Question: i provided a title of the factor value table that was provided, but the table was too long for me to include all of it.

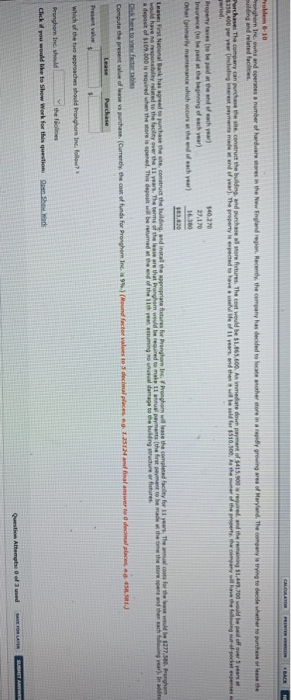

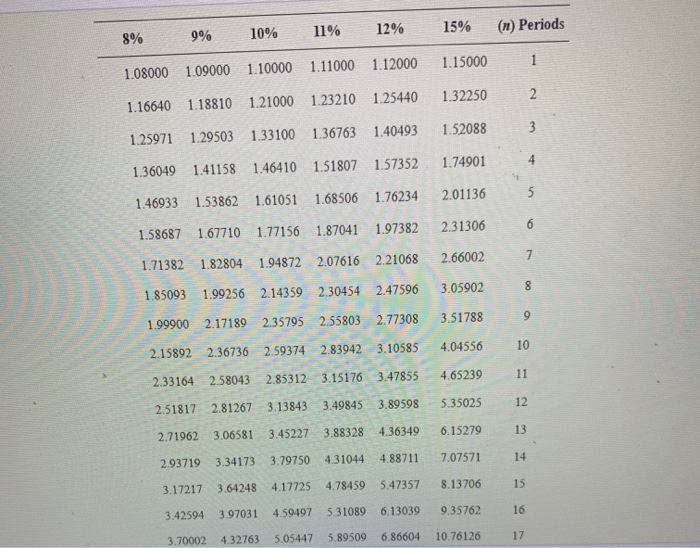

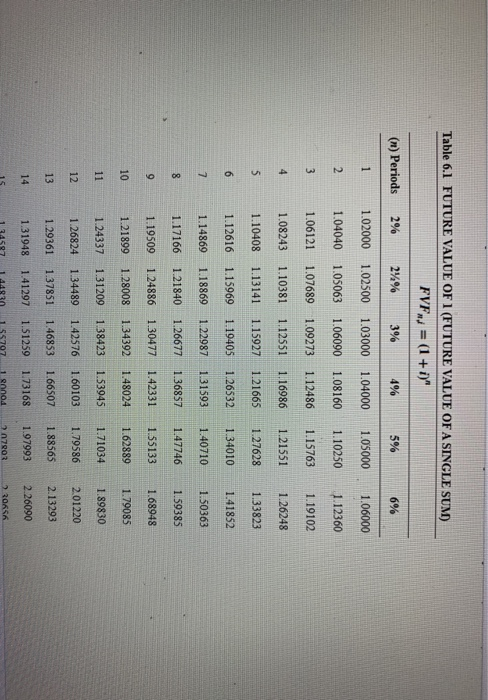

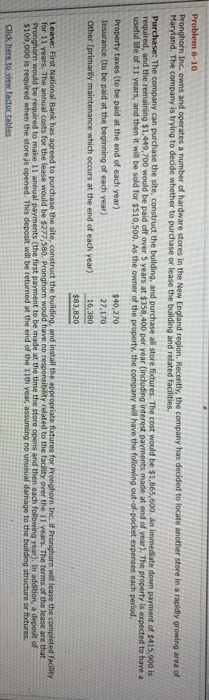

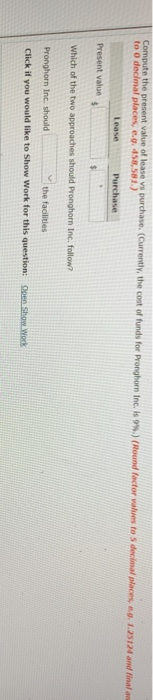

CHORATON PINTER WON Problem 6-10 ronghorn Inc. owns and operates a number of hardware were in the New England region. Recently, the company has decided to locate mother more in proving of Maryland. They trying to decide whether to purchase of lesse building and related faces Purchase the company can contract the building and purchase wil store tures. The cost would be $1.163.600An immediate down payment of $415.00 ve and there $1.441.700 would be pad off every 350.400 per year incheiding interest payments made wend of year. The property is expects have and then we w for $10.00. As the the company with the Windows Property to read the end of each year) Insurance to be the beginning of each year) Other primary mantenance which course the end of each year) $40.270 27,170 16.30 163,620 Lear National Bank has agreed to purchase the construct the building, and the appropriate futures for Preghorn Inc. Ponhom willease the comfocy for 11 years. The acts for these would be an archers would have no responsibility related to the facility over the 11 years. The terms of the lease are that Pronohom would be red male 11 anual payment that want to be made the then each year). In depost of $100.000 is required when the more is opened. This deposit will be retured the end of the 11 e mungo saldare to building wordt er for cimal places 1.25124 and finala decimal places...) Compute the present Lease Present value $ of lewe vs purchase. (Currently, the cost of funds for Pronghom Inc.) (Round factor valus Parchase s Which of the two approaches should ronghorn Inc. follow? Pronghorn Inc. should the files Click you would like to Shew Work for this question On Show STA Question Attems of used 10% 11% 12% 15% 9% (n) Periods 8% 1.15000 1 1.08000 1.09000 1.10000 1.11000 1.12000 1.32250 2. 1.16640 1.18810 1.21000 1.23210 1.25440 3 1.25971 1.29503 1.33100 1.40493 1.52088 1.36763 1.74901 4 1.36049 1.41158 1.46410 1.51807 1.57352 2.01136 1.68506 1.76234 5 1.46933 1.53862 1.61051 2.31306 6 1.58687 1.67710 1.77156 1.87041 1.97382 1.71382 1.82804 1.94872 2.07616 2.21068 2.66002 3.05902 7. 8 9 1.85093 1.99256 2.14359 2.30454 2.47596 1.99900 2.17189 3.51788 2.35795 2.55803 2.77308 2.15892 3.10585 10 2.36736 2.59374 2.83942 4.04556 11 2.33164 2.58043 4.65239 2.85312 3.15176 3.47855 2.51817 2.81267 3.13843 3.49845 3.89598 12 5.35025 2.71962 3.06581 3.45227 3.88328 4.36349 13 6.15279 2.93719 3.34173 3.79750 4.31044 4.88711 7.07571 14 3.17217 3.64248 4.17725 4.78459 5.47357 8.13706 15 3.42594 3.97031 4.59497 5.31089 6.13039 9.35762 16 3.70002 4.32763 5.05447 5.89509 6.86604 10.76126 17 Table 6.1 FUTURE VALUE OF 1 (FUTURE VALUE OF A SINGLE SUM) FVF, = (1 + i)" () Periods 2% 24% 3% 4% 5% 6% 1 1.02000 1.02500 1.03000 1.04000 1.05000 1.06000 2 1.04040 1.05063 1.06090 1.08160 1.10250 1.12360 3 1.06121 1.07689 1.09273 1.12486 1.15763 1.19102 4 1.08243 1.10381 1.12551 1.16986 1.21551 1.26248 5 1.10408 1.13141 1.15927 1.21665 1.27628 1.33823 6 1.12616 1.15969 1.19405 1.26532 1.34010 1.41852 7 1.14869 1.18869 1.22987 1.31593 1.40710 1.50363 8 1.17166 1.21840 1.26677 1.36857 1.47746 1.59385 9 1.19509 1.24886 1.30477 1.42331 1.55133 1.68948 10 1.21899 1.28008 1.34392 1.48024 1.62889 1.79085 11 1.24337 1.31209 1.38423 1.53945 1.71034 1.89830 12 1.26824 1.34489 1.42576 1.60103 1.79586 2.01220 13 1.29361 1.37851 1.46853 1.66507 1.88565 2.13293 14 1.31948 1.41297 1.51259 1.73168 1.97993 2.26090 55707 1 04 07903 ROKSA Problem 6-10 Pronghorn Inc, owns and operates a number of hardware stores in the New England region. Recently, the company has decided to locate another store in a rapidly growing area of Maryland. The company is trying to decide whether to purchase or lease the building and related facilities. Purchase: The company can purchase the site, construct the building, and purchase all store fixtures. The cost would be $1,865,600. An immediate down payment of $415,900 is required, and the remaining $1,449,700 would be paid off over 5 years at $358,400 per year (including interest payments made at end of year). The property is expected to have a useful life of 11 years, and then it will be sold for $510,500. As the owner of the property, the company will have the following out-of-pocket expenses each period. Property taxes (to be paid at the end of each year) $40,270 Insurance (to be paid at the beginning of each year) 27,170 other (primarily maintenance which occurs at the end of each year) 16,380 $83,820 Lease: First National Bank has agreed to purchase the site, construct the building, and install the appropriate fatures for Pronghorn Inc. if Pronghorn will lease the completed facility for 11 years. The annual costs for the lease would be $277,580. Pronghorn would have no responsibility related to the facility over the 11 years. The terms of the lease are that Pronghorn would be required to make 11 annual payments (the first payment to be made at the time the store opens and then each following year). In addition, a deposit of $109,000 is required when the store is opened. This deposit will be returned at the end of the 11th year, assuming no unusual damage to the building structure or fixtures. Click here to view factor tables Compute the present value of lease vs purchase. (Currently, the cost of funds for Pronghorn Inc. is 9%) (Round factor values to decimal places 1.25124 and finala to o decimal places, c. 458,581) Lease Purchase Present value $ $ Which of the two approaches should Pronghorn Inc. follow? Pronghorn Inc. should the facilities Click if you would like to show Work for this question: Open Show Work CHORATON PINTER WON Problem 6-10 ronghorn Inc. owns and operates a number of hardware were in the New England region. Recently, the company has decided to locate mother more in proving of Maryland. They trying to decide whether to purchase of lesse building and related faces Purchase the company can contract the building and purchase wil store tures. The cost would be $1.163.600An immediate down payment of $415.00 ve and there $1.441.700 would be pad off every 350.400 per year incheiding interest payments made wend of year. The property is expects have and then we w for $10.00. As the the company with the Windows Property to read the end of each year) Insurance to be the beginning of each year) Other primary mantenance which course the end of each year) $40.270 27,170 16.30 163,620 Lear National Bank has agreed to purchase the construct the building, and the appropriate futures for Preghorn Inc. Ponhom willease the comfocy for 11 years. The acts for these would be an archers would have no responsibility related to the facility over the 11 years. The terms of the lease are that Pronohom would be red male 11 anual payment that want to be made the then each year). In depost of $100.000 is required when the more is opened. This deposit will be retured the end of the 11 e mungo saldare to building wordt er for cimal places 1.25124 and finala decimal places...) Compute the present Lease Present value $ of lewe vs purchase. (Currently, the cost of funds for Pronghom Inc.) (Round factor valus Parchase s Which of the two approaches should ronghorn Inc. follow? Pronghorn Inc. should the files Click you would like to Shew Work for this question On Show STA Question Attems of used 10% 11% 12% 15% 9% (n) Periods 8% 1.15000 1 1.08000 1.09000 1.10000 1.11000 1.12000 1.32250 2. 1.16640 1.18810 1.21000 1.23210 1.25440 3 1.25971 1.29503 1.33100 1.40493 1.52088 1.36763 1.74901 4 1.36049 1.41158 1.46410 1.51807 1.57352 2.01136 1.68506 1.76234 5 1.46933 1.53862 1.61051 2.31306 6 1.58687 1.67710 1.77156 1.87041 1.97382 1.71382 1.82804 1.94872 2.07616 2.21068 2.66002 3.05902 7. 8 9 1.85093 1.99256 2.14359 2.30454 2.47596 1.99900 2.17189 3.51788 2.35795 2.55803 2.77308 2.15892 3.10585 10 2.36736 2.59374 2.83942 4.04556 11 2.33164 2.58043 4.65239 2.85312 3.15176 3.47855 2.51817 2.81267 3.13843 3.49845 3.89598 12 5.35025 2.71962 3.06581 3.45227 3.88328 4.36349 13 6.15279 2.93719 3.34173 3.79750 4.31044 4.88711 7.07571 14 3.17217 3.64248 4.17725 4.78459 5.47357 8.13706 15 3.42594 3.97031 4.59497 5.31089 6.13039 9.35762 16 3.70002 4.32763 5.05447 5.89509 6.86604 10.76126 17 Table 6.1 FUTURE VALUE OF 1 (FUTURE VALUE OF A SINGLE SUM) FVF, = (1 + i)" () Periods 2% 24% 3% 4% 5% 6% 1 1.02000 1.02500 1.03000 1.04000 1.05000 1.06000 2 1.04040 1.05063 1.06090 1.08160 1.10250 1.12360 3 1.06121 1.07689 1.09273 1.12486 1.15763 1.19102 4 1.08243 1.10381 1.12551 1.16986 1.21551 1.26248 5 1.10408 1.13141 1.15927 1.21665 1.27628 1.33823 6 1.12616 1.15969 1.19405 1.26532 1.34010 1.41852 7 1.14869 1.18869 1.22987 1.31593 1.40710 1.50363 8 1.17166 1.21840 1.26677 1.36857 1.47746 1.59385 9 1.19509 1.24886 1.30477 1.42331 1.55133 1.68948 10 1.21899 1.28008 1.34392 1.48024 1.62889 1.79085 11 1.24337 1.31209 1.38423 1.53945 1.71034 1.89830 12 1.26824 1.34489 1.42576 1.60103 1.79586 2.01220 13 1.29361 1.37851 1.46853 1.66507 1.88565 2.13293 14 1.31948 1.41297 1.51259 1.73168 1.97993 2.26090 55707 1 04 07903 ROKSA Problem 6-10 Pronghorn Inc, owns and operates a number of hardware stores in the New England region. Recently, the company has decided to locate another store in a rapidly growing area of Maryland. The company is trying to decide whether to purchase or lease the building and related facilities. Purchase: The company can purchase the site, construct the building, and purchase all store fixtures. The cost would be $1,865,600. An immediate down payment of $415,900 is required, and the remaining $1,449,700 would be paid off over 5 years at $358,400 per year (including interest payments made at end of year). The property is expected to have a useful life of 11 years, and then it will be sold for $510,500. As the owner of the property, the company will have the following out-of-pocket expenses each period. Property taxes (to be paid at the end of each year) $40,270 Insurance (to be paid at the beginning of each year) 27,170 other (primarily maintenance which occurs at the end of each year) 16,380 $83,820 Lease: First National Bank has agreed to purchase the site, construct the building, and install the appropriate fatures for Pronghorn Inc. if Pronghorn will lease the completed facility for 11 years. The annual costs for the lease would be $277,580. Pronghorn would have no responsibility related to the facility over the 11 years. The terms of the lease are that Pronghorn would be required to make 11 annual payments (the first payment to be made at the time the store opens and then each following year). In addition, a deposit of $109,000 is required when the store is opened. This deposit will be returned at the end of the 11th year, assuming no unusual damage to the building structure or fixtures. Click here to view factor tables Compute the present value of lease vs purchase. (Currently, the cost of funds for Pronghorn Inc. is 9%) (Round factor values to decimal places 1.25124 and finala to o decimal places, c. 458,581) Lease Purchase Present value $ $ Which of the two approaches should Pronghorn Inc. follow? Pronghorn Inc. should the facilities Click if you would like to show Work for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts