Question: I previously submitted to Chegg but the answer is wrong (see above). The statement of income for Steering Ltd. is shown below: STEERING LTD. Statement

I previously submitted to Chegg but the answer is wrong (see above).

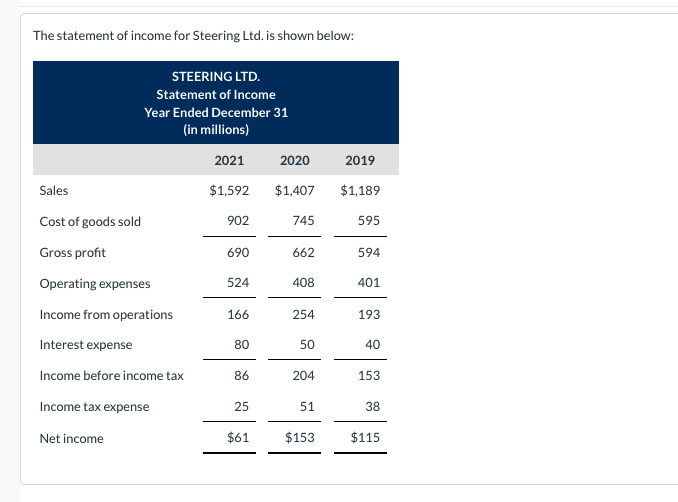

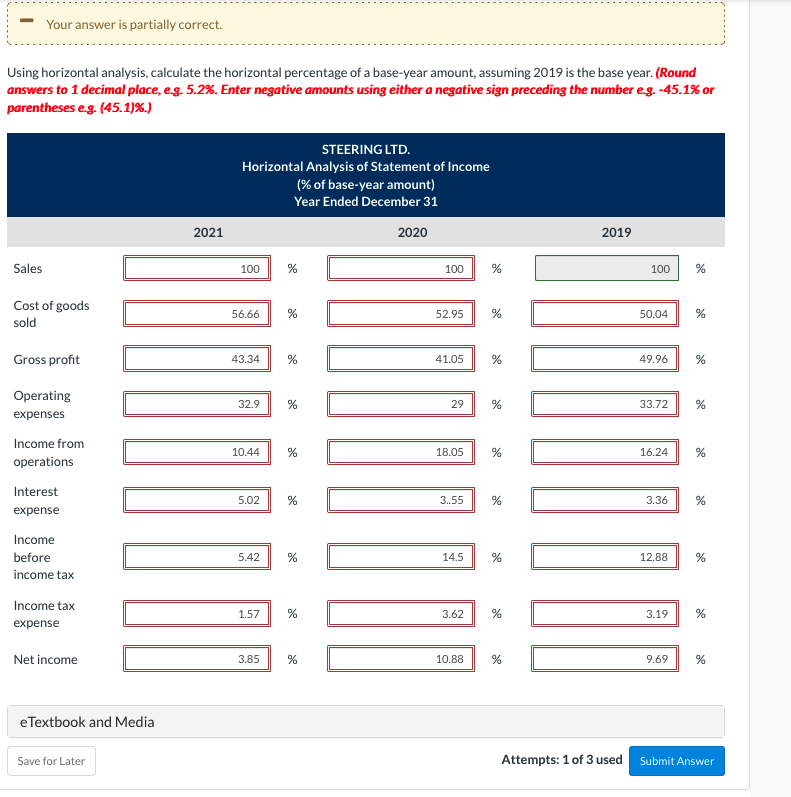

The statement of income for Steering Ltd. is shown below: STEERING LTD. Statement of Income Year Ended December 31 (in millions) 2021 2020 2019 Sales $1,592 $1,407 $1,189 Cost of goods sold 902 745 595 Gross profit 690 662 594 Operating expenses 524 408 401 Income from operations 166 254 193 Interest expense 80 50 40 Income before income tax 86 204 153 Income tax expense 25 51 38 Net income $61 $153 $115 Your answer is partially correct. Using horizontal analysis, calculate the horizontal percentage of a base-year amount, assuming 2019 is the base year. (Round answers to 1 decimal place, e.g. 5.2%. Enter negative amounts using either a negative sign preceding the number e.g. -45.1% or parentheses e.g. (45.1)%.) STEERING LTD. Horizontal Analysis of Statement of Income (% of base-year amount) Year Ended December 31 2021 2020 2019 Sales 100 % 100 % 100 % Cost of goods sold 56.66 % % 50.04 % Gross profit 43.34 % % 49.96 % Operating 32.9 % % 33.72 % expenses Income from 10.44 % % 16.24 % operations Interest 5.02 % % 3.36 % expense Income before 5.42 % % 12.88 % income tax Income tax 1.57 % % 3.19 % expense Net income 3.85 % % 9.69 % eTextbook and Media Save for Later Attempts: 1 of 3 used Submit Answer 52.95 41.05 29 18.05 3..55 14.5 3.62 10.88 de

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts