Question: I only need solutions to (d) and (e) BHP Billiton Limited is an Australian corporation engaging in mining, drilling, and processing mineral resources. It operates

I only need solutions to (d) and (e)

I only need solutions to (d) and (e)

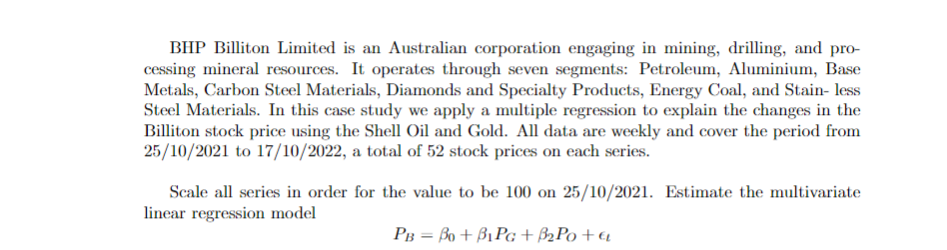

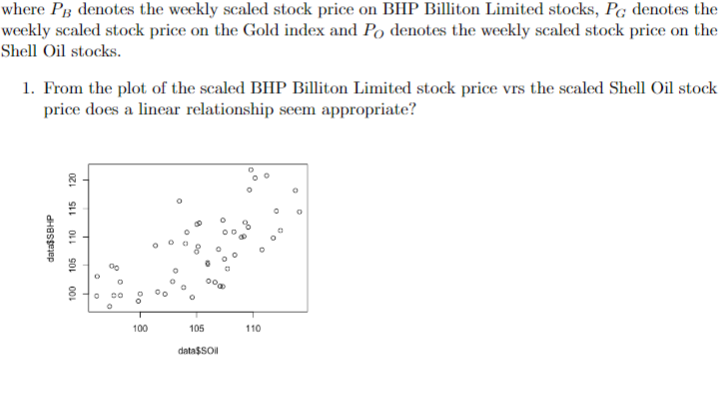

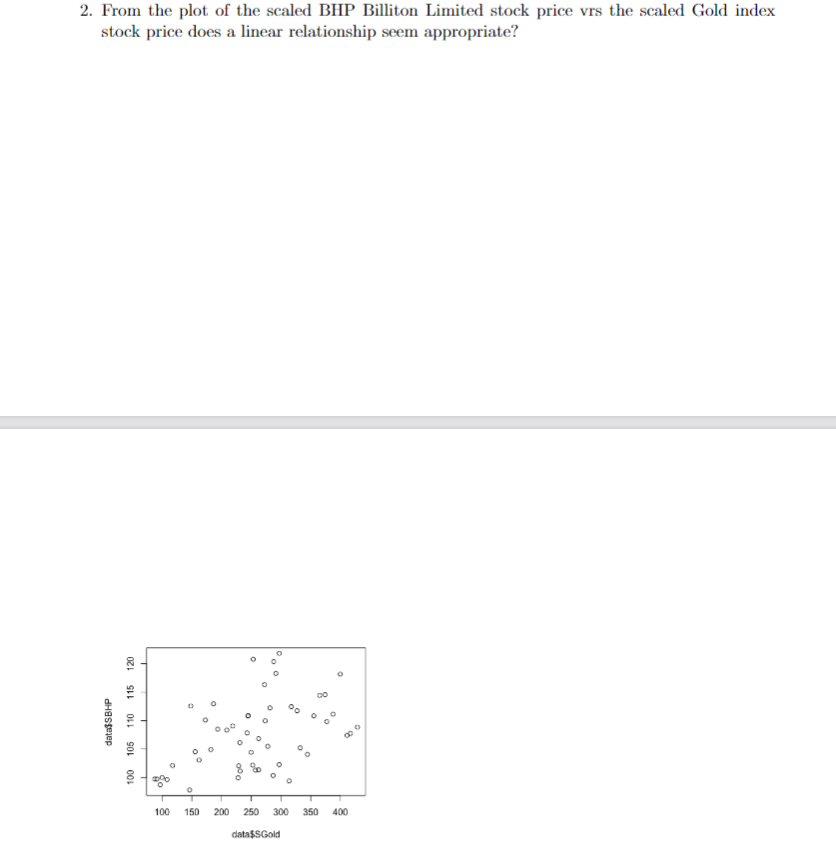

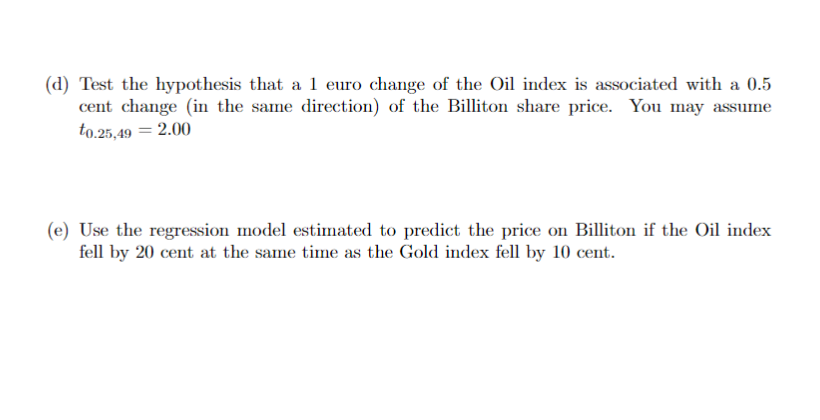

BHP Billiton Limited is an Australian corporation engaging in mining, drilling, and processing mineral resources. It operates through seven segments: Petroleum, Aluminium, Base Metals, Carbon Steel Materials, Diamonds and Specialty Products, Energy Coal, and Stain- less Steel Materials. In this case study we apply a multiple regression to explain the changes in the Billiton stock price using the Shell Oil and Gold. All data are weekly and cover the period from 25/10/2021 to 17/10/2022, a total of 52 stock prices on each series. Scale all series in order for the value to be 100 on 25/10/2021. Estimate the multivariate linear regression model PB=0+1PG+2PO+ where PB denotes the weekly scaled stock price on BHP Billiton Limited stocks, PG denotes the weekly scaled stock price on the Gold index and PO denotes the weekly scaled stock price on the Thell Oil stocks. 1. From the plot of the scaled BHP Billiton Limited stock price vrs the scaled Shell Oil stock price does a linear relationship seem appropriate? 2. From the plot of the scaled BHP Billiton Limited stock price vrs the scaled Gold index stock price does a linear relationship seem appropriate? 3. The following is output from R after fitting the model to the data lm(formula=data$SBHPdata$SGold+data$SOil) Residuals: (a) Does the estimates of the parameters align with your intuition after examining the relationship between the variables in the scatterplots in Q1 and Q2 (b) Are the Gold index and the Oil stock price significant determinants of the changes in the Billiton share price? (c) Find and interpret the 95% confidence interval for the coefficient on the Gold price in the Billiton regression. You may assume t0.25,49=2.00 (d) Test the hypothesis that a 1 euro change of the Oil index is associated with a 0.5 cent change (in the same direction) of the Billiton share price. You may assume t0.25,49=2.00 (e) Use the regression model estimated to predict the price on Billiton if the Oil index fell by 20 cent at the same time as the Gold index fell by 10 cent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts