Question: I only need help on NUMBER 5, everything else is just for context. Number 5 needs to be done with the revised profitablity ratios from

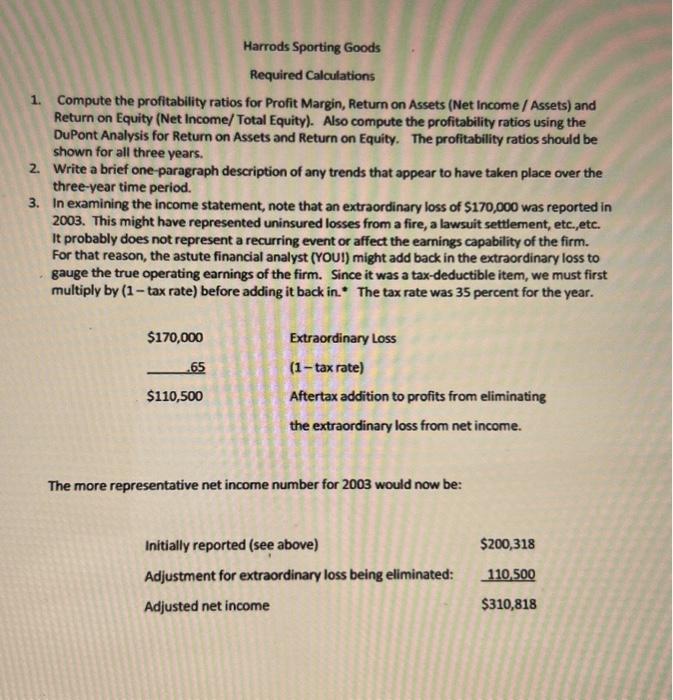

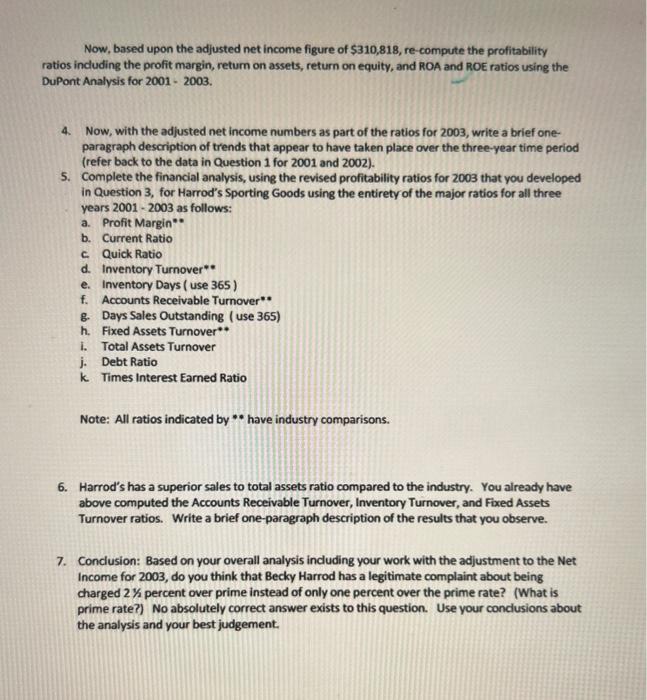

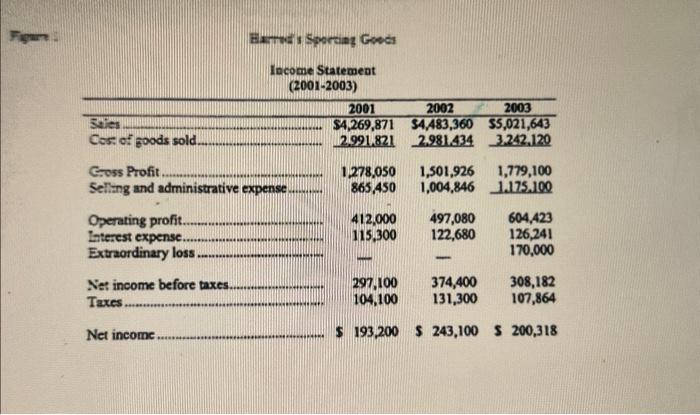

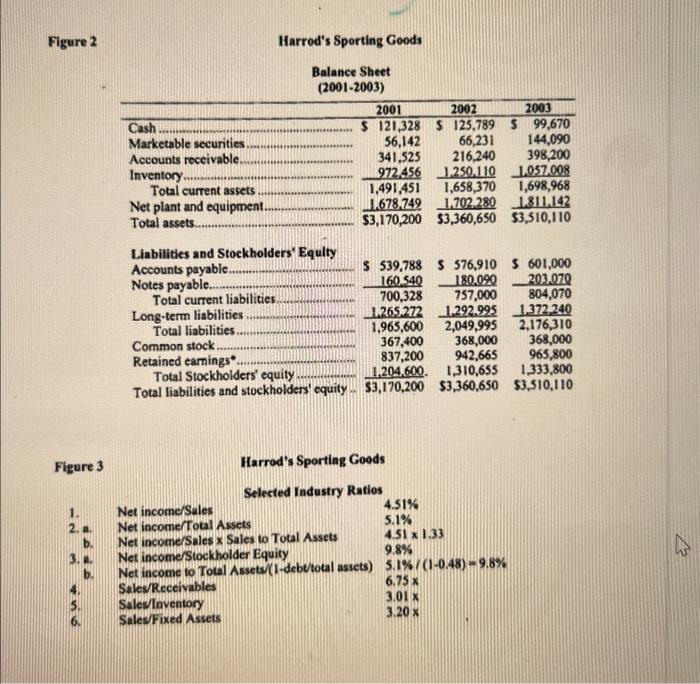

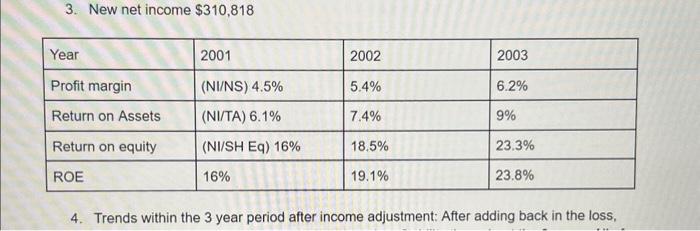

Harrods Sporting Goods Required Calculations 1. Compute the profitability ratios for Profit Margin, Return on Assets (Net Income / Assets) and Return on Equity (Net Income/ Total Equity). Also compute the profitability ratios using the DuPont Analysis for Return on Assets and Return on Equity. The profitability ratios should be shown for all three years. 2. Write a brief one-paragraph description of any trends that appear to have taken place over the three-year time period. 3. In examining the income statement, note that an extraordinary loss of $170,000 was reported in 2003. This might have represented uninsured losses from a fire, a lawsuit settlement, etc,etc. It probably does not represent a recurring event or affect the earnings capability of the firm. For that reason, the astute financial analyst (YOUI) might add back in the extraordinary loss to gauge the true operating earnings of the firm. Since it was a tax-deductible item, we must first multiply by ( 1 - tax rate) before adding it back in. The tax rate was 35 percent for the year. The more representative net income number for 2003 would now be: Now, based upon the adjusted net income figure of $310,818, re-compute the profitability ratios including the profit margin, retum on assets, return on equity, and ROA and ROE ratios using the DuPont Analysis for 2001 - 2003. 4. Now, with the adjusted net income numbers as part of the ratios for 2003 , write a brief oneparagraph description of trends that appear to have taken place over the three-year time period (refer back to the data in Question 1 for 2001 and 2002). 5. Complete the financial analysis, using the revised profitability ratios for 2003 that you developed in Question 3, for Harrod's Sporting Goods using the entirety of the major ratios for all three years 2001 - 2003 as follows: a. Profit Margin"* b. Current Ratio c. Quick Ratio d. Inventory Turnover** e. Inventory Days ( use 365 ) f. Accounts Receivable Turnover"* g. Days Sales Outstanding (use 365) h. Fixed Assets Turnover** i. Total Assets Turnover j. Debt Ratio k. Times Interest Earned Ratio Note: All ratios indicated by ** have industry comparisons. 6. Harrod's has a superior sales to total assets ratio compared to the industry. You already have above computed the Accounts Receivable Turnover, Inventory Turnover, and Fixed Assets Turnover ratios. Write a brief one-paragraph description of the results that you observe. 7. Conclusion: Based on your overall analysis including your work with the adjustment to the Net Income for 2003, do you think that Becky Harrod has a legitimate complaint about being charged 2% percent over prime instead of only one percent over the prime rate? (What is prime rate?) No absolutely correct answer exists to this question. Use your conclusions about the analysis and your best judgement. 3. New net income $310,818 4. Trends within the 3 year period after income adjustment: After adding back in the loss, Income Statement (20012003) Harrod's Sporting Goods Balance Sheet (2001-2003)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts