Question: I only need help with c) but i need step by step instructions and calculations including how to get the monthly depreciation, monthly interest and

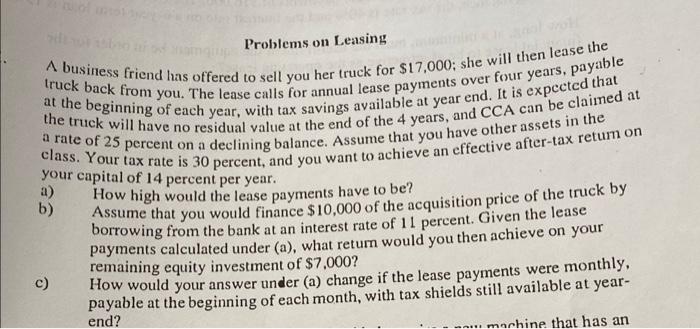

Problems on Leasing truck back from you. The lease calls for annual lease payments over four years, payable A business friend has offered to sell you her truck for $17,000; she will then lease the the truck will have no residual value at the end of the 4 years, and CCA can be claimed at a rate of 25 percent on a declining balance. Assume that you have other assets in the at the beginning of each year, with tax savings available at year end. It is expected that class. Your tax rate is 30 percent, and you want to achieve an effective after-tax return on your capital of 14 percent per year. a) How high would the lease payments have to be? b) Assume that you would finance $10,000 of the acquisition price of the truck by borrowing from the bank at an interest rate of 11 percent. Given the lease payments calculated under (a), what return would you then achieve on your remaining equity investment of $7,000? c) How would your answer under (a) change if the lease payments were monthly, payable at the beginning of each month, with tax shields still available at year- end? ... machine that has an c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts