Question: (i ) preferred stock has a RM50 par value and pays an annual dividend of RM7.50 per share and currently earning an 8% annual rate

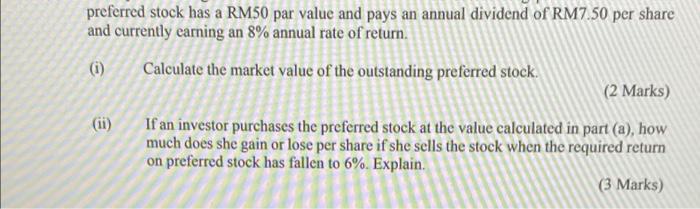

(i ) preferred stock has a RM50 par value and pays an annual dividend of RM7.50 per share and currently earning an 8% annual rate of return. Calculate the market value of the outstanding preferred stock. (2 Marks) (ii) If an investor purchases the preferred stock at the value calculated in part (a), how much does she gain or lose per share if she sells the stock when the required return on preferred stock has fallen to 6%. Explain

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock