Question: I only need part D solved, i already know the answer as well. Please solve part D in excel and show all steps. Samantha is

I only need part D solved, i already know the answer as well. Please solve part D in excel and show all steps.

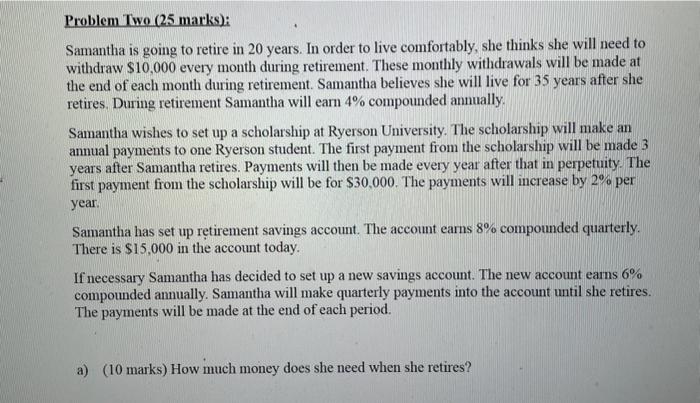

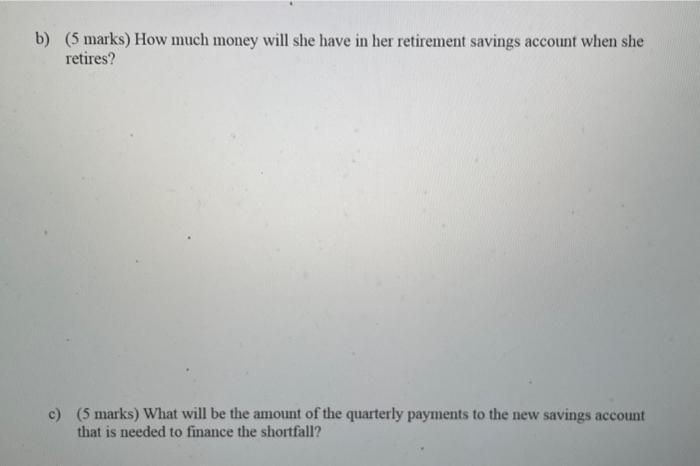

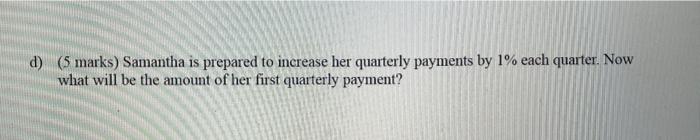

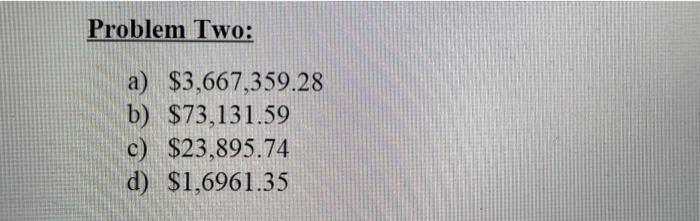

I only need part D solved, i already know the answer as well. Please solve part D in excel and show all steps.Samantha is going to retire in 20 years. In order to live comfortably, she thinks she will need to withdraw $10,000 every month during retirement. These monthly withdrawals will be made at the end of each month during retirement. Samantha believes she will live for 35 years after she retires. During retirement Samantha will earn 4% compounded annually. Samantha wishes to set up a scholarship at Ryerson University. The scholarship will make an annual payments to one Ryerson student. The first payment from the scholarship will be made 3 years after Samantha retires. Payments will then be made every year after that in perpetuity. The first payment from the scholarship will be for $30,000. The payments will increase by 2% per year. Samantha has set up retirement savings account. The account earns 8% compounded quarterly. There is $15,000 in the account today. If necessary Samantha has decided to set up a new savings account. The new account earns 6% compounded annually. Samantha will make quarterly payments into the account until she retires. The payments will be made at the end of each period. a) (10 marks) How much money does she need when she retires? b) (5 marks) How much money will she have in her retirement savings account when she retires? c) ( 5 marks) What will be the amount of the quarterly payments to the new savings account that is needed to finance the shortfall? d) ( 5 marks) Samantha is prepared to increase her quarterly payments by 1% each quarter. Now what will be the amount of her first quarterly payment? Problem Two: a) $3,667,359.28 b) $73,131.59 c) $23,895.74 d) $1,6961.35 Samantha is going to retire in 20 years. In order to live comfortably, she thinks she will need to withdraw $10,000 every month during retirement. These monthly withdrawals will be made at the end of each month during retirement. Samantha believes she will live for 35 years after she retires. During retirement Samantha will earn 4% compounded annually. Samantha wishes to set up a scholarship at Ryerson University. The scholarship will make an annual payments to one Ryerson student. The first payment from the scholarship will be made 3 years after Samantha retires. Payments will then be made every year after that in perpetuity. The first payment from the scholarship will be for $30,000. The payments will increase by 2% per year. Samantha has set up retirement savings account. The account earns 8% compounded quarterly. There is $15,000 in the account today. If necessary Samantha has decided to set up a new savings account. The new account earns 6% compounded annually. Samantha will make quarterly payments into the account until she retires. The payments will be made at the end of each period. a) (10 marks) How much money does she need when she retires? b) (5 marks) How much money will she have in her retirement savings account when she retires? c) ( 5 marks) What will be the amount of the quarterly payments to the new savings account that is needed to finance the shortfall? d) ( 5 marks) Samantha is prepared to increase her quarterly payments by 1% each quarter. Now what will be the amount of her first quarterly payment? Problem Two: a) $3,667,359.28 b) $73,131.59 c) $23,895.74 d) $1,6961.35

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts