Question: I posted this question previously and got it wrong please give me a clear answer as my table asked! Thank you! Please answer the question

I posted this question previously and got it wrong please give me a clear answer as my table asked! Thank you!

![following information applies to the questions displayed below.] Project Y requires a](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6718a18461d4d_4596718a183cc1fb.jpg)

Please answer the question as per table slots which should be clear

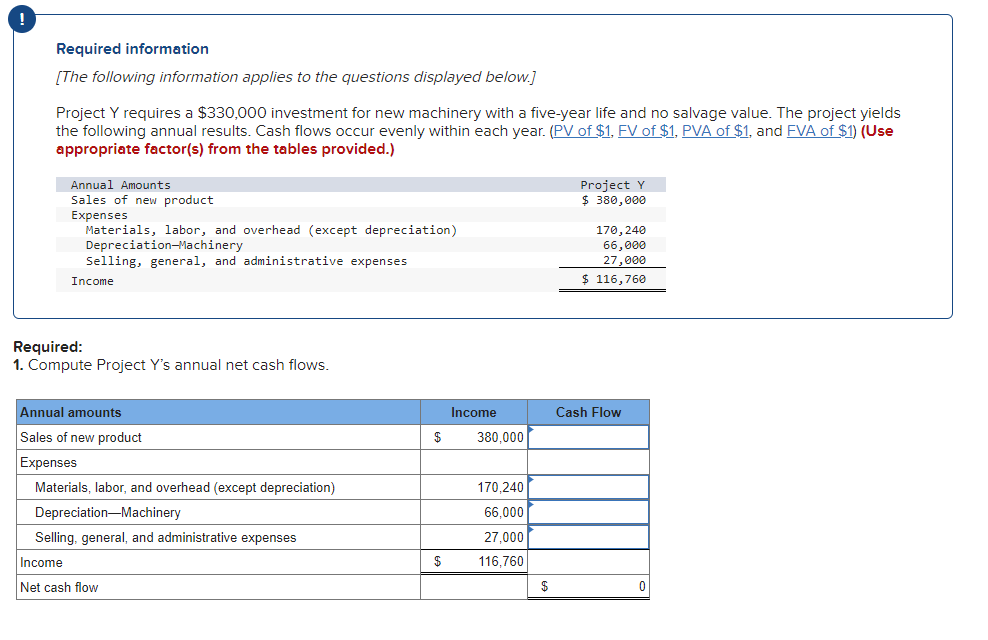

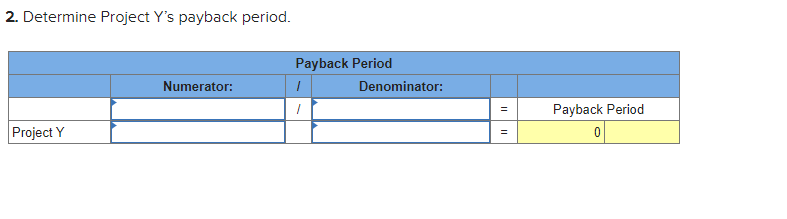

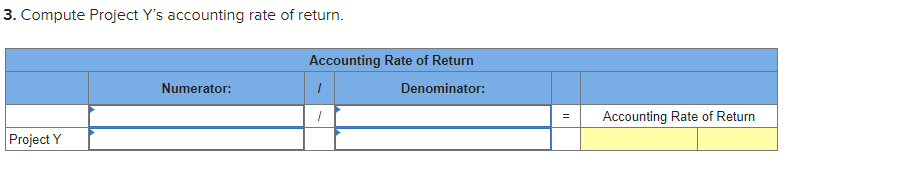

Required information [The following information applies to the questions displayed below.] Project Y requires a $330,000 investment for new machinery with a five-year life and no salvage value. The project yields the following annual results. Cash flows occur evenly within each year. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Annual Amounts Sales of new product Expenses Materials, labor, and overhead (except depreciation) Depreciation-Machinery Selling, general, and administrative expenses Income Required: 1. Compute Project Y's annual net cash flows. Annual amounts Sales of new product Expenses Materials, labor, and overhead (except depreciation) Depreciation-Machinery Selling, general, and administrative expenses Income Net cash flow $ $ Income 380,000 170,240 66.000 27,000 116,760 $ Project Y $ 380,000 170, 240 66,000 27,000 $ 116,760 Cash Flow 0 2. Determine Project Y's payback period. Project Y Numerator: Payback Period 1 Denominator: = = Payback Period 0 3. Compute Project Y's accounting rate of return. Project Y Numerator: Accounting Rate of Return Denominator: / = Accounting Rate of Return 4. Determine Project Y's net present value using 7% as the discount rate. (Do not round intermediate calculations. Round your present value factor to 4 decimals and final answers to the nearest whole dollar.) Years 1-6 Net present value Present Value Net Cash Flows x of Annuity at 7% = Present Value of Net Cash Flows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts