Question: I only need help on part B and part C. Thank you so much! 3.LO 5.5: Percent-of-Sales Method Beecbg had the following account balances at

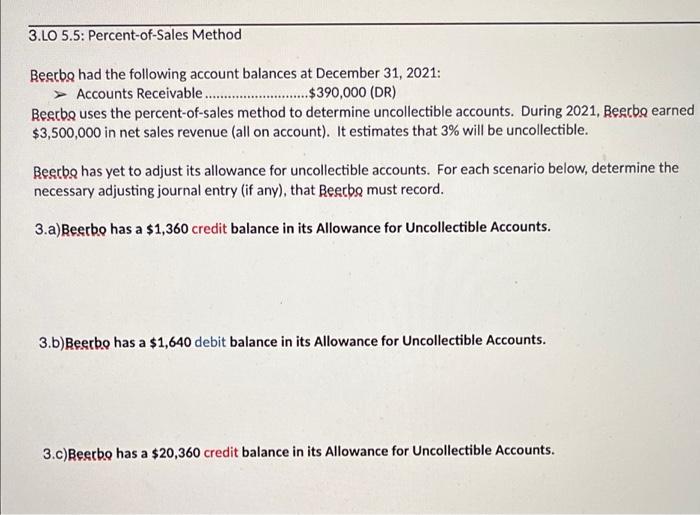

3.LO 5.5: Percent-of-Sales Method Beecbg had the following account balances at December 31, 2021: Accounts Receivable ........................$390,000 (DR) Beerbo uses the percent-of-sales method to determine uncollectible accounts. During 2021, Beecbg earned $3,500,000 in net sales revenue (all on account). It estimates that 3% will be uncollectible. Beerbg has yet to adjust its allowance for uncollectible accounts. For each scenario below, determine the necessary adjusting journal entry (if any), that Reecbg must record. 3.a) Beerbo has a $1,360 credit balance in its Allowance for Uncollectible Accounts. 3.b)Beerbo has a $1,640 debit balance in its Allowance for Uncollectible Accounts. 3.c)Beerbo has a $20,360 credit balance in its Allowance for Uncollectible Accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts