Question: I only need help with C, please I sent the question 3 times but you do not make the tables. can you do fill in

I only need help with C, please I sent the question 3 times but you do not make the tables. can you do fill in a table with investment, Coupon payment and Selling price not cash flow. So in the table given to us we need to fill in those three. How do I calculate that?

1.8 Bonds

You are considering purchasing the following bond:

Face Value: 1,000,000 SEK

Coupon rate: 5.0 % (coupons are paid once per year)

Time to maturity1: 30 years

The yield to maturity of the bond is 6 %.

a) What is the price of the bond today?

b) For the same bond in item a, assume that we wish to sell

10 years time after the coupon has just been paid and that the yield to maturity has dropped to 5 % by then. What price do we receive when we sell the bond?2

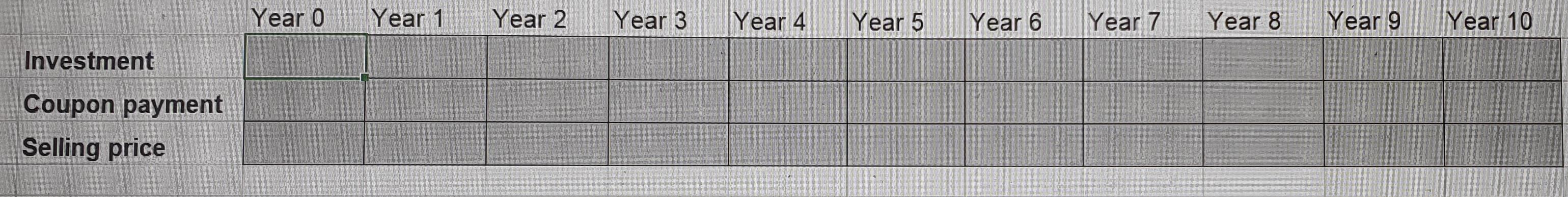

c) Use the table in the answer sheet and indicate the cash flows

received from an investment consisting in buying the bond

30 years before its maturity, keeping it for 10 years and selling it right after coupon number 10 is paid (the investment in year 0, the coupon

payments and the payment received when we sold the bond at the

price computed in item b). Use the values actually paid out those

years, not the present value. Also, indicate by using the sign + or if it was a cash outflow or a cash inflow).

In question c) the answers has to include; investment, Coupon payment and Selling price. So in the table given to us we need to fill in those three. How do I calculate that?

Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Investment Coupon payment Selling price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts