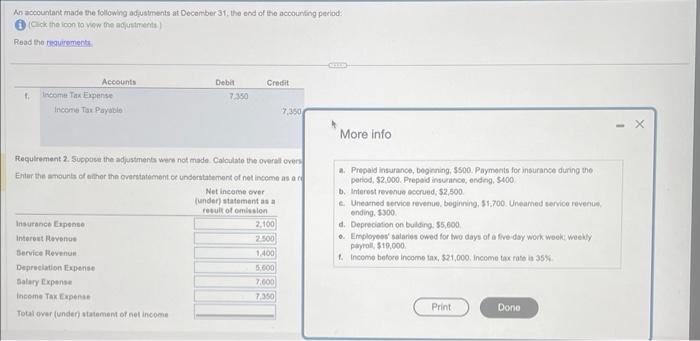

Question: I only need to calculate the Total over (under) statement of net income An acocuntant made the following adjutments at Decoitber 31. the end of

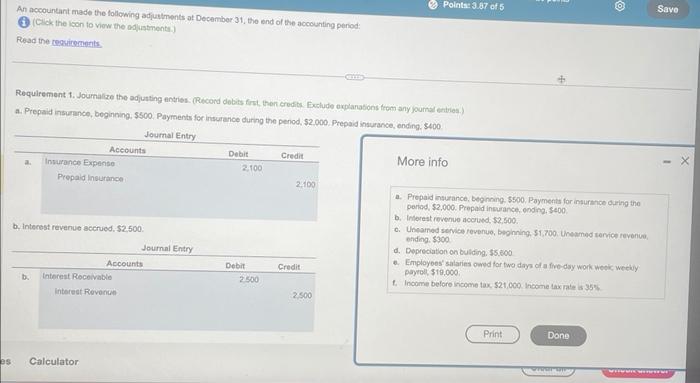

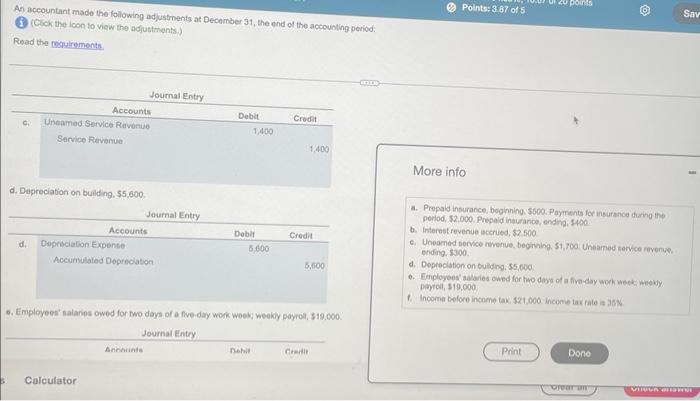

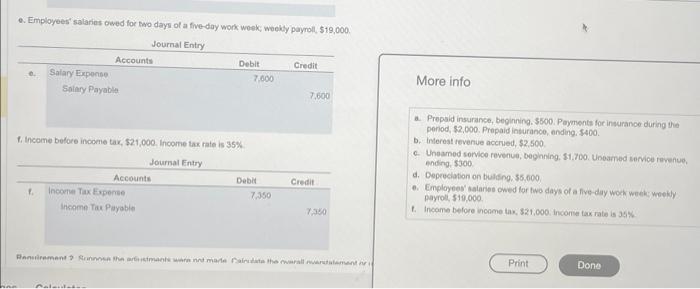

An acocuntant made the following adjutments at Decoitber 31. the end of the accounting period: (i) (Cack the icon to vew the acjutirnenta) Read the reaurements. An accountant made the following adjutments at December 31, the end of the accounting period: (1) (Clak the ison to view the odlustinente.) Resad the cectirements. a. Prepaid insurance, beginning, $300. Payments for insurance durng the penod, $2.000. Prepaid insurance, ending. $400 More info a. Piopaid nsuzance, begining. 5500 . Poyments for insurstice oring the peried, 52,000 . Prepaid insurance, ondeng. 5e00. b. Interest revenuo docised, $2,500. b. interest revenue accrued, $2,500. 0. Usearned sevice fevenue, beghning,51,700. Uheamed tervice revenco, nding. $300 d. Depreciation on bulding, $5,600 a. Empioyoes' salaries omed for two days of a five-day work week weeky payrol, $19,000 1. Inoome belore income tax, $21,000 thocone taxinale is 35% An accountant made the following adjustments at December 31, the end of the accounting period: (3) (Click the icon to view the adjustments.) Read the cogulrements. More info d. Depreciation on building, $5,600. a. Propald insurance, begining 5500 . Payments for insurance diring the period, \$2,000. Prepald inatranos, andin, 400 b. Intereat revenue accrued, $2,600 c. Uneamed service revenue. begiving. 51, 700 Untarned servce revente. ending. 5300. d. Depreciation on bulding, 55,000 . paytid, \$19.000/ 1. Income before income tax, $21,000 income lax fate ia 35. 6. Emplayees' nalanies owed for two doyn of a five-day work week; weekly payroll, 319.000. e. Employees' satarias owed foe tao dayn of a five-doy work woekc weeky payroll, $19,000. More info a. Prepald insurance, beginning. 3500 . Payments for insurance during the period, $2,000. Prepaid inturance, anding. $400. 1. Income belore income tax, $21,000. Income tax rate is 35% b. Imlereat tevenue accrued, $2.500 6. Uneamed sorvice revenue, beginning. 51.7Do. Uneamed service revenue, ending, 5300 d. Depreciation on buldeng. 55.600 i 8. Employees' alainse owed lar fwo days of a five-day woth weekc weelly payroli, 510,000 1. Income before income tak, $21,000 income tax rate is 34.4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts