Question: i posted this question already but its wrong so please post the right answer and do it step by step. I also have posted the

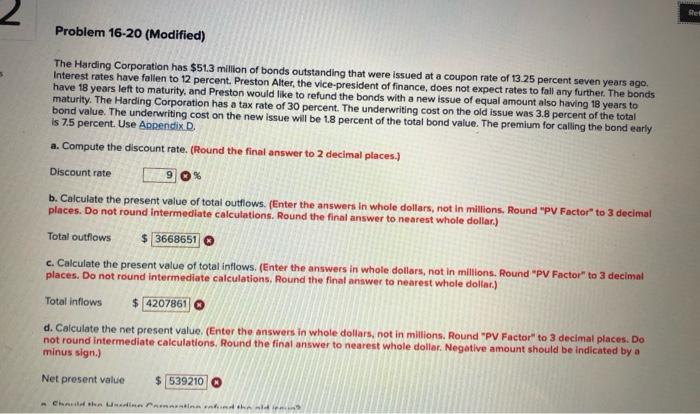

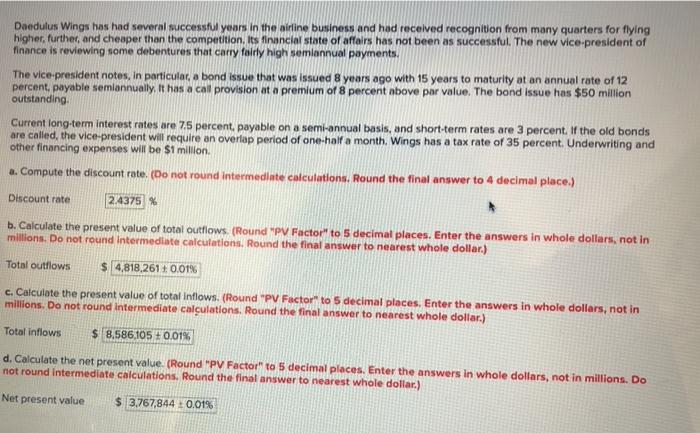

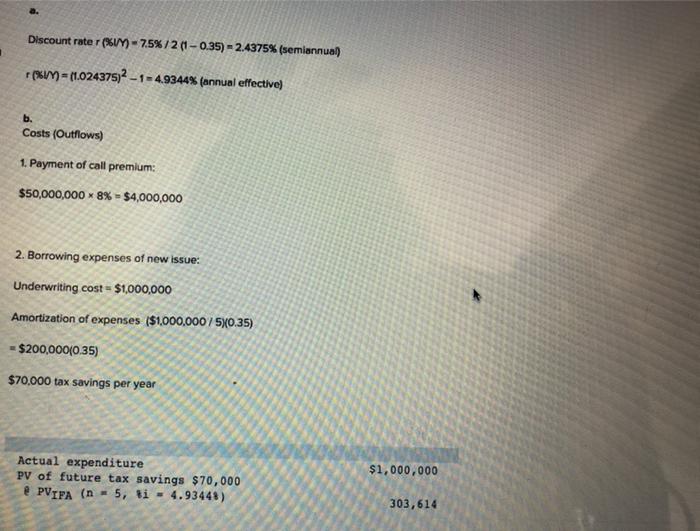

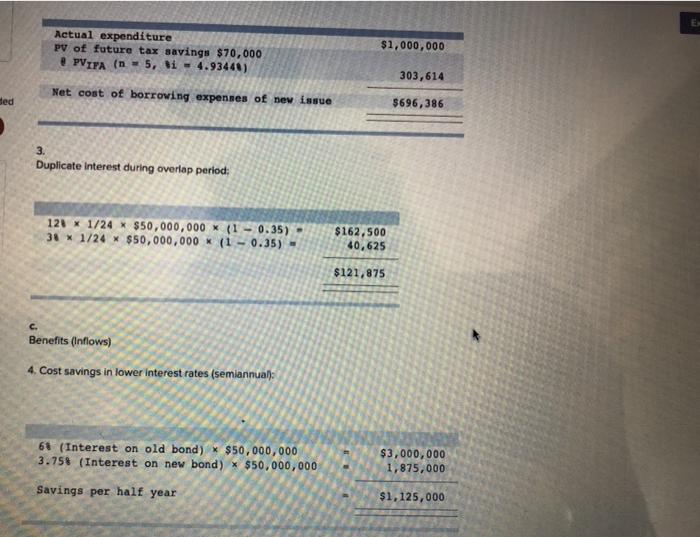

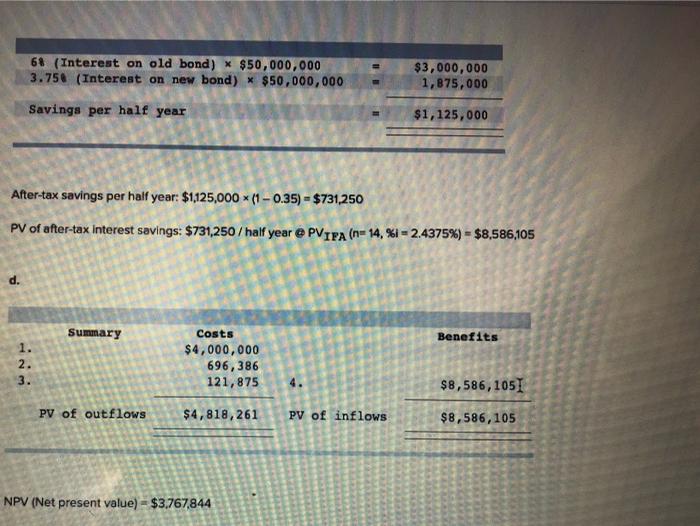

Discount rater (%61/4) -7.5%/21 -0.35) - 2.4375% (semiannual) (%1/7) = (1.024375|2 - 1 -4.9344% (annual effective) b. Costs (Outflows) 1. Payment of call premium: $50,000,000 8% - $4,000,000 2. Borrowing expenses of new issue: Underwriting cost = $1,000,000 Amortization of expenses ($1,000,000 7 570.35) = $200,000(0.35) $70.000 tax savings per year Actual expenditure PV of future tax savings $70,000 @ PVIFA (n = 5, ti - 4.93448) $1,000,000 303,614 Actual expenditure PV of future tax savings $70,000 PVITA (n = 5, ti - 4.93446) $1,000,000 303,614 Net cost of borroving expenses of new issue ded $696,386 3. Duplicate interest during overlap period: 121 * 1/24 * $50,000,000 (1 - 0.35) - 34 * 1/24 * $50,000,000 * (1 - 0.35) - $162,500 40,625 $121,875 c. Benefits (Inflows) 4. Cost savings in lower interest rates (semiannual 61 (Interest on old bond) * $50,000,000 3.75$ (Interest on new bond) * $50,000,000 $3,000,000 1,875,000 Savings per half year $1,125,000 68 (Interest on old bond) * $50,000,000 3.756 (Interest on new bond) * $50,000,000 $3,000,000 1,875,000 Savings per half year $1,125,000 After-tax savings per half year: $1,125,000 (1 -0.35) - $731,250 PV of after-tax Interest savings: $731,250/half year @PVIPA (n= 14, %i = 2.4375%) = $8,586,105 d. Summary Benefits 1. 2. 3. Costs $4,000,000 696,386 121,875 $8,586,1051 PV of outflows $4,818, 261 PV of inflows $8,586,105 NPV (Net present value) $3.767,844 Discount rater (%61/4) -7.5%/21 -0.35) - 2.4375% (semiannual) (%1/7) = (1.024375|2 - 1 -4.9344% (annual effective) b. Costs (Outflows) 1. Payment of call premium: $50,000,000 8% - $4,000,000 2. Borrowing expenses of new issue: Underwriting cost = $1,000,000 Amortization of expenses ($1,000,000 7 570.35) = $200,000(0.35) $70.000 tax savings per year Actual expenditure PV of future tax savings $70,000 @ PVIFA (n = 5, ti - 4.93448) $1,000,000 303,614 Actual expenditure PV of future tax savings $70,000 PVITA (n = 5, ti - 4.93446) $1,000,000 303,614 Net cost of borroving expenses of new issue ded $696,386 3. Duplicate interest during overlap period: 121 * 1/24 * $50,000,000 (1 - 0.35) - 34 * 1/24 * $50,000,000 * (1 - 0.35) - $162,500 40,625 $121,875 c. Benefits (Inflows) 4. Cost savings in lower interest rates (semiannual 61 (Interest on old bond) * $50,000,000 3.75$ (Interest on new bond) * $50,000,000 $3,000,000 1,875,000 Savings per half year $1,125,000 68 (Interest on old bond) * $50,000,000 3.756 (Interest on new bond) * $50,000,000 $3,000,000 1,875,000 Savings per half year $1,125,000 After-tax savings per half year: $1,125,000 (1 -0.35) - $731,250 PV of after-tax Interest savings: $731,250/half year @PVIPA (n= 14, %i = 2.4375%) = $8,586,105 d. Summary Benefits 1. 2. 3. Costs $4,000,000 696,386 121,875 $8,586,1051 PV of outflows $4,818, 261 PV of inflows $8,586,105 NPV (Net present value) $3.767,844

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts