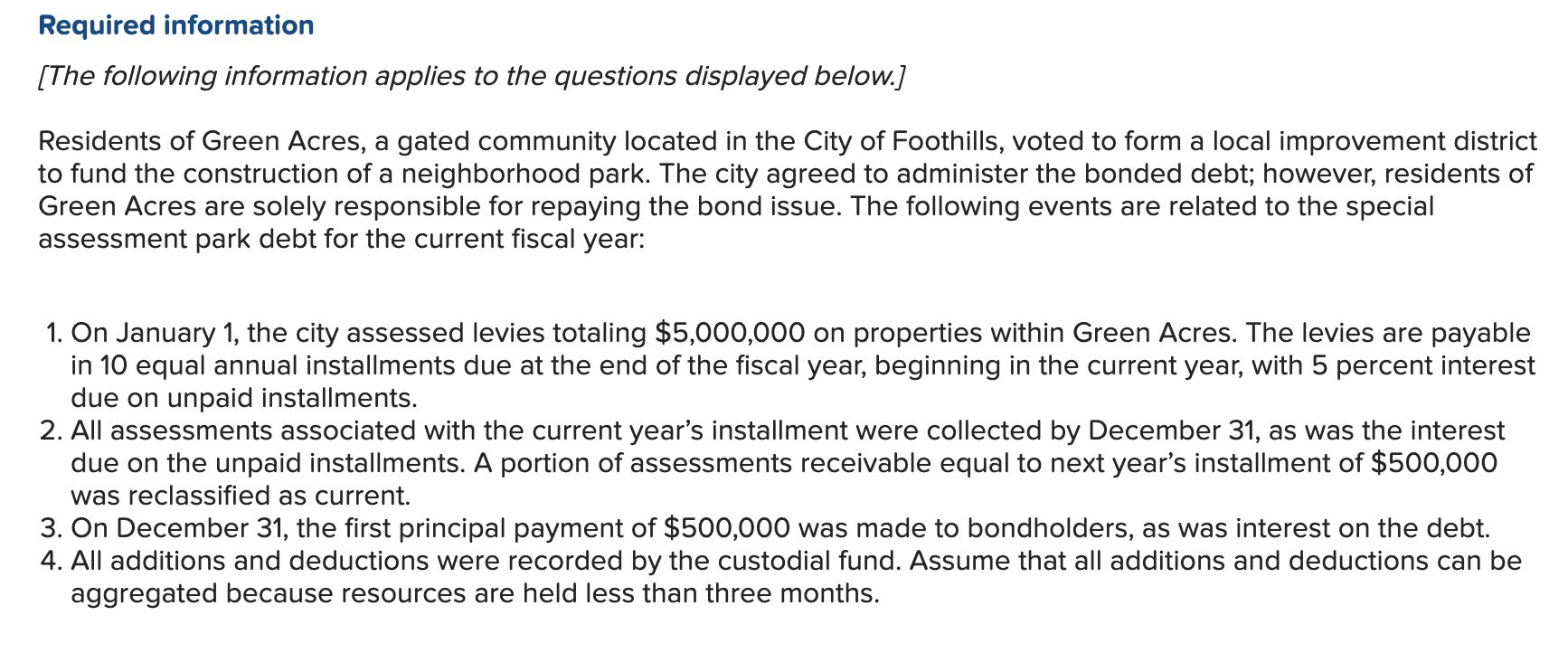

Required information [The following information applies to the questions displayed below.] Residents of Green Acres, a gated community located in the City of Foothills, voted to form a local improvement district to fund the construction of a neighborhood park. The city agreed to administer the bonded debt; however, residents of Green Acres are solely responsible for repaying the bond issue. The following events are related to the special assessment park debt for the current fiscal year: 1. On January 1, the city assessed levies totaling $5,000,000 on properties within Green Acres. The levies are payable in 10 equal annual installments due at the end of the fiscal year, beginning in the current year, with 5 percent interest due on unpaid installments. 2. All assessments associated with the current year's installment were collected by December 31, as was the interest due on the unpaid installments. A portion of assessments receivable equal to next year's installment of $500,000 was reclassified as current. 3. On December 31, the first principal payment of $500,000 was made to bondholders, as was interest on the debt. 4. All additions and deductions were recorded by the custodial fund. Assume that all additions and deductions can be aggregated because resources are held less than three months

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts