Question: I ONLY NEED HELP WITH QUESTION #40. Not sure if the other questions are essential to answer question #40. Please help! Thank you!! Over the

I ONLY NEED HELP WITH QUESTION #40. Not sure if the other questions are essential to answer question #40. Please help! Thank you!!

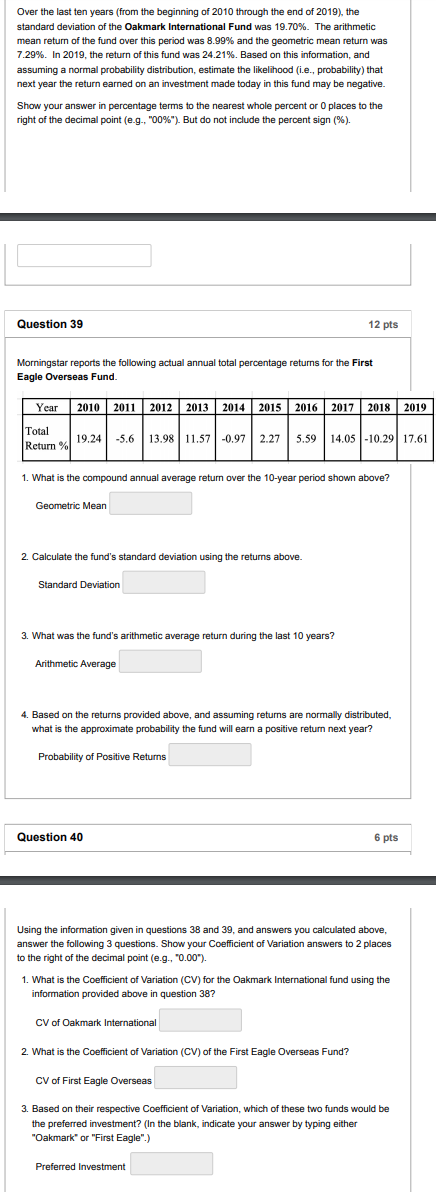

Over the last ten years (from the beginning of 2010 through the end of 2019), the standard deviation of the Oakmark International Fund was 19.70%. The arithmetic mean return of the fund over this period was 8.99% and the geometric mean return was 7.29%. In 2019, the return of this fund was 24.21%. Based on this information, and assuming a normal probability distribution, estimate the likelihood (i.e., probability) that next year the return earned on an investment made today in this fund may be negative. Show your answer in percentage terms to the nearest whole percent or o places to the right of the decimal point(e.g., "00%"). But do not include the percent sign (%). Question 39 12 pts Morningstar reports the following actual annual total percentage returns for the First Eagle Overseas Fund. Year 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Total Return% 19.24 -5.6 13.98 11.57 -0.97 2.275.59 14.05-10.29 17.61 1. What is the compound annual average return over the 10-year period shown above? Geometric Mean 2. Calculate the fund's standard deviation using the returns above. Standard Deviation 3. What was the fund's arithmetic average return during the last 10 years? Arithmetic Average 4. Based on the returns provided above, and assuming returns are normally distributed, what is the approximate probability the fund will earn a positive return next year? Probability of Positive Returns Question 40 6 6 pts pts Using the information given in questions 38 and 39, and answers you calculated above, answer the following 3 questions. Show your Coefficient of Variation answers to 2 places to the right of the decimal point (e.g.."0.00"). 1. What is the Coefficient of Variation (CV) for the Oakmark International fund using the information provided above in question 38? CV of Oakmark International 2. What is the Coefficient of Variation (CV) of the First Eagle Overseas Fund? CV of First Eagle Overseas 3. Based on their respective Coefficient of Variation, which of these two funds would be the preferred investment? (In the blank, indicate your answer by typing either "Oakmark" or "First Eagle") Preferred Investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts