Question: (i) Prepare a statement, in a format suitable for making a decision on whether to discontinue product D, which clearly shows the results of products

(i) Prepare a statement, in a format suitable for making a decision on whether to discontinue product D, which clearly shows the results of products A, B, C and D in February. Would you recommend discontinuing product D? Explain your recommendation. (ii) The production manager has presented during a management meeting in March that if product D was discontinued, the resources freed up could be used to increase the production of product C by 40%. In addition, if the production quantity of any product increases by more than 25%, then its specific fixed production costs will increase by 30%. Based on this new information, prepare a statement clearly showing the results for February if product D was discontinued. Based on your revised statement, recommend if Zell should discontinue product D.

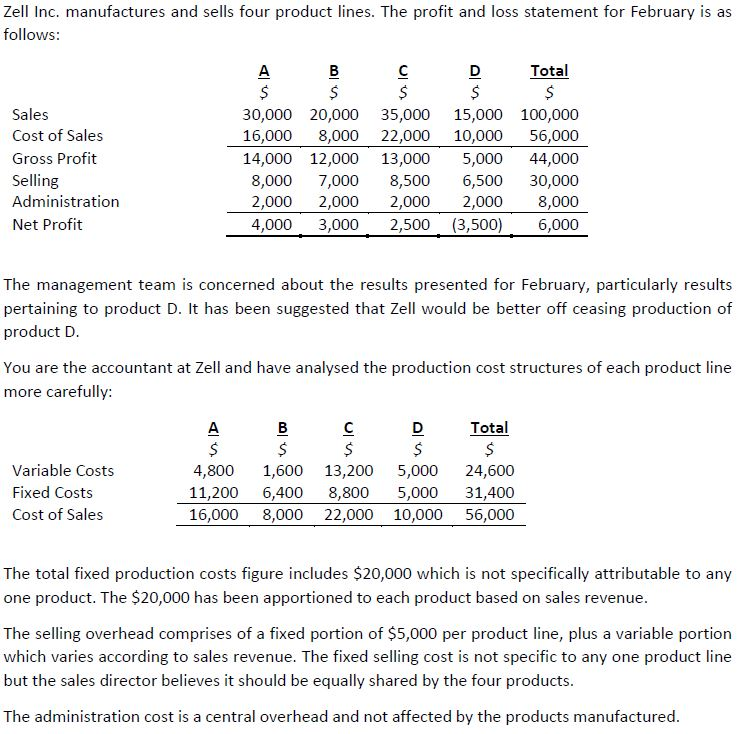

Zell Inc. manufactures and sells four product lines. The profit and loss statement for February is as ollows: Total Sales Cost of Sales Gross Profit Selling Administration Net Profit 30,000 20,000 35,000 15,000 100,000 16,000 8,000 22,000 10,000 56,000 14,000 12,000 13,000 5,000 44,000 8,000 7,0008,500 6,500 30,000 2,000 2,000 2,000 2,000 8,000 4,000 3,000 2,500 (3,500) 6,000 The management team is concerned about the results presented for February, particularly results pertaining to product D. It has been suggested that Zell would be better off ceasing production of product D You are the accountant at Zell and have analysed the production cost structures of each product line more carefully: Total Variable Costs Fixed Costs Cost of Sales 4,800 1,600 13,200 5,000 24,600 11,200 6,400 8,800 5,000 31,400 16,000 8,000 22,000 10,000 56,000 The total fixed production costs figure includes $20,000 which is not specifically attributable to any one product. The $20,000 has been apportioned to each product based on sales revenue The selling overhead comprises of a fixed portion of $5,000 per product line, plus a variable portion which varies according to sales revenue. The fixed selling cost is not specific to any one product line but the sales director believes it should be equally shared by the four products The administration cost is a central overhead and not affected by the products manufactured

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts