Question: I only need requirement 2 solved please! I believe my answer is correct, but not sure. Requirement 1. Prepare a schedule for the cost of

I only need requirement 2 solved please! I believe my answer is correct, but not sure.

I only need requirement 2 solved please! I believe my answer is correct, but not sure.

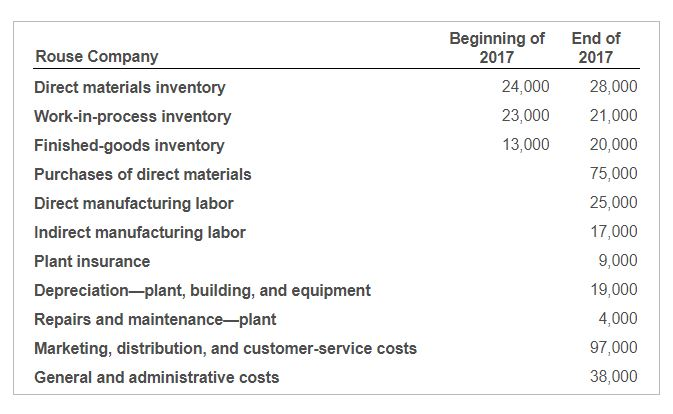

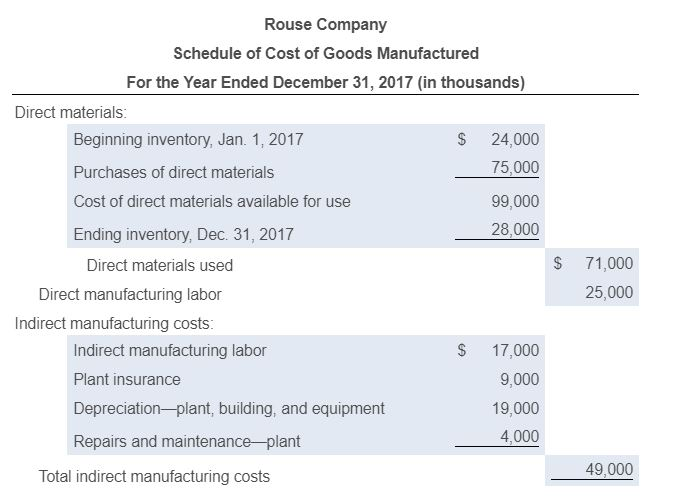

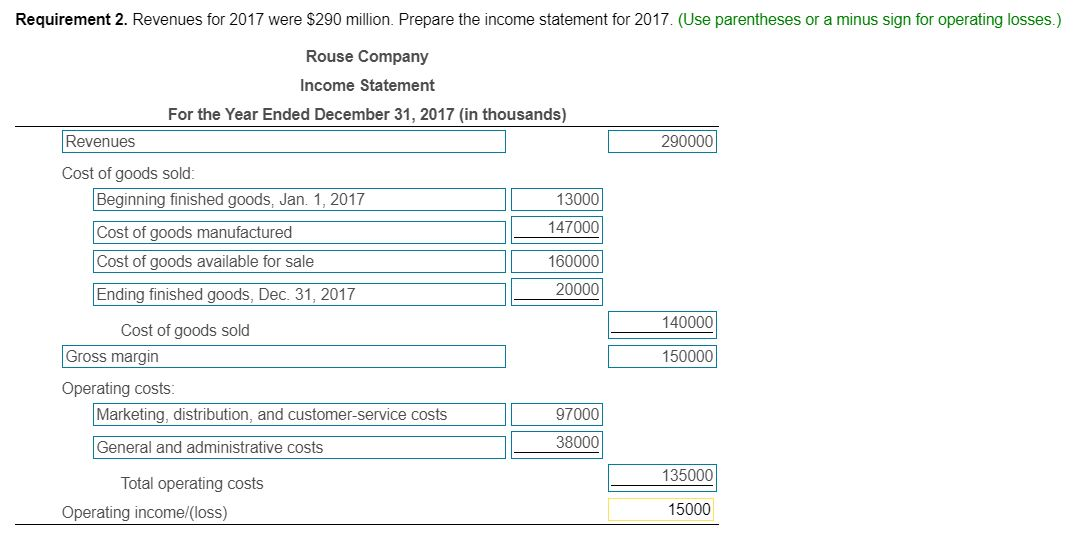

Requirement 1. Prepare a schedule for the cost of goods manufactured for 2017 Begin by preparing the schedule of cost of goods manufactured in thousands). Start with the direct materials and labor costs, then indirect manufacturing costs, and complete the schedule by calculating cost of goods manufactured. Beginning of 2017 24,000 23,000 13,000 Rouse Company Direct materials inventory Work-in-process inventory Finished-goods inventory Purchases of direct materials Direct manufacturing labor Indirect manufacturing labor Plant insurance Depreciationplant, building, and equipment Repairs and maintenance-plant Marketing, distribution, and customer-service costs General and administrative costs End of 2017 28,000 21,000 20,000 75,000 25,000 17,000 9,000 19,000 4,000 97,000 38,000 Rouse Company Schedule of Cost of Goods Manufactured For the Year Ended December 31, 2017 (in thousands) Direct materials: Beginning inventory, Jan. 1, 2017 $ 24,000 Purchases of direct materials 75,000 Cost of direct materials available for use 99,000 Ending inventory, Dec 31, 2017 28,000 Direct materials used Direct manufacturing labor Indirect manufacturing costs: Indirect manufacturing labor $ 17,000 Plant insurance 9,000 Depreciation-plant, building, and equipment 19,000 Repairs and maintenance plant 4,000 Total indirect manufacturing costs $ 71,000 25,000 49,000 49,000 Total indirect manufacturing costs Manufacturing costs incurred during 2017 Beginning work-in-process inventory, Jan. 1, 2017 Total manufacturing costs to account for Ending work-in-process inventory, Dec. 31, 2017 145,000 23,000 168,000 21,000 $ 147,000 Cost of goods manufactured Requirement 2. Revenues for 2017 were $290 million. Prepare the income statement for 2017. (Use parentheses or a minus sign for operating losses.) Rouse Company Income Statement For the Year Ended December 31, 2017 (in thousands) Revenues 290000 13000 147000 Cost of goods sold: Beginning finished goods, Jan 1, 2017 Cost of goods manufactured Cost of goods available for sale Ending finished goods, Dec. 31, 2017 160000 20000 140000 Cost of goods sold Gross margin 150000 Operating costs: Marketing, distribution, and customer-service costs General and administrative costs 97000 38000 135000 Total operating costs Operating income/loss) 15000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts