Question: I only need the answer and step by step for B. This question has been posted a few times but the answer is wrong. Thanks!

I only need the answer and step by step for B. This question has been posted a few times but the answer is wrong. Thanks!

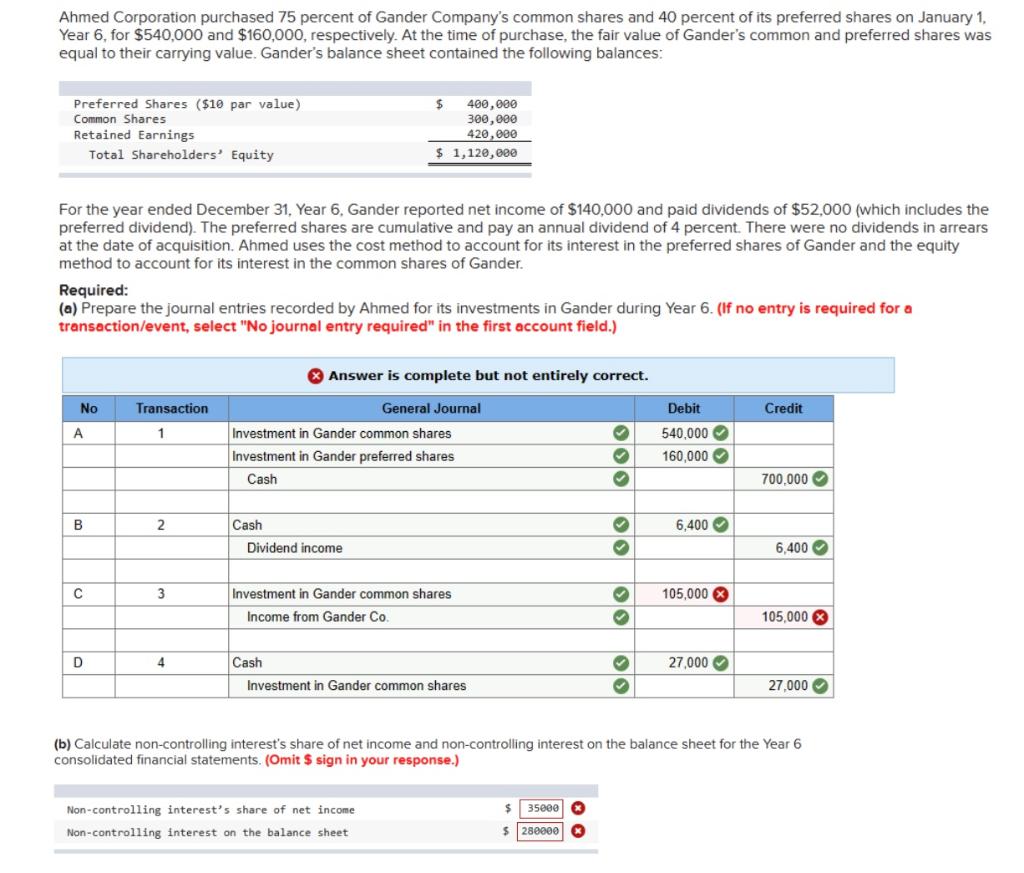

Ahmed Corporation purchased 75 percent of Gander Company's common shares and 40 percent of its preferred shares on January 1 . Year 6 , for $540,000 and $160,000, respectively. At the time of purchase, the fair value of Gander's common and preferred shares was equal to their carrying value. Gander's balance sheet contained the following balances: For the year ended December 31, Year 6, Gander reported net income of $140,000 and paid dividends of $52,000 (which includes the preferred dividend). The preferred shares are cumulative and pay an annual dividend of 4 percent. There were no dividends in arrears at the date of acquisition. Ahmed uses the cost method to account for its interest in the preferred shares of Gander and the equity method to account for its interest in the common shares of Gander. Required: (a) Prepare the journal entries recorded by Ahmed for its investments in Gander during Year 6. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) (b) Calculate non-controlling interest's share of net income and non-controlling interest on the balance sheet for the Year 6 consolidated financial statements. (Omit \$ sign in your response.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts