i provide the reports to answer the question

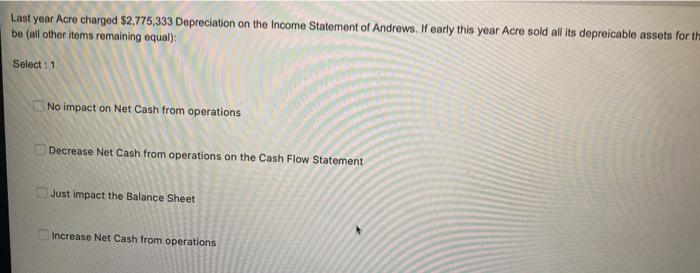

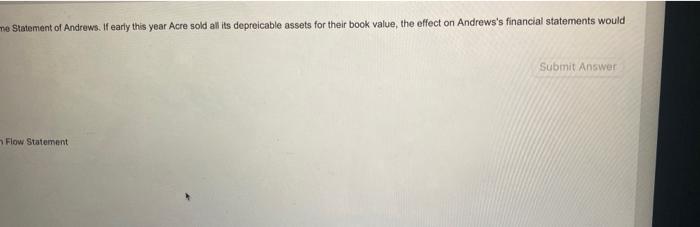

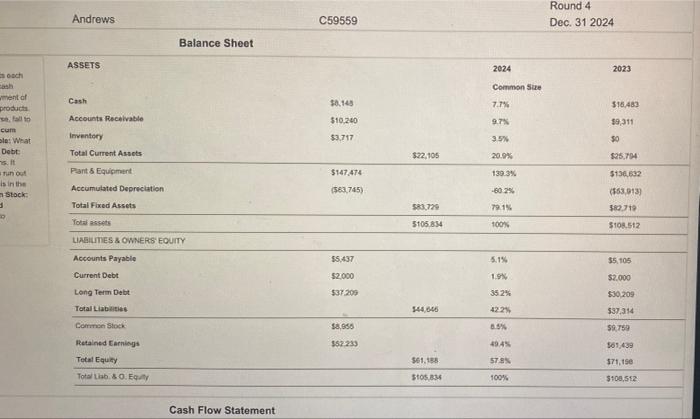

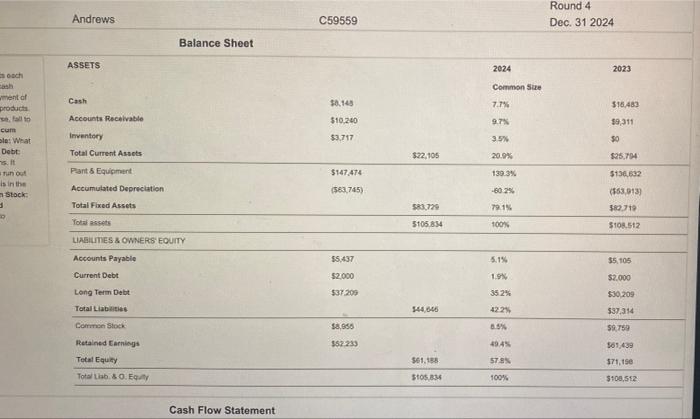

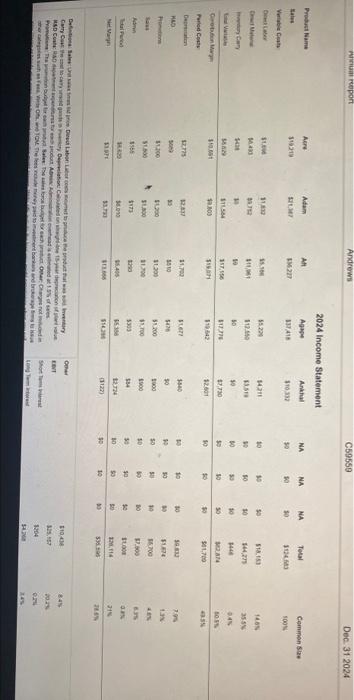

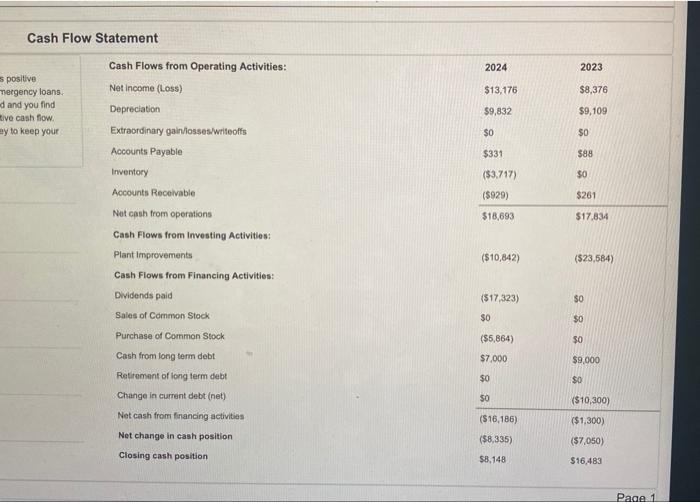

Last year Acre charged $2.775,333 Depreciation on the Income Statement of Andrews. If early this year Acre sold all its deprecable assets for the be (all other items remaining equal): Select : 1 No impact on Net Cash from operations Decrease Net Cash from operations on the Cash Flow Statement Just impact the Balance Sheet Increase Net Cash from operations me Statement of Andrews. If early this year Acre sold all its deprecable assets for their book value, the effect on Andrews's financial statements would Submit Answer Flow Statement Andrews C59559 Round 4 Dec. 31 2024 Balance Sheet ASSETS 2024 2023 ach ment of products Cash Common Size 7.7% $18.483 Accounts Receivable $0.145 $10.240 $3.717 9.7% $9,311 $0 3.5% $22,105 20.0% $25,794 cum bla: What Debt 5. It Tun is in the Stock: Inventory Total Current Assets Pant & Equipment Accumulated Depreciation $147.474 139.3% (563.745) $136.632 (563,013 382,719 Total Fixed Assets $83.720 . 79.15 100% 5105854 $108.512 LIABILITIES & OWNERS EQUITY Accounts Payable $5,437 5.1% Current Debt 52.000 $37.205 55.105 $2.000 $50,209 537.354 Long Term Debt 3525 Total Liabutis 544.646 422 Common Stock 8.5% 58.750 $8,856 $52.233 49.4% 569.439 Retained Earning Total Equy 578 371,tse 561.158 Stos. 234 Total Lisb80E 100% $100,512 Cash Flow Statement Andrews C59559 Round 4 Dec. 31 2024 Balance Sheet ASSETS 2024 2023 ach ment of products Cash Common Size 7.7% $18.483 Accounts Receivable $0.145 $10.240 $3.717 9.7% $9,311 $0 3.5% $22,105 20.0% $25,794 cum bla: What Debt 5. It Tun is in the Stock: Inventory Total Current Assets Pant & Equipment Accumulated Depreciation $147.474 139.3% (563.745) $136.632 (563,013 382,719 Total Fixed Assets $83.720 . 79.15 100% 5105854 $108.512 LIABILITIES & OWNERS EQUITY Accounts Payable $5,437 5.1% Current Debt 52.000 $37.205 55.105 $2.000 $50,209 537.354 Long Term Debt 3525 Total Liabutis 544.646 422 Common Stock 8.5% 58.750 $8,856 $52.233 49.4% 569.439 Retained Earning Total Equy 578 371,tse 561.158 Stos. 234 Total Lisb80E 100% $100,512 Cash Flow Statement Report Andrews C59559 Dec 31 2024 2024 Income Statement Product Name Acre Adam AR Ankhal NA NA NA Total 11931 Sales Ver Cust Agape WA EM211 Common Se SOON ROU so & 04 W 112 31. 1430 15.10 5520 14211 10 518.15 W 1485 355 01 50 w 05 112.60 50 12 10 10 144,27 14 06 80 SPO ST 17.15 $ 50 Cores 12,730 12601 $1642 CH 05 $ 0$ $11.700 VE Periodo 2725 2.1 11.700 940 19 10 SU HILO 33 10 06 30 30 00 30 1900 1200 OS au BE 5420 $1200 700 3303 5358 11100 1500 3566 of is ws SOCIE 0035 50 09 10 16700 2.500 hamn $ 05 GY 04 15.03 33.73 554 1274 1127) 30 50 15.405 31. HOPE so NIE 510 12.114 3 30 OT 00 110 849 De Labour Canyon Carcas MADRADA Thales Thermano The bars and be EVT 157 2029 Shot 1204 SI Cash Flow Statement 2024 2023 $13,176 $8,376 s positive mergency loans. d and you find Live cash flow. ay to keep your $9,832 $9,109 $0 0 $0 $331 $88 (53.717) $0 Cash Flows from Operating Activities: Net Income (Loss) Depreciation Extraordinary gain losses/Writeoffs Accounts Payable Inventory Accounts Receivable Not cash from operations Cash Flows from Investing Activities: Plant Improvements Cash Flows from Financing Activities: Dividends paid Sales of Common Stock (5929) $261 $18,693 $17.834 ($10,842) ($23,584) ($17,323) $0 $0 $0 Purchase of Common Stock ($5,864) $0 Cash from long term debt $7,000 $9,000 Retirement of long term debt $0 $0 Change in current debt (net) $0 Net cash from financing activities ($10,300 ($1.300) (516,186) Net change in cash position ($8,335) ($7,050) Closing cash position $8,148 $16.483 Page 1