Question: I only need the answer to question 2 and 3a. I already got question 1 and 3b correct. Thanks! Exercise 10-27 (Algo) Cash Disbursements Budget

![Disbursements Budget [LO 10-4] Bond Company budgets the following purchases of direct](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6718849fe4b74_0636718849f5ef62.jpg)

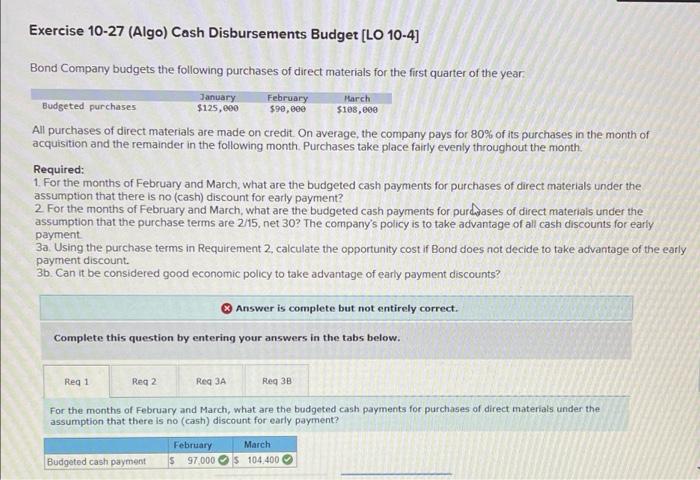

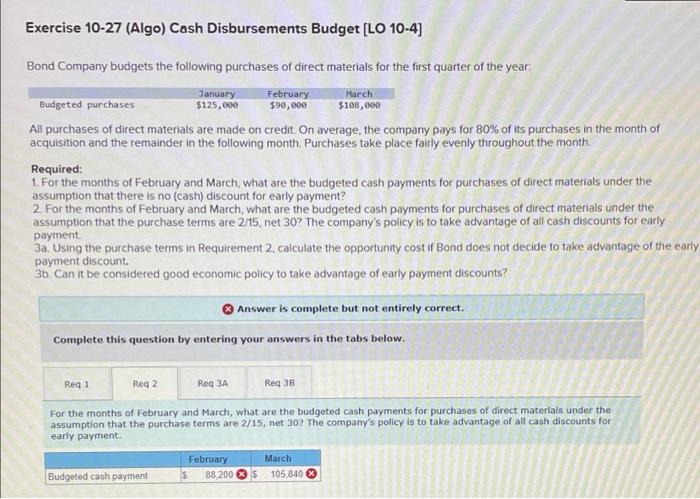

Exercise 10-27 (Algo) Cash Disbursements Budget [LO 10-4] Bond Company budgets the following purchases of direct materials for the first quarter of the year March January February Budgeted purchases $125,000 $90,000 $108,000 All purchases of direct materials are made on credit. On average, the company pays for 80% of its purchases in the month of acquisition and the remainder in the following month. Purchases take place fairly evenly throughout the month. Required: 1. For the months of February and March, what are the budgeted cash payments for purchases of direct materials under the assumption that there is no (cash) discount for early payment? 2 For the months of February and March, what are the budgeted cash payments for purchases of direct materials under the assumption that the purchase terms are 2/15, net 30? The company's policy is to take advantage of all cash discounts for early 3a. Using the purchase terms in Requirement 2 calculate the opportunity cost if Bond does not decide to take advantage of the early payment discount. 3b Can it be considered good economic policy to take advantage of early payment discounts? payment Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 Red 3A Reg 38 For the months of February and March, what are the budgeted cash payments for purchases of direct materials under the assumption that there is no (cash) discount for early payment? February March Budgeted cash payment 97.000 $ 104,400 Exercise 10-27 (Algo) Cash Disbursements Budget [LO 10-4] March Bond Company budgets the following purchases of direct materials for the first quarter of the year January February Budgeted purchases $125,000 $90,000 $180,000 All purchases of direct materials are made on credit. On average, the company pays for 80% of its purchases in the month of acquisition and the remainder in the following month. Purchases take place fairly evenly throughout the month Required: 1. For the months of February and March, what are the budgeted cash payments for purchases of direct materials under the assumption that there is no (cash) discount for early payment? 2. For the months of February and March, what are the budgeted cash payments for purchases of direct materials under the assumption that the purchase terms are 2/15, net 30The company's policy is to take advantage of all cash discounts for early 3a. Using the purchase terms in Requirement 2 calculate the opportunity cost if Bond does not decide to take advantage of the early payment discount. 36 Can it be considered good economic policy to take advantage of early payment discounts? payment Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 Req 3A Reg 38 For the months of February and March, what are the budgeted cash payments for purchases of direct materials under the assumption that the purchase terms are 2/15, net 30? The company's policy is to take advantage of all cash discounts for early payment. February 88 200 $ March 105,840 Budgeted cash payment Exercise 10-27 (Algo) Cash Disbursements Budget [LO 10-4) February March Bond Company budgets the following purchases of direct materials for the first quarter of the year January Budgeted purchases $125,000 $90,000 $188,000 All purchases of direct materials are made on credit. On average, the company pays for 80% of its purchases in the month of acquisition and the remainder in the following month Purchases take place fairly evenly throughout the month, Required: 1. For the months of February and March, what are the budgeted cash payments for purchases of direct materials under the assumption that there is no (cash) discount for early payment? 2. For the months of February and March, what are the budgeted cash payments for purchases of direct materials under the assumption that the purchase terms are 2/15, net 30? The company's policy is to take advantage of all cash discounts for early payment 3a Using the purchase terms in Requirement 2 calculate the opportunity cost if Bond does not decide to take advantage of the early payment discount 3b Can it be considered good economic policy to take advantage of early payment discounts? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Reg 38 Req 1 Reg 2 Reg 3A Using the purchase terms in Requirement 2, calculate the opportunity cost if Bond does not decide to take advantage of the early payment discount. (Enter your answer as a percent rounded to 2 decimal places (T.e. 1234 = 12.34%)) Opportunity cost 20.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts