Question: I only need solutions to questions E and F. 5. (20 points) Suppose Daniel makes a $50,000 deposit to Chase bank. The reserve ratio set

I only need solutions to questions E and F.

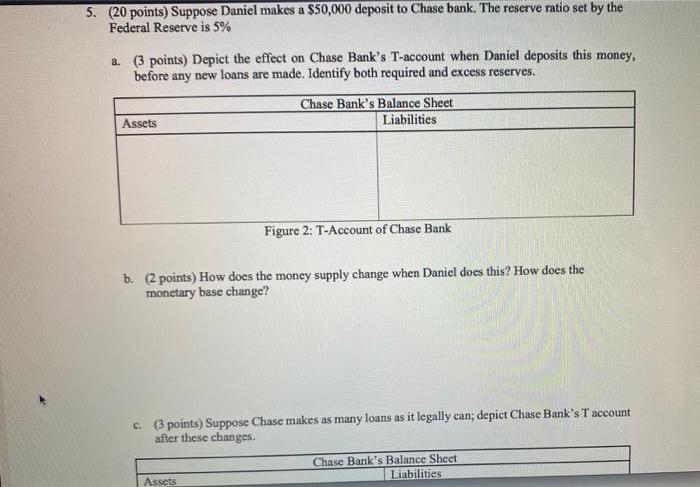

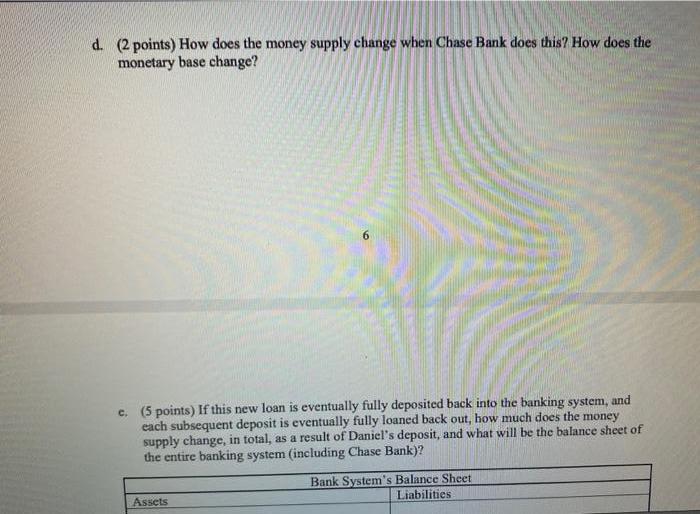

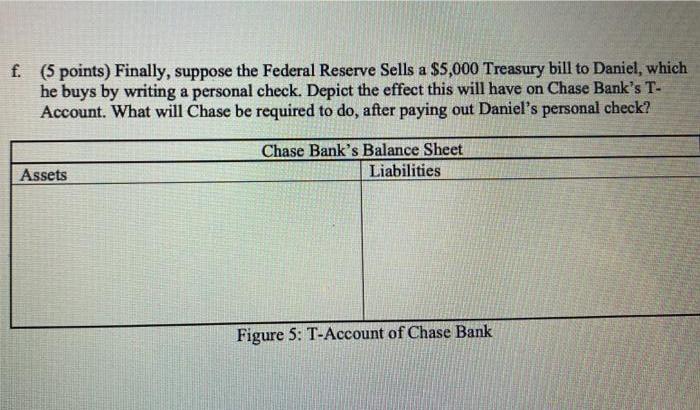

5. (20 points) Suppose Daniel makes a $50,000 deposit to Chase bank. The reserve ratio set by the Federal Reserve is 5% a. (3 points) Depict the effect on Chase Bank's T-account when Daniel deposits this money, before any new loans are made. Identify both required and excess reserves. Chase Bank's Balance Sheet Liabilities Assets Figure 2: T-Account of Chase Bank b. (2 points) How does the money supply change when Daniel does this? How does the monetary base change? c (3 points) Suppose Chase makes as many loans as it legally can; depict Chase Bank's T account after these changes. Chase Bank's Balance Sheet Liabilities Assets d. (2 points) How does the money supply change when Chase Bank does this? How does the monetary base change? c. (5 points) If this new loan is eventually fully deposited back into the banking system, and each subsequent deposit is eventually fully loaned back out, how much does the money supply change, in total, as a result of Daniel's deposit, and what will be the balance sheet of the entire banking system (including Chase Bank)? Bank System's Balance Sheet Liabilities Assets f. (5 points) Finally, suppose the Federal Reserve Sells a $5,000 Treasury bill to Daniel, which he buys by writing a personal check. Depict the effect this will have on Chase Bank's T- Account. What will Chase be required to do, after paying out Daniel's personal check? Chase Bank's Balance Sheet Liabilities Assets Figure 5: T-Account of Chase Bank

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts