Question: (*I only need help with Required B1*) Sky Co. employed Tom Mills in Year 1. Tom earned $5,600 per month and worked the entire year.

(*I only need help with Required B1*)

Sky Co. employed Tom Mills in Year 1. Tom earned $5,600 per month and worked the entire year. Assume the Social Security tax rate is 6 percent for the first $130,000 of earnings, and the Medicare tax rate is 1.5 percent. Toms federal income tax withholding amount is $900 per month. Use 5.4 percent for the state unemployment tax rate and 0.6 percent for the federal unemployment tax rate on the first $7,000 of earnings per employee.

Required

b. Assume that instead of $5,600 per month Tom earned $11,100 per month. Based on this new level of income Toms new federal income tax withholding is $2,200. Answer the following question.

(I only need help with Required B1)

(I only need help with Required B1)

Thank you.

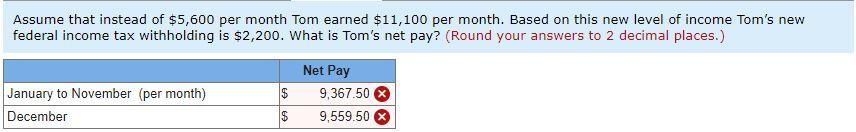

Required B1 Assume that instead of $5,600 per month Tom earned $11,100 per month. Based on this new level of income Tom's new federal income tax withholding is $2,200. What is Tom's net pay? (Round your answers to 2 decimal places.) January to November (per month) December $ $ Net Pay 9,367.50 9,559.50 X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts