Question: I only need help with C. This is what I have so far which is correct. Use Excel to do problem C a. Calculate 2020

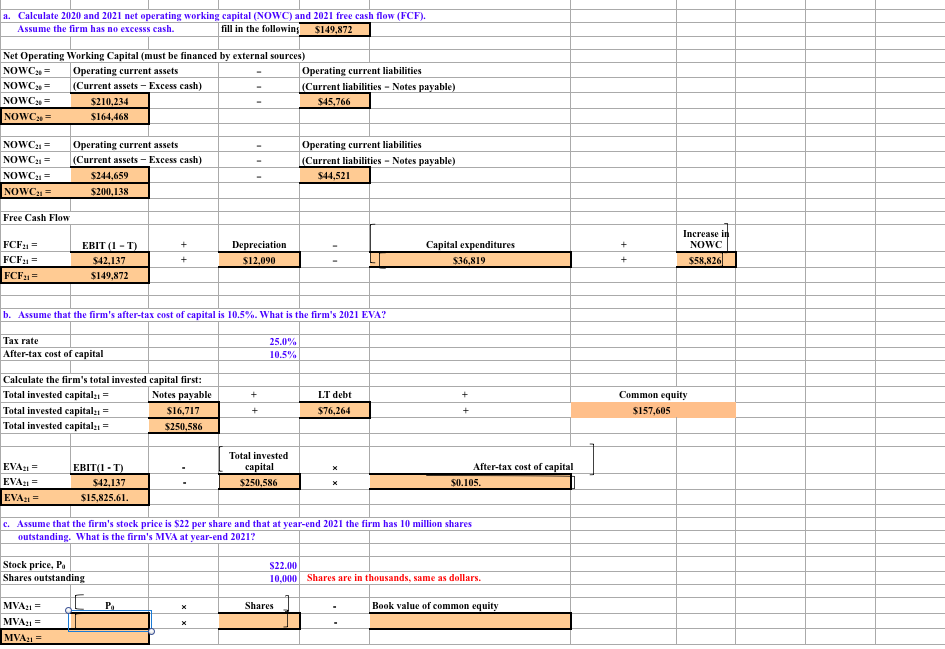

I only need help with C. This is what I have so far which is correct.

Use Excel to do problem C

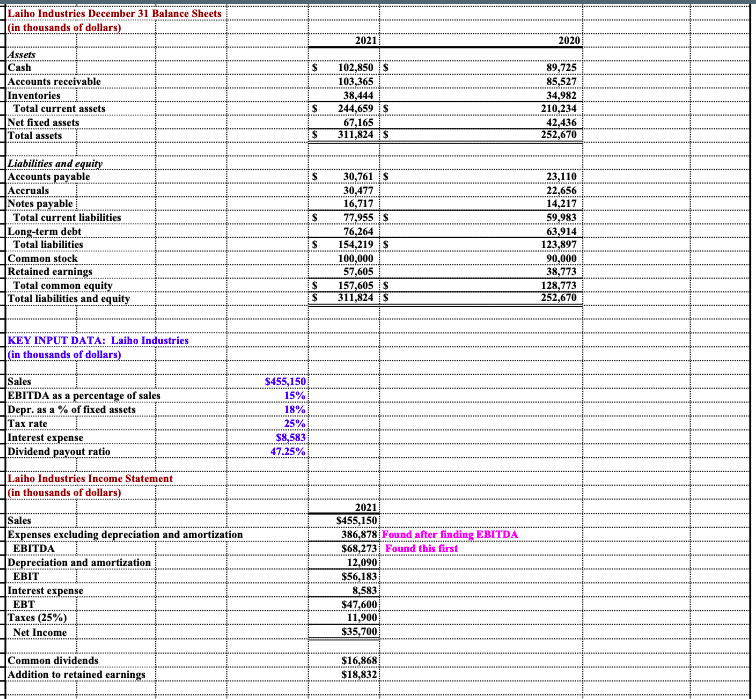

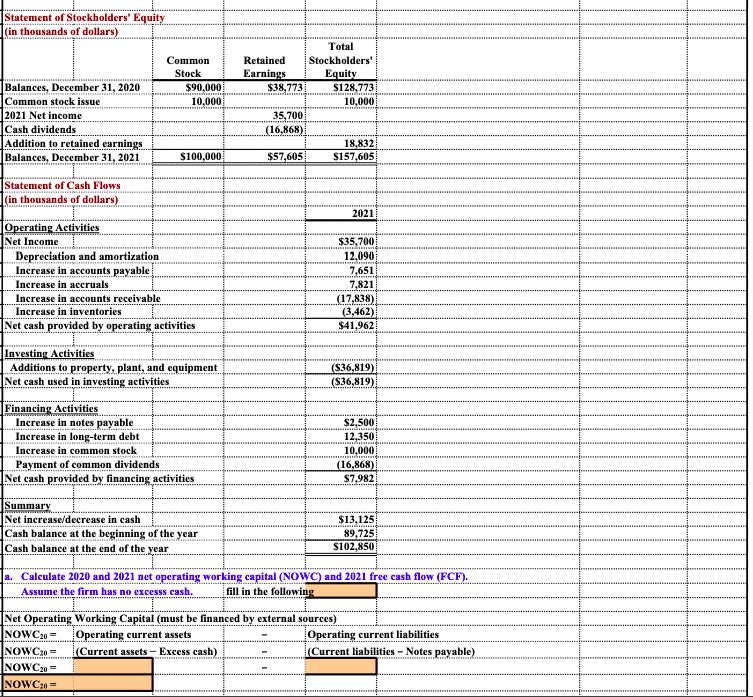

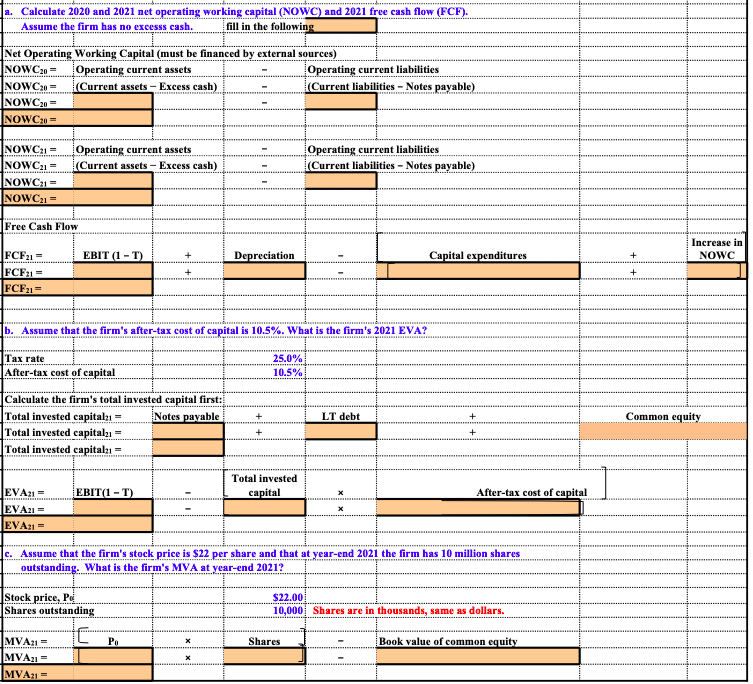

a. Calculate 2020 and 2021 net operating working capital (NOWC) and 2021 free cash flow (FCF). a. Calculate 2020 and 2021 net operating working capital (NOWC) and 2021 free cash flow (FCF). Assume the firm has no excesss cash. fill in the following $149,872 Net Operating Working Capital (must be financed by external sources) \begin{tabular}{l|l|lll|} NOWC21= & Operating current assets & - & Operating current liabilities \\ NOWC21= & (Current assets - Excess cash) & - & (Current liabilities - Notes payable) \\ \hline NOWCC21= & $244,659 & & $44,521 \\ \hline NOWC21= & $200,138 & & & \\ \hline \end{tabular} Free Cash Flow \begin{tabular}{lc|} FCF21= & EBIT(1T) \\ \( {_{21}}=} \) & $42,137 \\ FCF21= & $149,872 \\ \hline \end{tabular} b. Assume that the firm's after-tax cost of capital is 10.5%. What is the firm's 2021 EVA? \begin{tabular}{|l|r|} \hline Tax rate & \\ \hline After-tax cost of capital & 25.0% \\ \hline \end{tabular} Calculate the firm's total invested capital first: \begin{tabular}{|c|} \hline Notes payable \\ \hline$16,717 \\ \hline$250,586 \\ \hline \end{tabular} c. Assume that the firm's stock price is $22 per share and that at year-end 2021 the firm has 10 million shares outstanding. What is the firm's MVA at year-end 2021 ? Stock price, P0 522.00 Shares outstanding a. Calculate 2020 and 2021 net operating working capital (NOWC) and 2021 free cash flow (FCF). a. Calculate 2020 and 2021 net operating working capital (NOWC) and 2021 free cash flow (FCF). Assume the firm has no excesss cash. fill in the following $149,872 Net Operating Working Capital (must be financed by external sources) \begin{tabular}{l|l|lll|} NOWC21= & Operating current assets & - & Operating current liabilities \\ NOWC21= & (Current assets - Excess cash) & - & (Current liabilities - Notes payable) \\ \hline NOWCC21= & $244,659 & & $44,521 \\ \hline NOWC21= & $200,138 & & & \\ \hline \end{tabular} Free Cash Flow \begin{tabular}{lc|} FCF21= & EBIT(1T) \\ \( {_{21}}=} \) & $42,137 \\ FCF21= & $149,872 \\ \hline \end{tabular} b. Assume that the firm's after-tax cost of capital is 10.5%. What is the firm's 2021 EVA? \begin{tabular}{|l|r|} \hline Tax rate & \\ \hline After-tax cost of capital & 25.0% \\ \hline \end{tabular} Calculate the firm's total invested capital first: \begin{tabular}{|c|} \hline Notes payable \\ \hline$16,717 \\ \hline$250,586 \\ \hline \end{tabular} c. Assume that the firm's stock price is $22 per share and that at year-end 2021 the firm has 10 million shares outstanding. What is the firm's MVA at year-end 2021 ? Stock price, P0 522.00 Shares outstanding

Step by Step Solution

There are 3 Steps involved in it

To calculate the firms Market Value Added MVA for 2021 you ... View full answer

Get step-by-step solutions from verified subject matter experts