Question: I only need the answer for the circled portion, thank you. Exercise 6: Stock Dividends Rather than paying dividends in cash, a company may elect

I only need the answer for the circled portion, thank you.

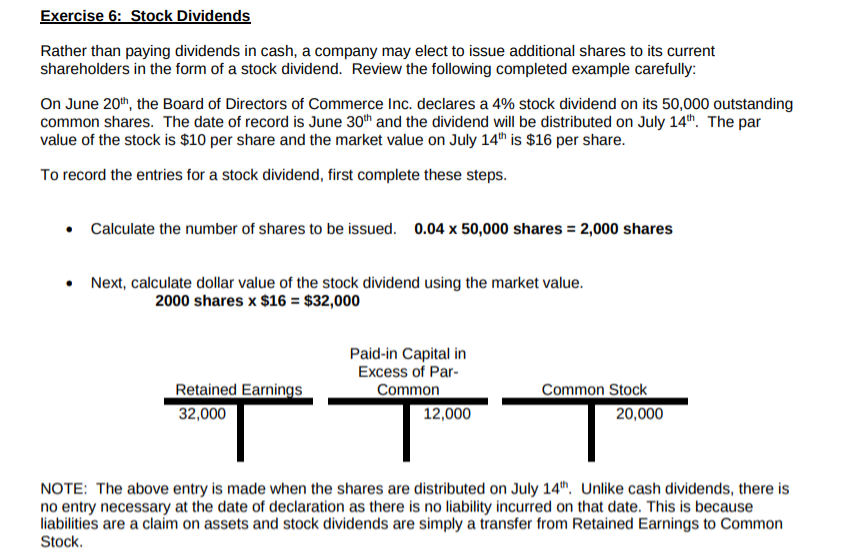

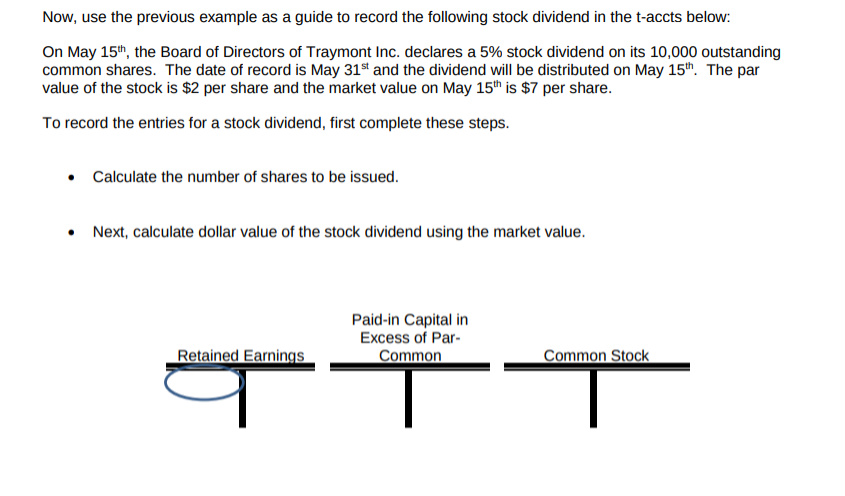

Exercise 6: Stock Dividends Rather than paying dividends in cash, a company may elect to issue additional shares to its current shareholders in the form of a stock dividend. Review the following completed example carefully: On June 20th, the Board of Directors of Commerce Inc. declares a 4% stock dividend on its 50,000 outstanding common shares. The date of record is June 30h and the dividend will be distributed on July 14th. The par value of the stock is $10 per share and the market value on July 14th is $16 per share. To record the entries for a stock dividend, first complete these steps. Calculate the number of shares to be issued. 0.04 x 50,000 shares 2,000 shares Next, calculate dollar value of the stock dividend using the market value. 2000 shares x $16 $32,000 Paid-in Capital in Excess of Par Common Common Stock 32,000 12,000 20,000 NOTE: The above entry is made when the shares are distributed on July 14th, Unlike cash dividends, there is no entry necessary at the date of declaration as there is no liability incurred on that date. This is because liabilities are a claim on assets and stock dividends are simply a transfer from Retained Earnings to Common Stock Now, use the previous example as a guide to record the following stock dividend in the t-accts below: On May 15th, the Board of Directors of Traymont Inc. declares a 5% stock dividend on its 10,000 outstanding common shares. The date of record is May 31st and the dividend will be distributed on May 15th. The par value of the stock is $2 per share and the market value on May 15th is $7 per share. To record the entries for a stock dividend, first complete these steps. Calculate the number of shares to be issued. Next, calculate dollar value of the stock dividend using the market value. Paid-in Capital in Excess of Par Common Retained Earnings Common Stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts