Question: I. Please prepare a vertical and horizontal analysis for the following statement of financial position for 2020 and compare it with the year 2019. Identify

I. Please prepare a vertical and horizontal analysis for the following statement of financial position for 2020 and compare it with the year 2019. Identify and explain 3 of the most important issues. Please help with the solution.

Thank You hoping for a quick response thank you.

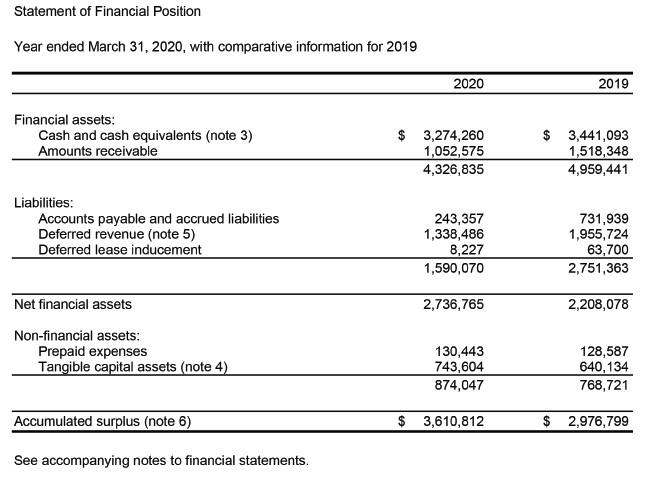

Statement of Financial Position Year ended March 31, 2020, with comparative information for 2019 2020 2019 Financial assets: Cash and cash equivalents (note 3) Amounts receivable $ 3,274,260 1,052,575 4,326,835 $ 3,441,093 1,518,348 4,959,441 Liabilities: Accounts payable and accrued liabilities Deferred revenue (note 5) Deferred lease inducement 243,357 1,338,486 8,227 1,590,070 731,939 1,955,724 63,700 2,751,363 2,736,765 2,208,078 Net financial assets Non-financial assets: Prepaid expenses Tangible capital assets (note 4) 130,443 743,604 874,047 128,587 640,134 768,721 Accumulated surplus (note 6) $ 3,610,812 $ 2,976,799 See accompanying notes to financial statements. Statement of Financial Position Year ended March 31, 2020, with comparative information for 2019 2020 2019 Financial assets: Cash and cash equivalents (note 3) Amounts receivable $ 3,274,260 1,052,575 4,326,835 $ 3,441,093 1,518,348 4,959,441 Liabilities: Accounts payable and accrued liabilities Deferred revenue (note 5) Deferred lease inducement 243,357 1,338,486 8,227 1,590,070 731,939 1,955,724 63,700 2,751,363 2,736,765 2,208,078 Net financial assets Non-financial assets: Prepaid expenses Tangible capital assets (note 4) 130,443 743,604 874,047 128,587 640,134 768,721 Accumulated surplus (note 6) $ 3,610,812 $ 2,976,799 See accompanying notes to financial statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts