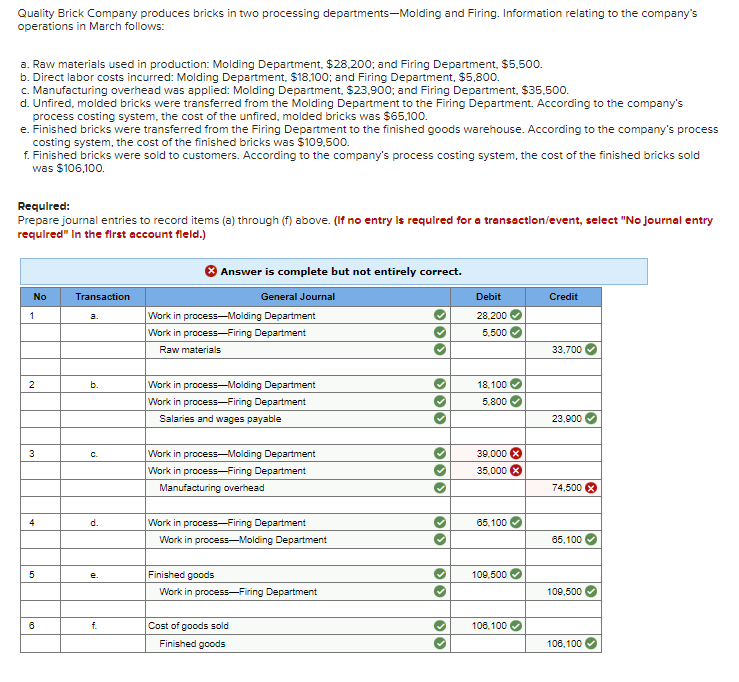

Question: I only need help with C: C) Manufacturing overhead was applied: Molding Department, $23,900; and Firing Department, $35,500. Quality Brick Company produces bricks in two

I only need help with C:

C) Manufacturing overhead was applied: Molding Department, $23,900; and Firing Department, $35,500.

Quality Brick Company produces bricks in two processing departments-Molding and Firing. Information relating to the company"s operations in March follows: a. Raw materials used in production: Molding Department, $28,200; and Firing Department, $5,500. b. Direct labor costs incurred: Molding Department, $18,100; and Firing Department, $5,800. c. Manufacturing overhead was applied: Molding Department, \$23,900; and Firing Department, \$35,500. d. Unfired, molded bricks were transferred from the Molding Department to the Firing Department. According to the company's process costing system, the cost of the unfired, molded bricks was $65,100. e. Finished bricks were transferred from the Firing Department to the finished goods warehouse. According to the company's process costing system, the cost of the finished bricks was $109,500. f. Finished bricks were sold to customers. According to the company's process costing system, the cost of the finished bricks sold was $106,100. Required: Prepare journal entries to record items (a) through (f) above. (If no entry ls requlred for a transoction/event, select "No journal entry required" In the flrst account fleld.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts