Question: i only need this one please , i figured out the other one! SINO Assume that you may come with the following canons for the

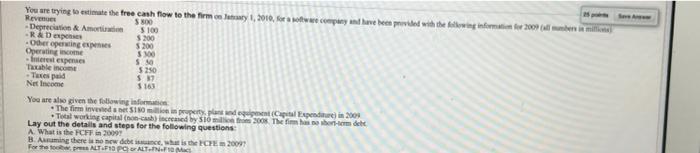

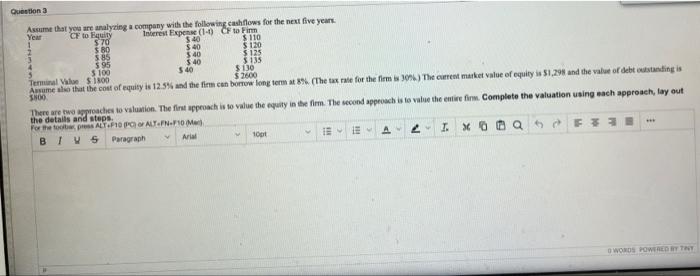

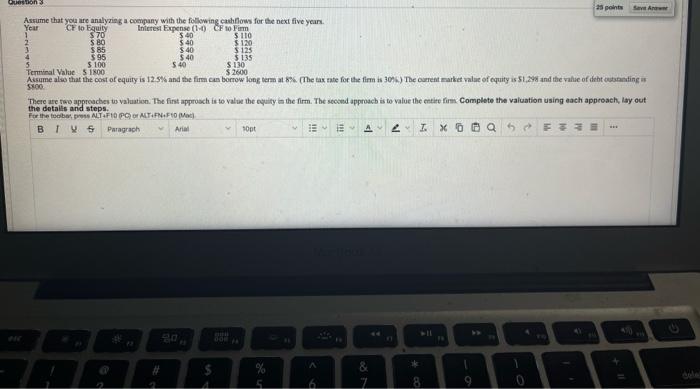

SINO Assume that you may come with the following canons for the best five years Year County Interest opene (1-0 CF Form 570 SB $40 3110 510 85 $95 $ 40 3125 140 3115 $100 $40 Terminal Value $ 1800 Ale also that the cost of equity is 11.5% and the firm can brow longtem(The use for the time. The content market af equity is $1.29 dhe shof dieting SNOO There are agroaches to valuation. The first approach is a value the equity in the fim. The cond practise value the entire tlm. Complete the valuation using each approach, layout details and steps For the press ALT.F10 PALT.PN.FI 1 us Paragrain 10 SO You are trying to estimate the free cash flow to the firmy 1, 2010, fratres company and have been provided with the town notion for 2009 denben a motorte $ Depreciation & Amor 5100 R&D $200 oder peringe 5200 Operating income Interest expenses S. Taxable income 5250 Tuxes paid $39 Net Income 3163 You are also given the following info The firm invested 10. in part plan de Capital Expenditure in 2009 Total working capital Concash) increased by SIO 2008 The fim de bestemdche Lay out the details and steps for the following questions: A What is the FCFF in 2009 B. Auming there is no new, what is the CFE 2009 For the pre ALT F10 PALT.N.FM Question $123 $135 Assume that you are analyzing a company with the following cashflows for the next five years Year CF to Fauity Interest Expense (1-6 CF to Finn 570 $40 $ 110 $80 $40 $ 120 S85 $40 595 $40 5 $ 100 340 $ 130 Terminal de S1800 $ 2600 Assume that the cost of equity is 12.5% and the firm can borrow long term at 8% (The tax rate for the firm 30%) The current market value of equity is 51,291 and the value of debtstanding is 3800 There are two approaches to valuation. The fint approach is so value the equity in the firm. The second approach is to value the entire firm. Complete the valuation using much approach, lay out the details and steps Portret ALT PRO PO ALY.IN.F10 Meil B TV5 Paragraph Ar 1001 IEEA I. XOQ FEE WONDS POWERED BY TNT Questions 25 point Save A Assume that you are analyzing a company with the following cashllows for the next five yours. Year CF to Equity Interest Expense (1-0) CF 10 Firm $70 $40 $ 110 $ 80 $40 $ 120 $ 85 $40 $ 125 $95 $40 $135 $ 100 $ 40 S 130 Terminal Value $ Assume als that the cost of equity is 12.5% and the firm can borrow long term at % (he tax rate for the firm : 3016) The current market value of equity is $1.29 and the value of deht outurinting or S100 There are two approaches us valuation. The first approach is to value the equity in the firm. The stond approach is to value the entire firm. Complete the valuation using each approach, lay out the details and steps. For the foobs ALTAFO POR ALTEN.FM BTU & Paragrach Arial sont A XOOQ5 EEE A k 6 SINO Assume that you may come with the following canons for the best five years Year County Interest opene (1-0 CF Form 570 SB $40 3110 510 85 $95 $ 40 3125 140 3115 $100 $40 Terminal Value $ 1800 Ale also that the cost of equity is 11.5% and the firm can brow longtem(The use for the time. The content market af equity is $1.29 dhe shof dieting SNOO There are agroaches to valuation. The first approach is a value the equity in the fim. The cond practise value the entire tlm. Complete the valuation using each approach, layout details and steps For the press ALT.F10 PALT.PN.FI 1 us Paragrain 10 SO You are trying to estimate the free cash flow to the firmy 1, 2010, fratres company and have been provided with the town notion for 2009 denben a motorte $ Depreciation & Amor 5100 R&D $200 oder peringe 5200 Operating income Interest expenses S. Taxable income 5250 Tuxes paid $39 Net Income 3163 You are also given the following info The firm invested 10. in part plan de Capital Expenditure in 2009 Total working capital Concash) increased by SIO 2008 The fim de bestemdche Lay out the details and steps for the following questions: A What is the FCFF in 2009 B. Auming there is no new, what is the CFE 2009 For the pre ALT F10 PALT.N.FM Question $123 $135 Assume that you are analyzing a company with the following cashflows for the next five years Year CF to Fauity Interest Expense (1-6 CF to Finn 570 $40 $ 110 $80 $40 $ 120 S85 $40 595 $40 5 $ 100 340 $ 130 Terminal de S1800 $ 2600 Assume that the cost of equity is 12.5% and the firm can borrow long term at 8% (The tax rate for the firm 30%) The current market value of equity is 51,291 and the value of debtstanding is 3800 There are two approaches to valuation. The fint approach is so value the equity in the firm. The second approach is to value the entire firm. Complete the valuation using much approach, lay out the details and steps Portret ALT PRO PO ALY.IN.F10 Meil B TV5 Paragraph Ar 1001 IEEA I. XOQ FEE WONDS POWERED BY TNT Questions 25 point Save A Assume that you are analyzing a company with the following cashllows for the next five yours. Year CF to Equity Interest Expense (1-0) CF 10 Firm $70 $40 $ 110 $ 80 $40 $ 120 $ 85 $40 $ 125 $95 $40 $135 $ 100 $ 40 S 130 Terminal Value $ Assume als that the cost of equity is 12.5% and the firm can borrow long term at % (he tax rate for the firm : 3016) The current market value of equity is $1.29 and the value of deht outurinting or S100 There are two approaches us valuation. The first approach is to value the equity in the firm. The stond approach is to value the entire firm. Complete the valuation using each approach, lay out the details and steps. For the foobs ALTAFO POR ALTEN.FM BTU & Paragrach Arial sont A XOOQ5 EEE A k 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts