Question: I only want the answer for part D and E Thank you. Question 3 Jesslyn's husband, Sung, is considering purchasing a new vehicle. He sees

I only want the answer for part D and E

Thank you.

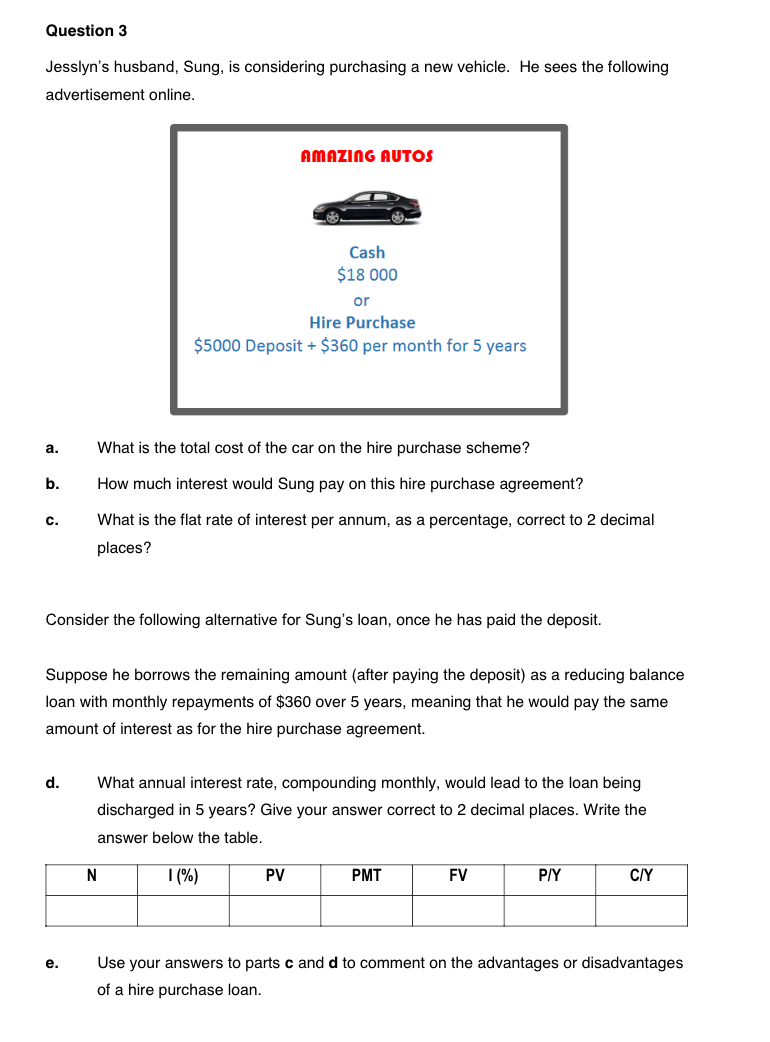

Question 3 Jesslyn's husband, Sung, is considering purchasing a new vehicle. He sees the following advertisement online. AMAZING AUTOS Cash $18 000 or Hire Purchase $5000 Deposit + $360 per month for 5 years What is the total cost of the car on the hire purchase scheme? How much interest would Sung pay on this hire purchase agreement? What is the flat rate of interest per annum, as a percentage, correct to 2 decimal places? Consider the following alternative for Sung's loan, once he has paid the deposit. Suppose he borrows the remaining amount (after paying the deposit) as a reducing balance loan with monthly repayments of $360 over 5 years, meaning that he would pay the same amount of interest as for the hire purchase agreement. d. What annual interest rate, compounding monthly, would lead to the loan being discharged in 5 years? Give your answer correct to 2 decimal places. Write the answer below the table. N 1(%) PVPMT FV P/ Y CY Use your answers to parts c and d to comment on the advantages or disadvantages of a hire purchase loan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts