Question: I only need help with Part 3 please stage. Proposed capital investments are included in the annual budget. This includes the estimated cost of acquisition

I only need help with Part 3 please

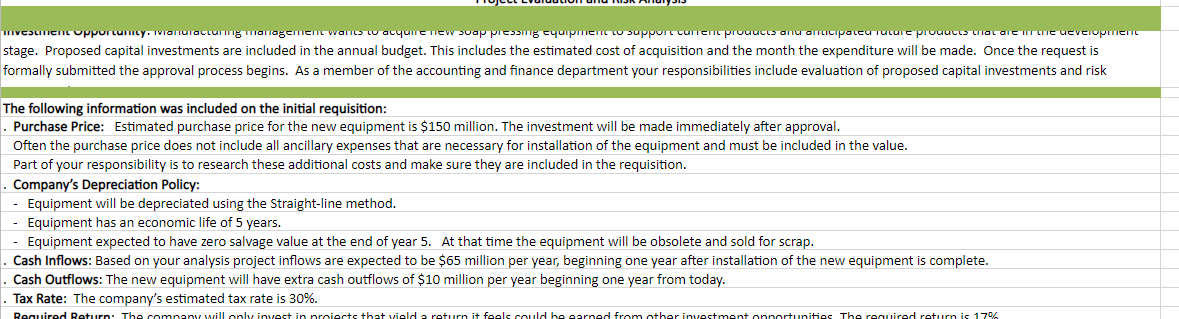

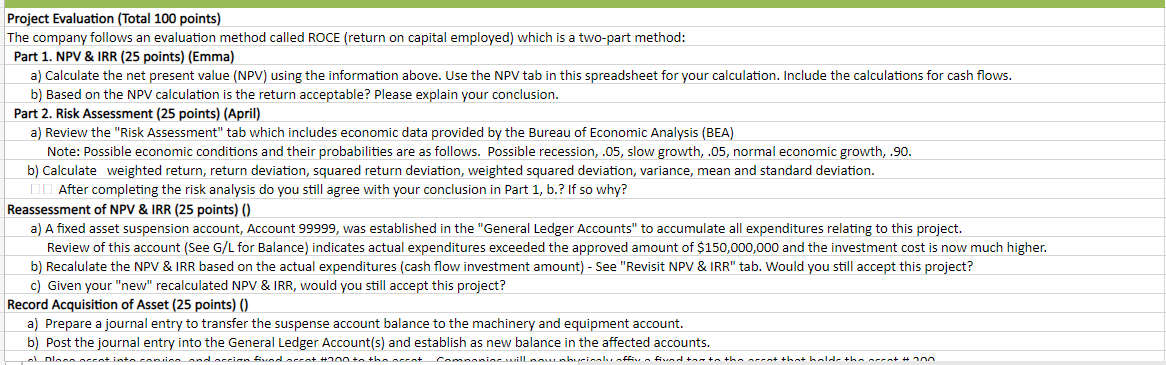

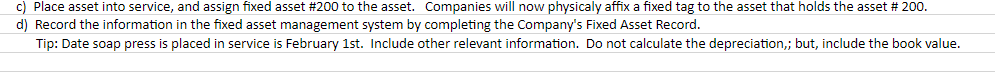

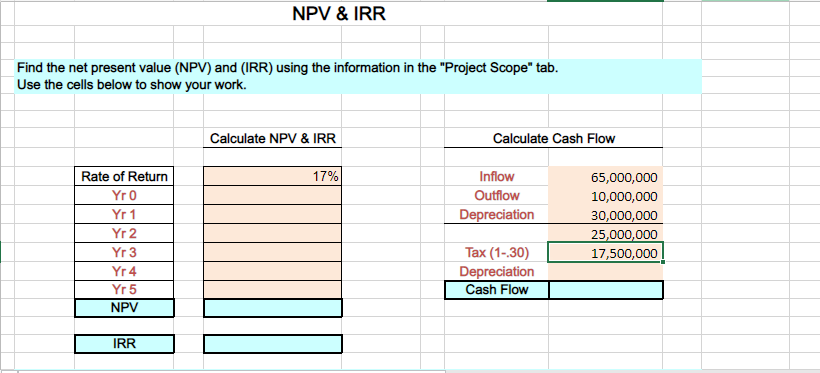

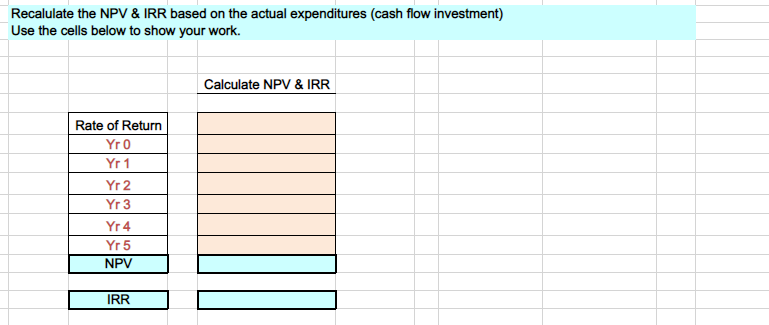

stage. Proposed capital investments are included in the annual budget. This includes the estimated cost of acquisition and the month the expenditure will be made. Once the request is formally submitted the approval process begins. As a member of the accounting and finance department your responsibilities include evaluation of proposed capital investments and risk The following information was included on the initial requisition: . Purchase Price: Estimated purchase price for the new equipment is $150 million. The investment will be made immediately after approval. Often the purchase price does not include all ancillary expenses that are necessary for installation of the equipment and must be included in the value. Part of your responsibility is to research these additional costs and make sure they are included in the requisition. Company's Depreciation Policy: - Equipment will be depreciated using the Straight-line method. - Equipment has an economic life of 5 years. - Equipment expected to have zero salvage value at the end of year 5. At that time the equipment will be obsolete and sold for scrap. . Cash Inflows: Based on your analysis project inflows are expected to be $65 million per year, beginning one year after installation of the new equipment is complete. . Cash Outflows: The new equipment will have extra cash outflows of $10 million per year beginning one year from today. - Tax Rate: The company's estimated tax rate is 30%. Project Evaluation (Total 100 points) The company follows an evaluation method called ROCE (return on capital employed) which is a two-part method: Part 1. NPV \& IRR (25 points) (Emma) a) Calculate the net present value (NPV) using the information above. Use the NPV tab in this spreadsheet for your calculation. Include the calculations for cash flows. b) Based on the NPV calculation is the return acceptable? Please explain your conclusion. Part 2. Risk Assessment ( 25 points) (April) a) Review the "Risk Assessment" tab which includes economic data provided by the Bureau of Economic Analysis (BEA) Note: Possible economic conditions and their probabilities are as follows. Possible recession, .05, slow growth, .05, normal economic growth, .90. b) Calculate weighted return, return deviation, squared return deviation, weighted squared deviation, variance, mean and standard deviation. After completing the risk analysis do you still agree with your conclusion in Part 1 , b.? If so why? Reassessment of NPV \& IRR ( 25 points) () a) A fixed asset suspension account, Account 99999 , was established in the "General Ledger Accounts" to accumulate all expenditures relating to this project. Review of this account (See G/L for Balance) indicates actual expenditures exceeded the approved amount of $150,000,000 and the investment cost is now much higher. b) Recalulate the NPV \& IRR based on the actual expenditures (cash flow investment amount) - See "Revisit NPV \& IRR" tab. Would you still accept this project? c) Given your "new" recalculated NPV \& IRR, would you still accept this project? Record Acquisition of Asset ( 25 points) () a) Prepare a journal entry to transfer the suspense account balance to the machinery and equipment account. b) Post the journal entry into the General Ledger Account(s) and establish as new balance in the affected accounts. c) Place asset into service, and assign fixed asset \#200 to the asset. Companies will now physicaly affix a fixed tag to the asset that holds the asset \# 200. d) Record the information in the fixed asset management system by completing the Company's Fixed Asset Record. Tip: Date soap press is placed in service is February 1 st. Include other relevant information. Do not calculate the depreciation,; but, include the book value. Find the net present value (NPV) and (IRR) using the information in the "Project Scope" tab. Use the cells below to show your work. Recalulate the NPV \& IRR based on the actual expenditures (cash flow investment) Use the cells below to show your work. Calculate NPV \& IRR \begin{tabular}{|c|} \hline Rate of Return \\ \hline Yr0 \\ \hline Yr1 \\ \hline Yr2 \\ \hline Yr3 \\ \hline Yr4 \\ \hline Yr5 \\ \hline NPV \\ \hline \end{tabular} \begin{tabular}{|} \hline \\ \hline \\ \hline \\ \hline \\ \hline \\ \hline \\ \hline \\ \hline \\ \hline \end{tabular} IRR stage. Proposed capital investments are included in the annual budget. This includes the estimated cost of acquisition and the month the expenditure will be made. Once the request is formally submitted the approval process begins. As a member of the accounting and finance department your responsibilities include evaluation of proposed capital investments and risk The following information was included on the initial requisition: . Purchase Price: Estimated purchase price for the new equipment is $150 million. The investment will be made immediately after approval. Often the purchase price does not include all ancillary expenses that are necessary for installation of the equipment and must be included in the value. Part of your responsibility is to research these additional costs and make sure they are included in the requisition. Company's Depreciation Policy: - Equipment will be depreciated using the Straight-line method. - Equipment has an economic life of 5 years. - Equipment expected to have zero salvage value at the end of year 5. At that time the equipment will be obsolete and sold for scrap. . Cash Inflows: Based on your analysis project inflows are expected to be $65 million per year, beginning one year after installation of the new equipment is complete. . Cash Outflows: The new equipment will have extra cash outflows of $10 million per year beginning one year from today. - Tax Rate: The company's estimated tax rate is 30%. Project Evaluation (Total 100 points) The company follows an evaluation method called ROCE (return on capital employed) which is a two-part method: Part 1. NPV \& IRR (25 points) (Emma) a) Calculate the net present value (NPV) using the information above. Use the NPV tab in this spreadsheet for your calculation. Include the calculations for cash flows. b) Based on the NPV calculation is the return acceptable? Please explain your conclusion. Part 2. Risk Assessment ( 25 points) (April) a) Review the "Risk Assessment" tab which includes economic data provided by the Bureau of Economic Analysis (BEA) Note: Possible economic conditions and their probabilities are as follows. Possible recession, .05, slow growth, .05, normal economic growth, .90. b) Calculate weighted return, return deviation, squared return deviation, weighted squared deviation, variance, mean and standard deviation. After completing the risk analysis do you still agree with your conclusion in Part 1 , b.? If so why? Reassessment of NPV \& IRR ( 25 points) () a) A fixed asset suspension account, Account 99999 , was established in the "General Ledger Accounts" to accumulate all expenditures relating to this project. Review of this account (See G/L for Balance) indicates actual expenditures exceeded the approved amount of $150,000,000 and the investment cost is now much higher. b) Recalulate the NPV \& IRR based on the actual expenditures (cash flow investment amount) - See "Revisit NPV \& IRR" tab. Would you still accept this project? c) Given your "new" recalculated NPV \& IRR, would you still accept this project? Record Acquisition of Asset ( 25 points) () a) Prepare a journal entry to transfer the suspense account balance to the machinery and equipment account. b) Post the journal entry into the General Ledger Account(s) and establish as new balance in the affected accounts. c) Place asset into service, and assign fixed asset \#200 to the asset. Companies will now physicaly affix a fixed tag to the asset that holds the asset \# 200. d) Record the information in the fixed asset management system by completing the Company's Fixed Asset Record. Tip: Date soap press is placed in service is February 1 st. Include other relevant information. Do not calculate the depreciation,; but, include the book value. Find the net present value (NPV) and (IRR) using the information in the "Project Scope" tab. Use the cells below to show your work. Recalulate the NPV \& IRR based on the actual expenditures (cash flow investment) Use the cells below to show your work. Calculate NPV \& IRR \begin{tabular}{|c|} \hline Rate of Return \\ \hline Yr0 \\ \hline Yr1 \\ \hline Yr2 \\ \hline Yr3 \\ \hline Yr4 \\ \hline Yr5 \\ \hline NPV \\ \hline \end{tabular} \begin{tabular}{|} \hline \\ \hline \\ \hline \\ \hline \\ \hline \\ \hline \\ \hline \\ \hline \\ \hline \end{tabular} IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts