Question: I posted part A already since I can't ask multiple questions per post. It can be found here: https://www.chegg.com/homework-help/questions-and-answers/terminal-cash-flow-various-lives-sale-prices-looner-industries-currently-analyzing-purchas-q49471397?trackid=3MFwjmgO The drop downs for part B

I posted part A already since I can't ask multiple questions per post. It can be found here: https://www.chegg.com/homework-help/questions-and-answers/terminal-cash-flow-various-lives-sale-prices-looner-industries-currently-analyzing-purchas-q49471397?trackid=3MFwjmgO

The drop downs for part B are: less/more loss/gain lower/higher

Part d's drop downs are: Higher/lower.

Thank you!!!

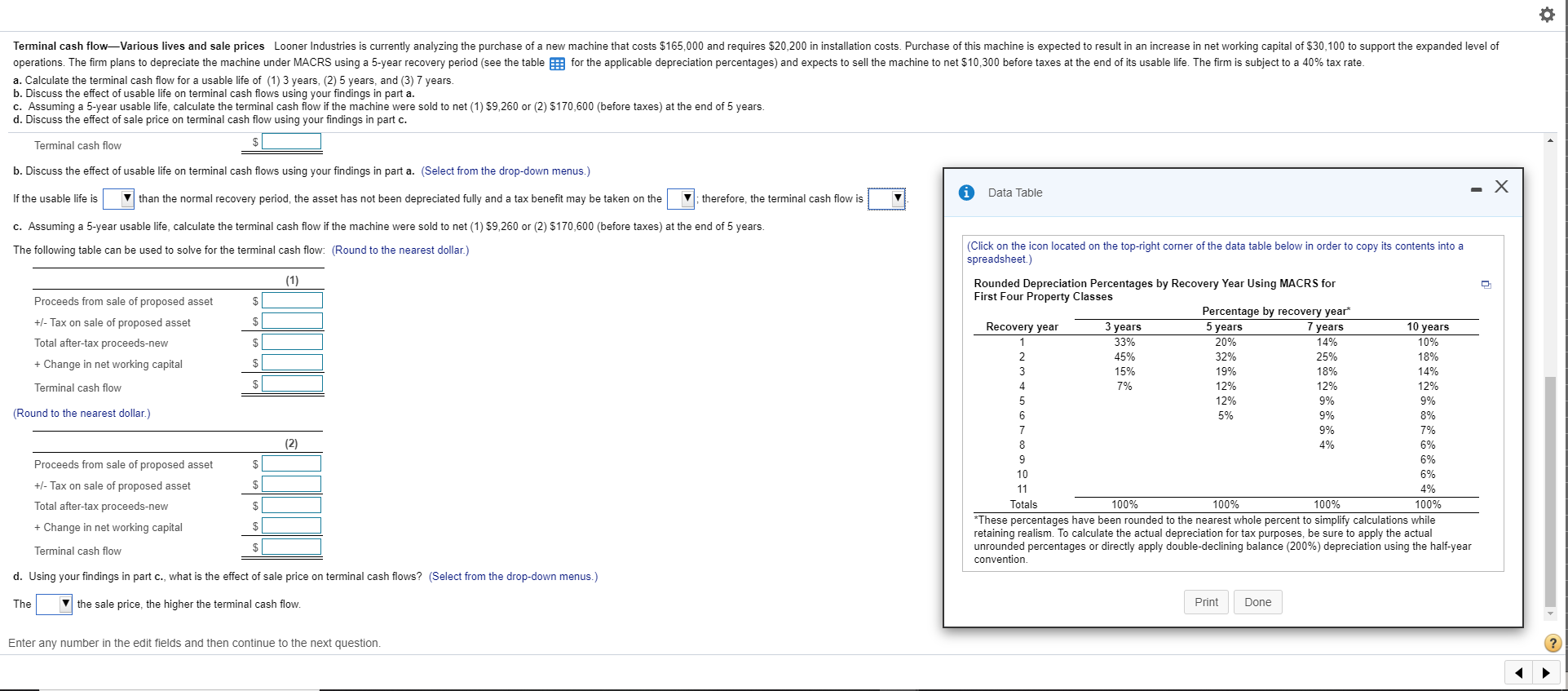

Terminal cash flow-Various lives and sale prices Looner Industries is currently analyzing the purchase of a new machine that costs $165,000 and requires $20,200 in installation costs. Purchase of this machine is expected to result in an increase in net working capital of $30,100 to support the expanded level of operations. The firm plans to depreciate the machine under MACRS using a 5-year recovery period (see the table for the applicable depreciation percentages) and expects to sell the machine to net $10,300 before taxes at the end of its usable life. The firm is subject to a 40% tax rate. a. Calculate the terminal cash flow for a usable life of (1) 3 years, (2) 5 years, and (3) 7 years. b. Discuss the effect of usable life on terminal cash flows using your findings in part a. c. Assuming a 5-year usable life, calculate the terminal cash flow if the machine were sold to net (1) $9,260 or (2) $170,600 (before taxes) at the end of 5 years. d. Discuss the effect of sale price on terminal cash flow using your findings in part c. Terminal cash flow b. Discuss the effect of usable life on terminal cash flows using your findings in part a. (Select from the drop-down menus.) If the usable life is than the normal recovery period, the asset has not been depreciated fully and a tax benefit may be taken on the therefore, the terminal cash flow is i Data Table c. Assuming a 5-year usable life, calculate the terminal cash flow if the machine were sold to net (1) $9,260 or (2) $170,600 (before taxes) at the end of 5 years. The following table can be used to solve for the terminal cash flow: (Round to the nearest dollar.) (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) $ Proceeds from sale of proposed asset +/- Tax on sale of proposed asset Total after-tax proceeds-new + Change in net working capital $ WN- Terminal cash flow 12% 12% (Round to the nearest dollar.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year Recovery year 3 years 5 years 7 years 10 years 33% 20% 14% 10% 45% 32% 25% 18% 15% 19% 18% 14% 7% 12% 12% 9% 9% 7% 4% 6% 6% 6% 4% Totals 100% 100% 100% 100% *These percentages have been rounded to the nearest whole percent to simplify calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year convention. 9% Soco O Proceeds from sale of proposed asset $ +/- Tax on sale of proposed asset Total after-tax proceeds-new + Change in net working capital $ Terminal cash flow d. Using your findings in part c., what is the effect of sale price on terminal cash flows? (Select from the drop-down menus.) The the sale price, the higher the terminal cash flow. Print Done Enter any number in the edit fields and then continue to the next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts