Question: I only need help with question 4. Stockholders equity. There is one value I can't figure out. How do I find this value? Mar. 15.

I only need help with question 4. Stockholders equity. There is one value I can't figure out. How do I find this value?

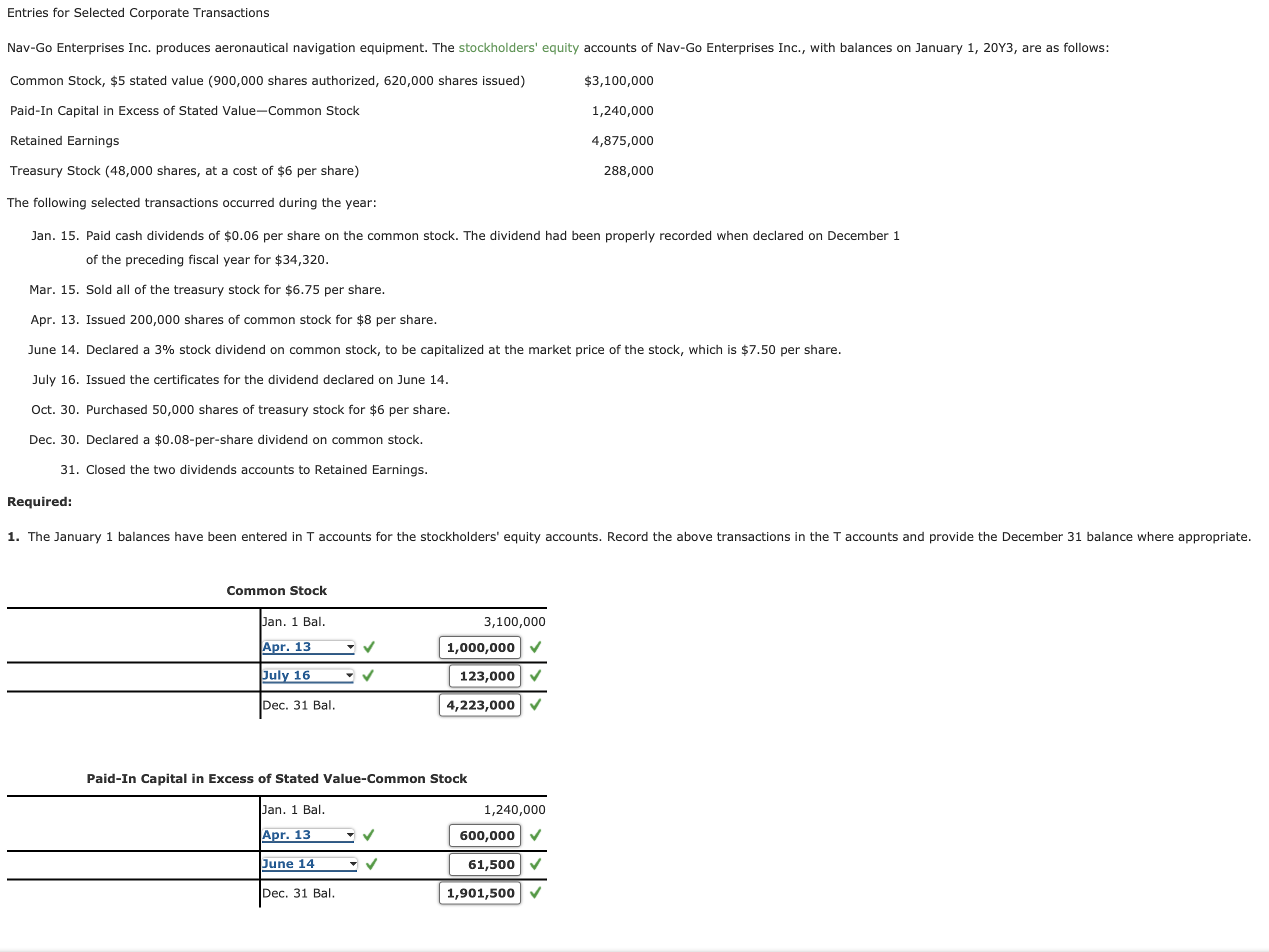

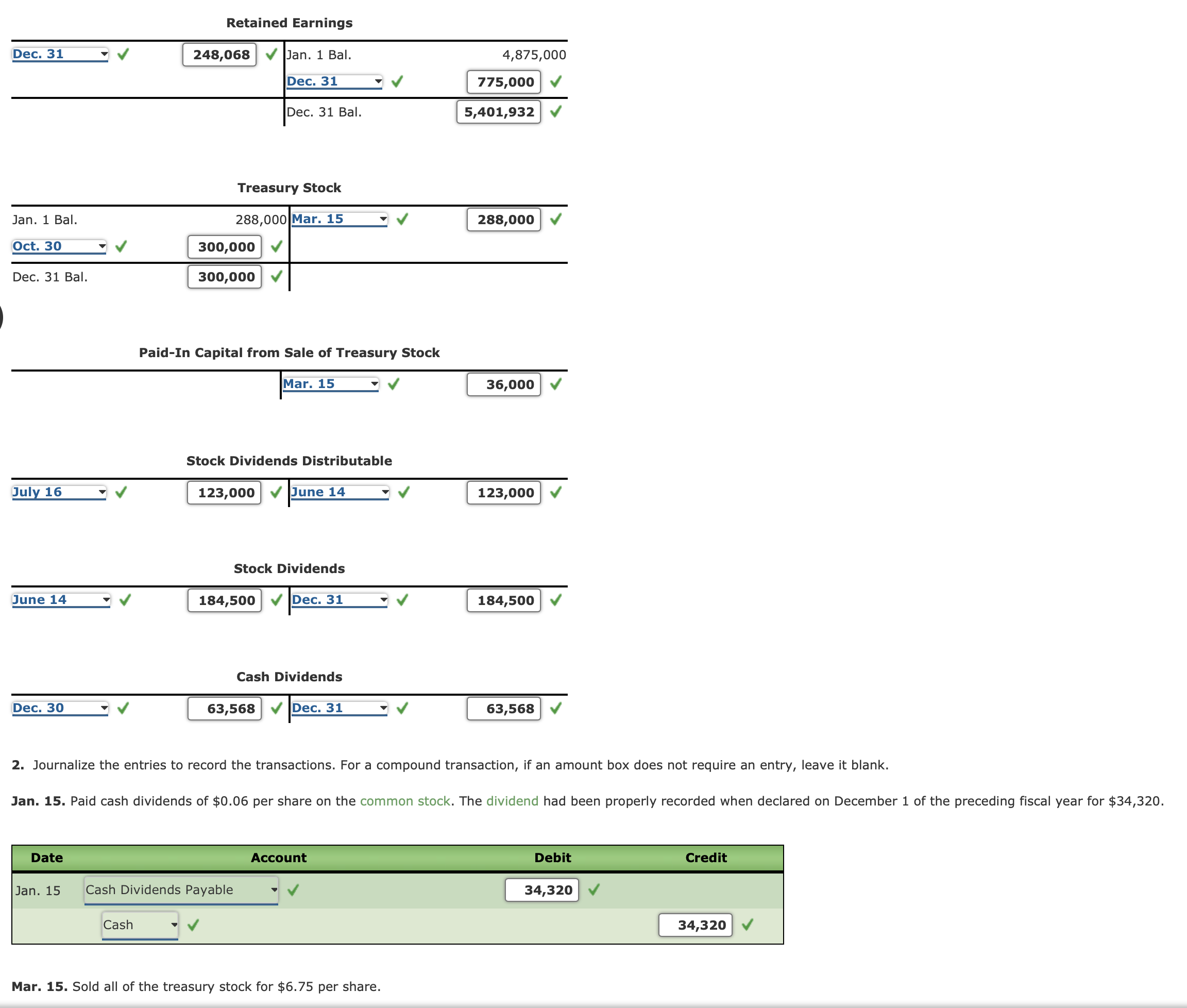

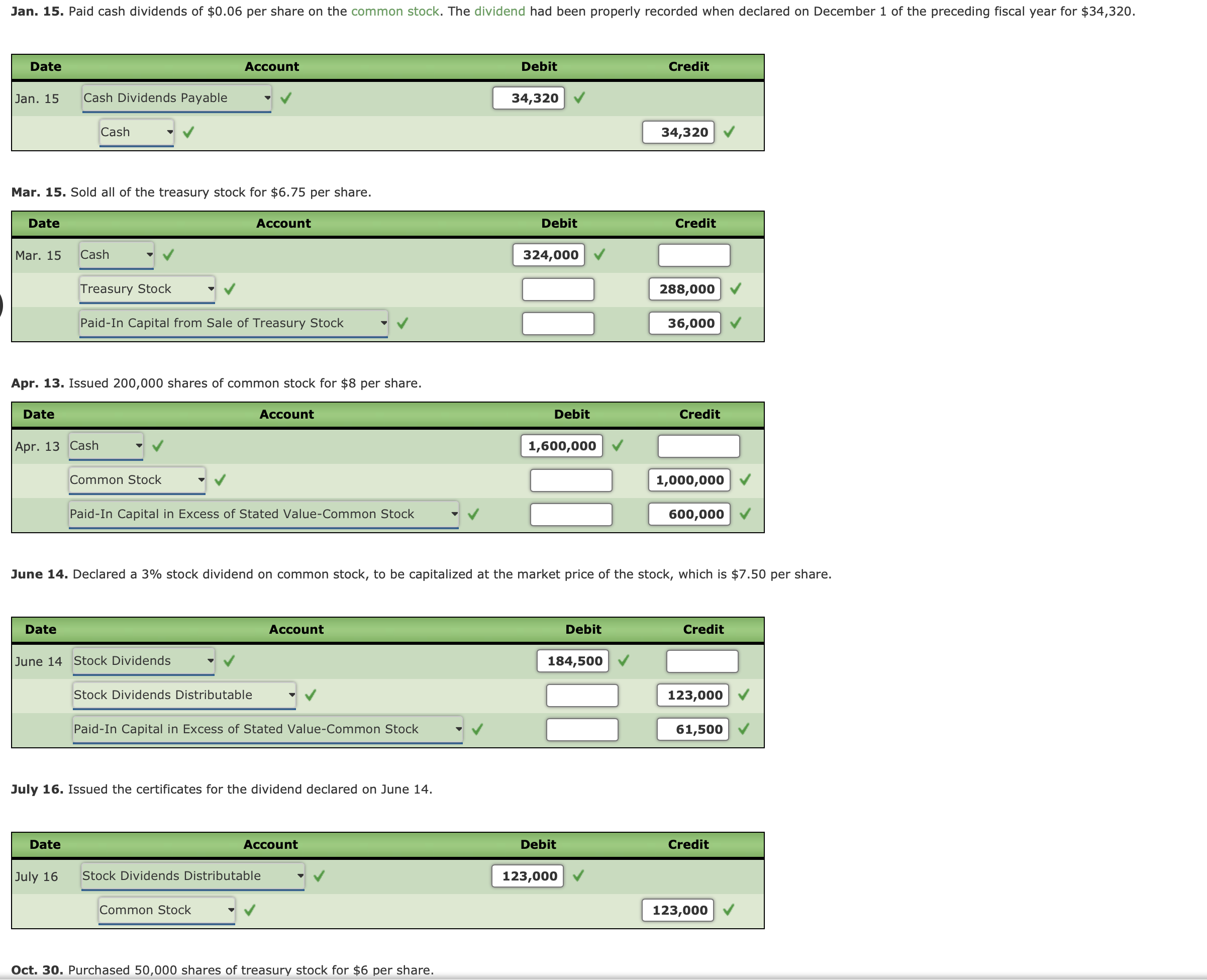

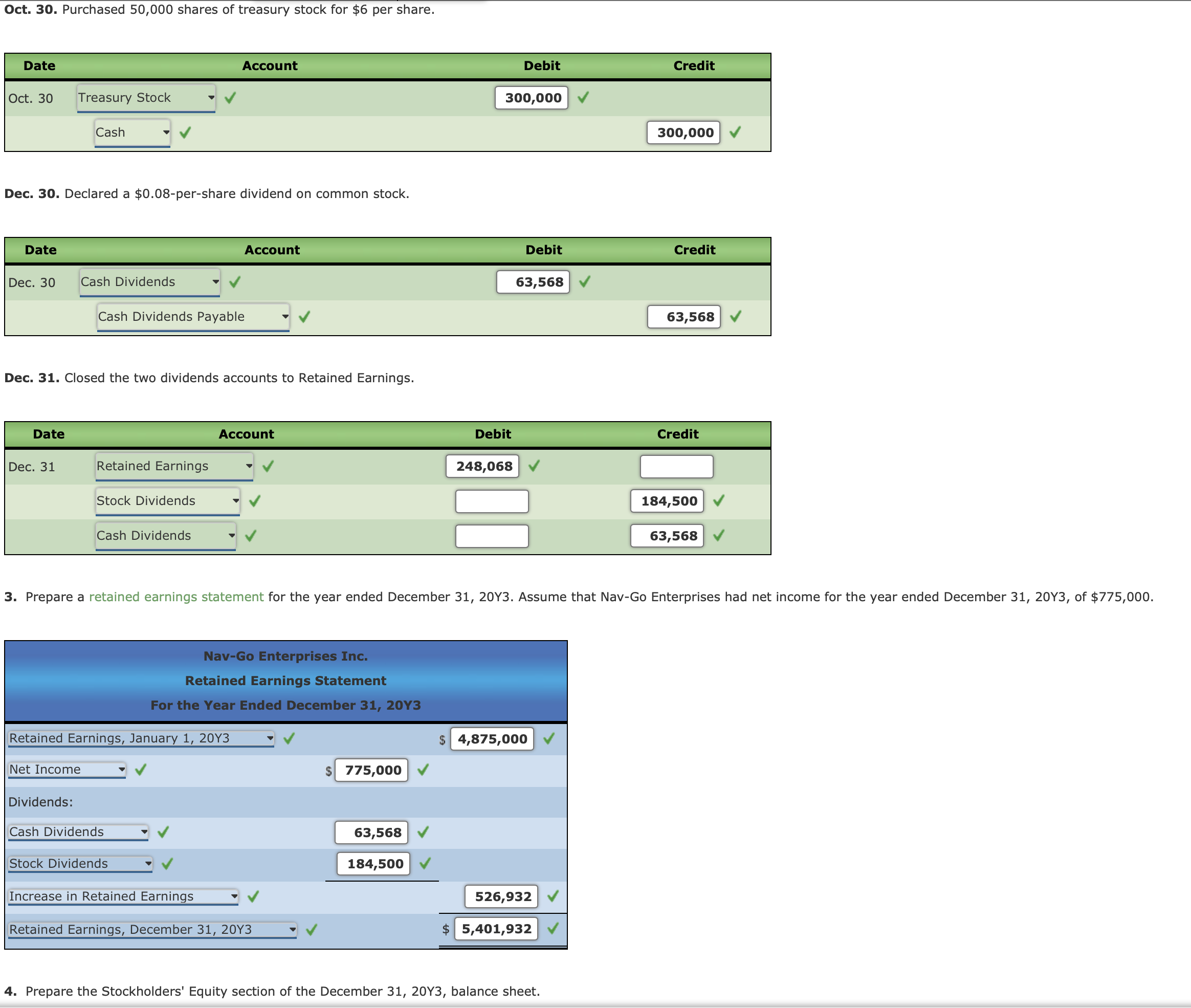

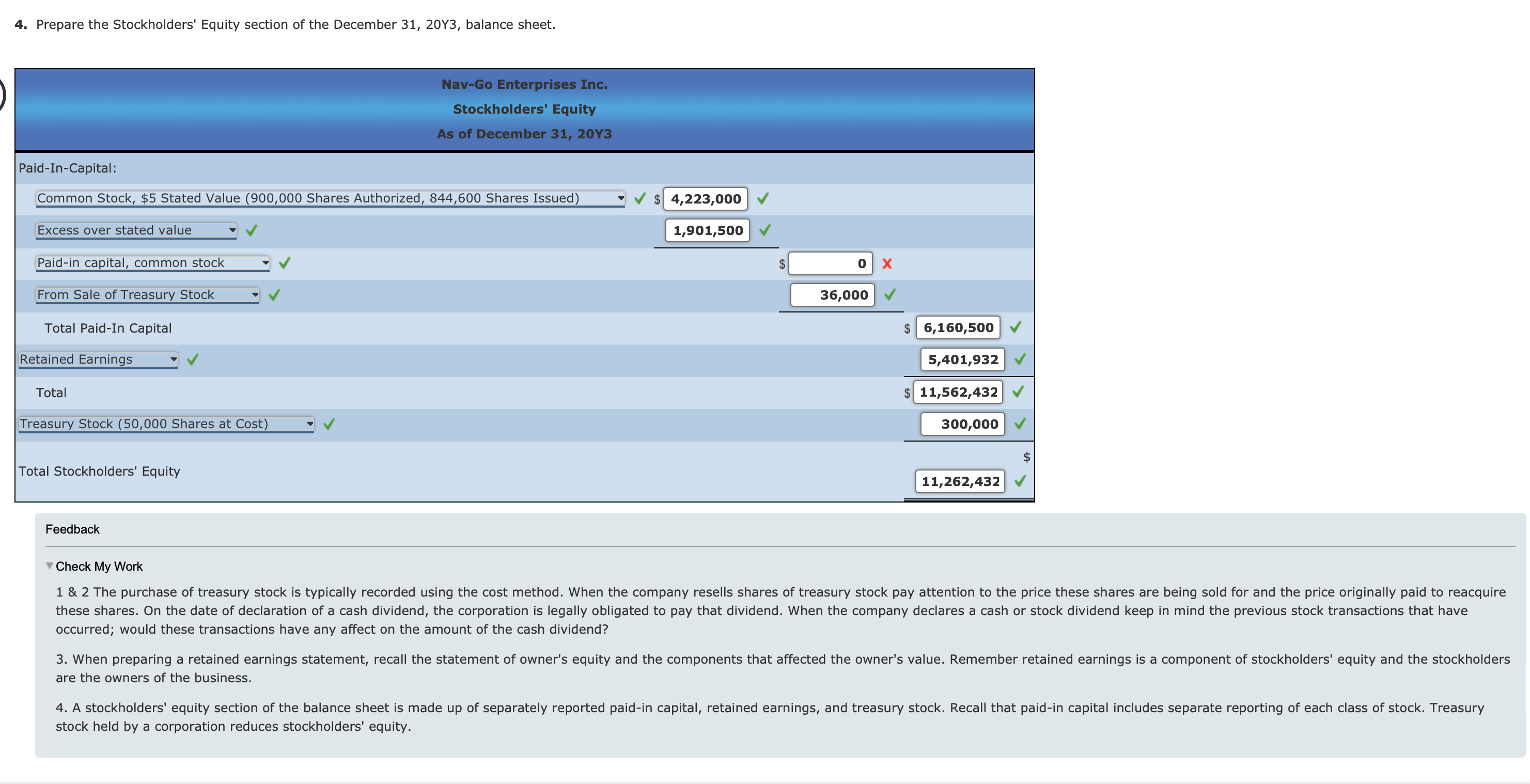

Mar. 15. Sold all of the treasury stock for $6.75 per share. Apr. 13. Issued 200,000 shares of common stock for $8 per share. June 14. Declared a 3% stock dividend on common stock, to be capitalized at the market price of the stock, which is $7.50 per s July 16. Issued the certificates for the dividend declared on June 14. Oct. 30. Purchased 50,000 shares of treasury stock for $6 per share. 4. Prepare the Stockholders' Equity section of the December 31, 20Y3, balance sheet. Feedback Vheck My Work occurred; would these transactions have any affect on the amount of the cash dividend? are the owners of the business. stock held by a corporation reduces stockholders' equity. 2. Journalize the entries to record the transactions. For a compound transaction, if an amount box does not require an entry, leave it blank. Mar. 15. Sold all of the treasury stock for $6.75 per share. Oct. 30. Purchased 50,000 shares of treasury stock for $6 per share. Dec. 30. Declared a $0.08-per-share dividend on common stock. Dec. 31. Closed the two dividends accounts to Retained Earnings. 3. Prepare a retained earnings statement for the year ended December 31,20Y3. Assu 4. Prepare the Stockholders' Equity section of the December 31,20Y3, balance sheet. The following selected transactions occurred durng the year: Jan. 15. Paid cash dividends of $0.06 per share on the common stock. The dividend had been properly recorded when declared on December 1 of the preceding fiscal year for $34,320. Mar. 15. Sold all of the treasury stock for $6.75 per share. Apr. 13. Issued 200,000 shares of common stock for $8 per share. June 14. Declared a 3% stock dividend on common stock, to be capitalized at the market price of the stock, which is $7.50 per share. July 16. Issued the certificates for the dividend declared on June 14. Oct. 30. Purchased 50,000 shares of treasury stock for $6 per share. Dec. 30. Declared a \$0.08-per-share dividend on common stock. 31. Closed the two dividends accounts to Retained Earnings. Required: 1. The January 1 balances have been entered in T accounts for the stockholders' equity accounts. Record the above transactions in the T accounts Paid-In Capital in Excess of Stated Value-Common Stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts