Question: I only need help with question B, I am a little lost please help Table 2. 5) Assume that stock returns are governed by the

I only need help with question B, I am a little lost please help

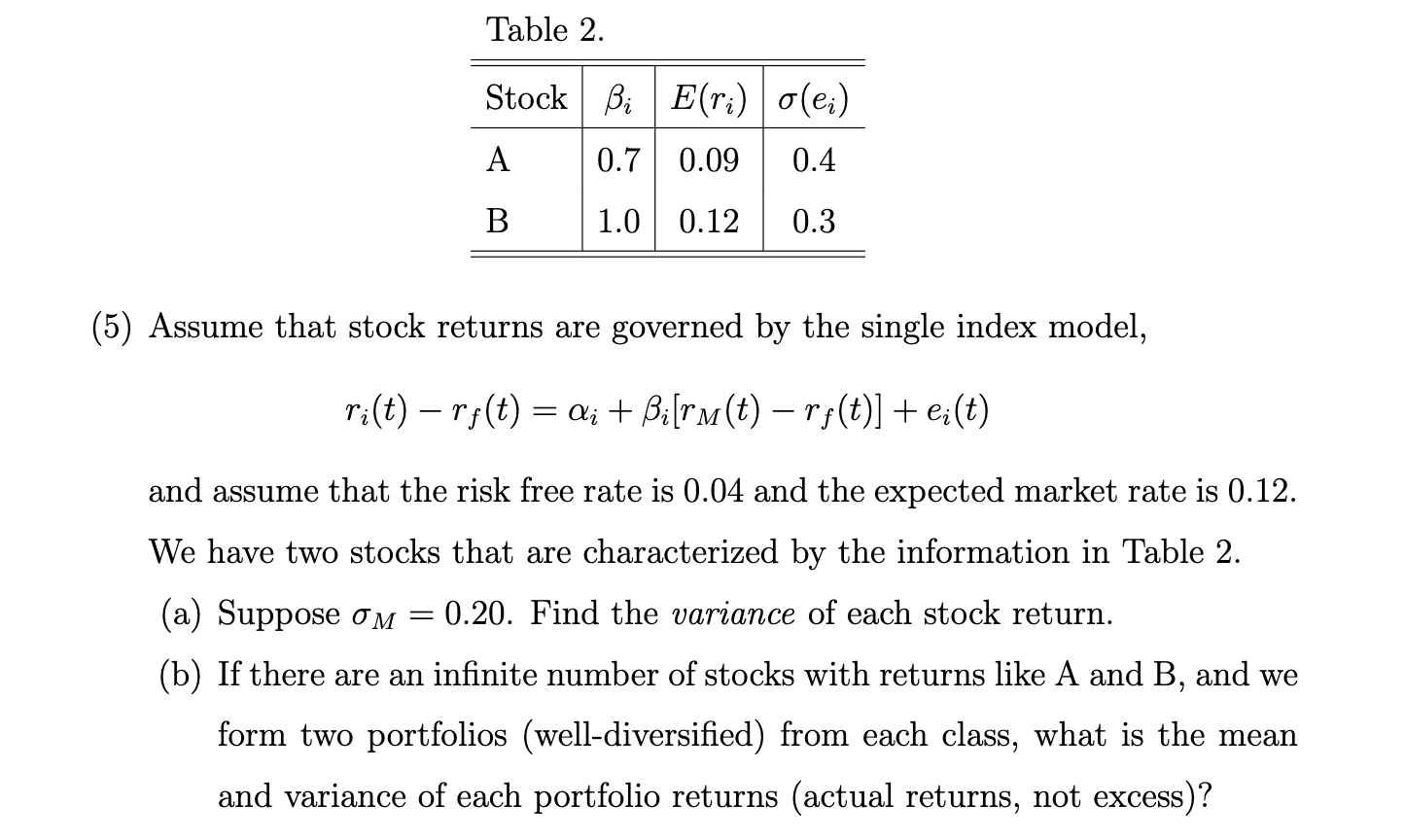

Table 2. 5) Assume that stock returns are governed by the single index model, ri(t)rf(t)=i+i[rM(t)rf(t)]+ei(t) and assume that the risk free rate is 0.04 and the expected market rate is 0.12 . We have two stocks that are characterized by the information in Table 2. (a) Suppose M=0.20. Find the variance of each stock return. (b) If there are an infinite number of stocks with returns like A and B, and we form two portfolios (well-diversified) from each class, what is the mean and variance of each portfolio returns (actual returns, not excess)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts