Question: * I only need part b Robert is the sole shareholder and CEO of ABC, Inc., an S corporation that is a qualified trade or

* I only need part b

* I only need part b

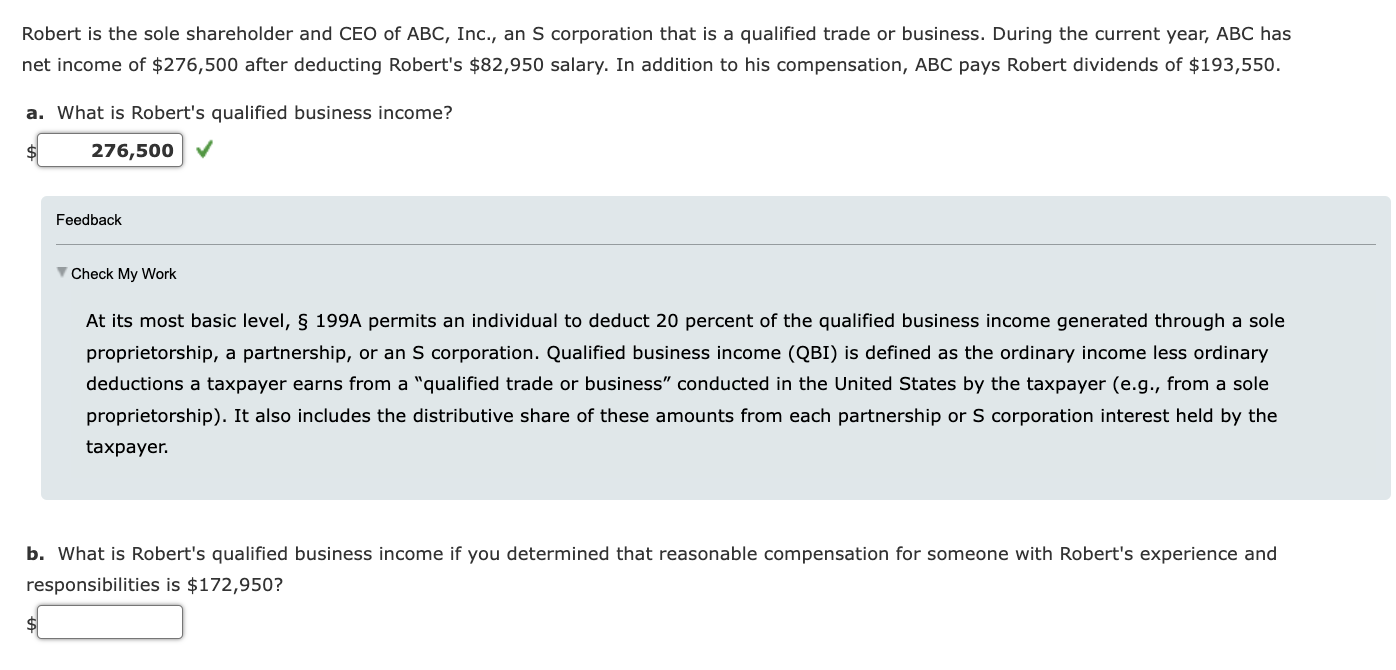

Robert is the sole shareholder and CEO of ABC, Inc., an S corporation that is a qualified trade or business. During the current year, ABC has net income of $276,500 after deducting Robert's $82,950 salary. In addition to his compensation, ABC pays Robert dividends of $193,550. a. What is Robert's qualified business income? Feedback V Check My Work At its most basic level, 199A permits an individual to deduct 20 percent of the qualified business income generated through a sole proprietorship, a partnership, or an S corporation. Qualified business income (QBI) is defined as the ordinary income less ordinary deductions a taxpayer earns from a "qualified trade or business" conducted in the United States by the taxpayer (e.g., from a sole taxpayer. responsibilities is $172,950

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts