Question: I only need the answer to question (c). Please show all workings clearly with explanations, thank you. c. Which portfolio(s) is/are overvalued and undervalued? QUESTION

I only need the answer to question (c). Please show all workings clearly with explanations, thank you.

c. Which portfolio(s) is/are overvalued and undervalued?

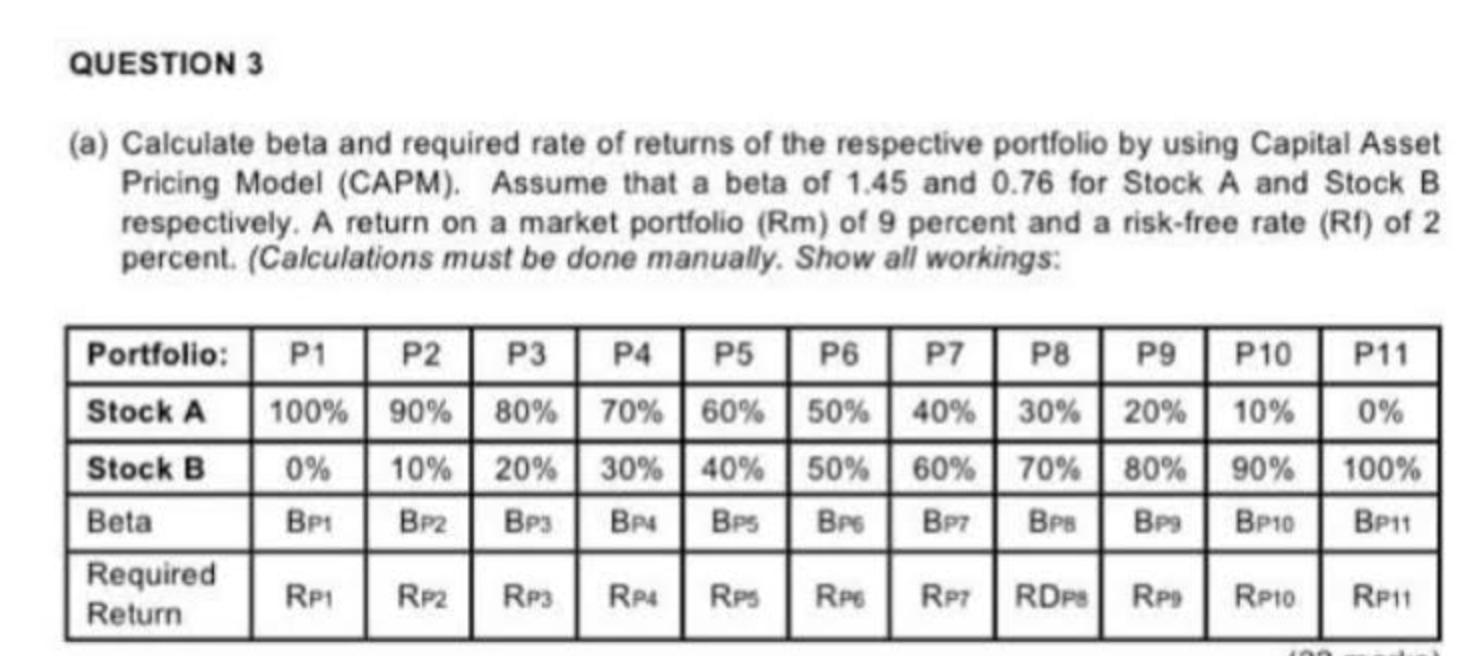

QUESTION 3 (a) Calculate beta and required rate of returns of the respective portfolio by using Capital Asset Pricing Model (CAPM). Assume that a beta of 1.45 and 0.76 for Stock A and Stock B respectively. A return on a market portfolio (Rm) of 9 percent and a risk-free rate (RI) of 2 percent. (Calculations must be done manually. Show all workings: Portfolio: P1 P2 P9 P11 Stock A 0% P3 P4 P5 P6 P7 100% 90% 80% 70% 60% 50% 40% 0% 10% 20% 30% 40% 50% 60% BP: Bp2 BP3 BP BPS BPS BP7 P8 P10 30% 20% 10% 70% 80% 90% BPS BPS BP10 Stock B 100% Beta BP11 Required Return Rp1 RP2 Rp3 Rp4 Rus RPC RPT RDPS Rps RPio RP11 QUESTION 3 (a) Calculate beta and required rate of returns of the respective portfolio by using Capital Asset Pricing Model (CAPM). Assume that a beta of 1.45 and 0.76 for Stock A and Stock B respectively. A return on a market portfolio (Rm) of 9 percent and a risk-free rate (RI) of 2 percent. (Calculations must be done manually. Show all workings: Portfolio: P1 P2 P9 P11 Stock A 0% P3 P4 P5 P6 P7 100% 90% 80% 70% 60% 50% 40% 0% 10% 20% 30% 40% 50% 60% BP: Bp2 BP3 BP BPS BPS BP7 P8 P10 30% 20% 10% 70% 80% 90% BPS BPS BP10 Stock B 100% Beta BP11 Required Return Rp1 RP2 Rp3 Rp4 Rus RPC RPT RDPS Rps RPio RP11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts