Question: I provided some working however, not sure if im correct - could you please have a look :) QUESTION 2 Depreciation and overhauls GST version

I provided some working however, not sure if im correct - could you please have a look :)

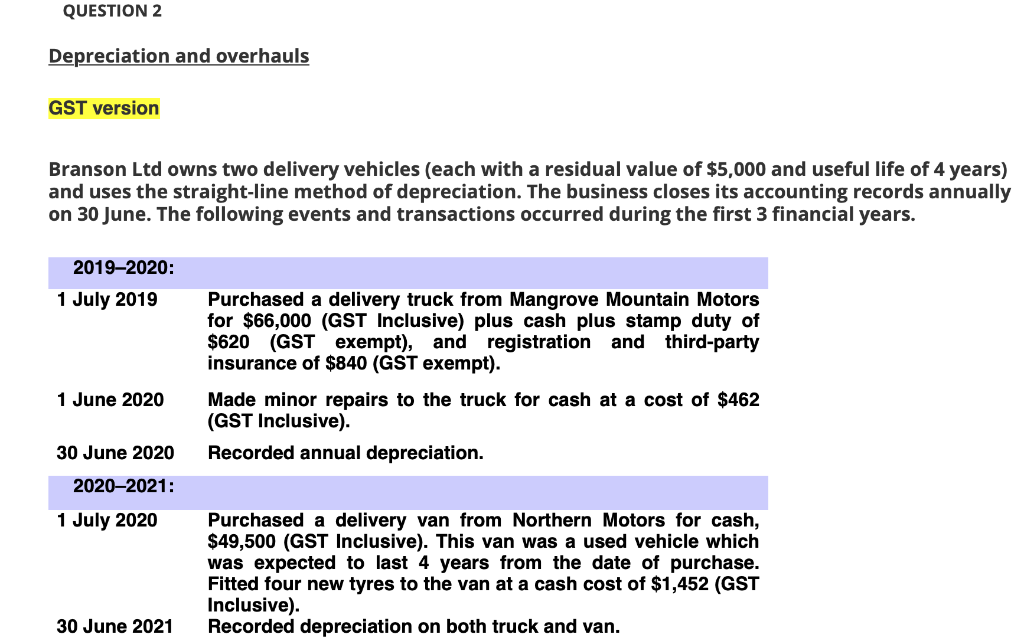

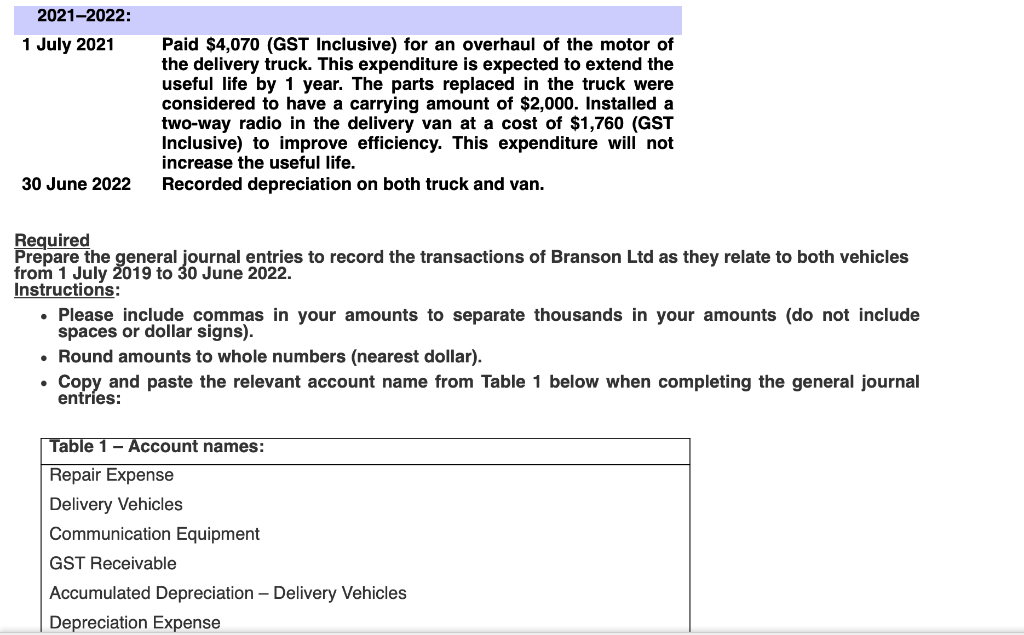

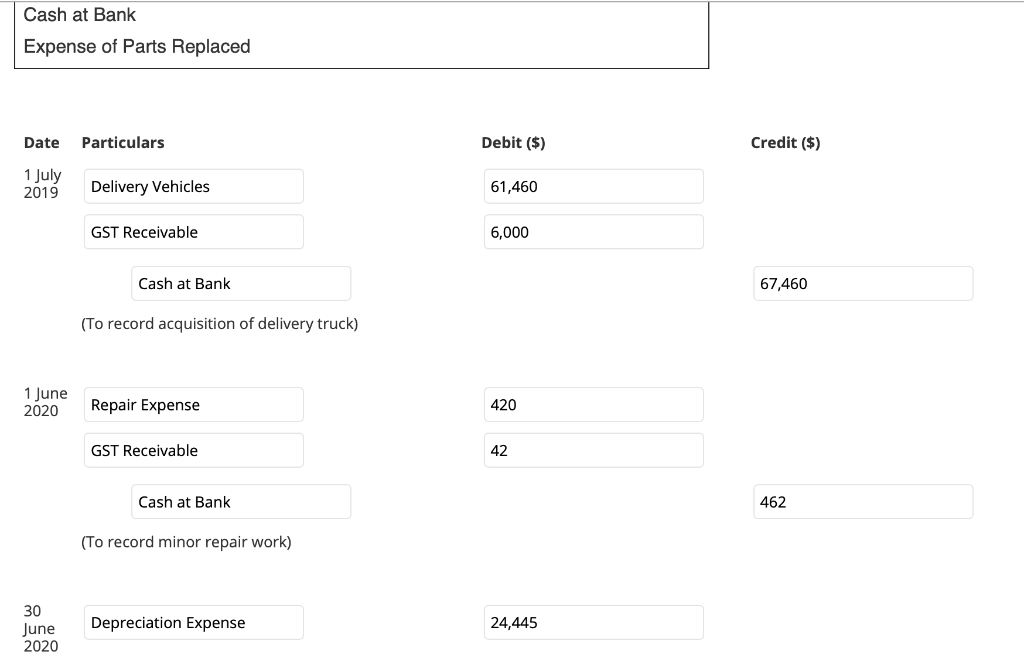

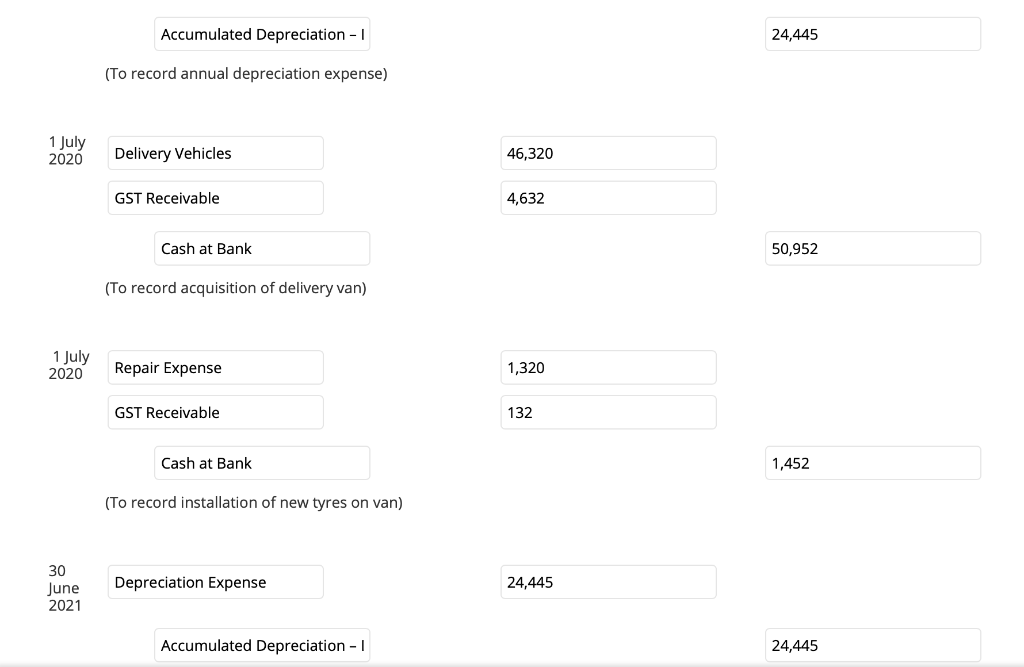

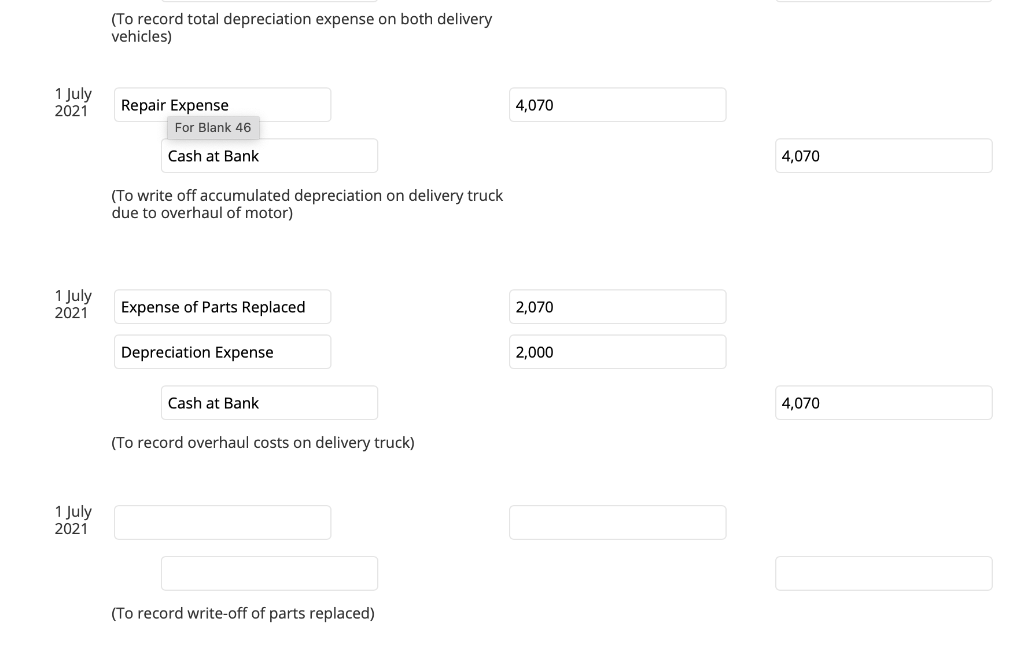

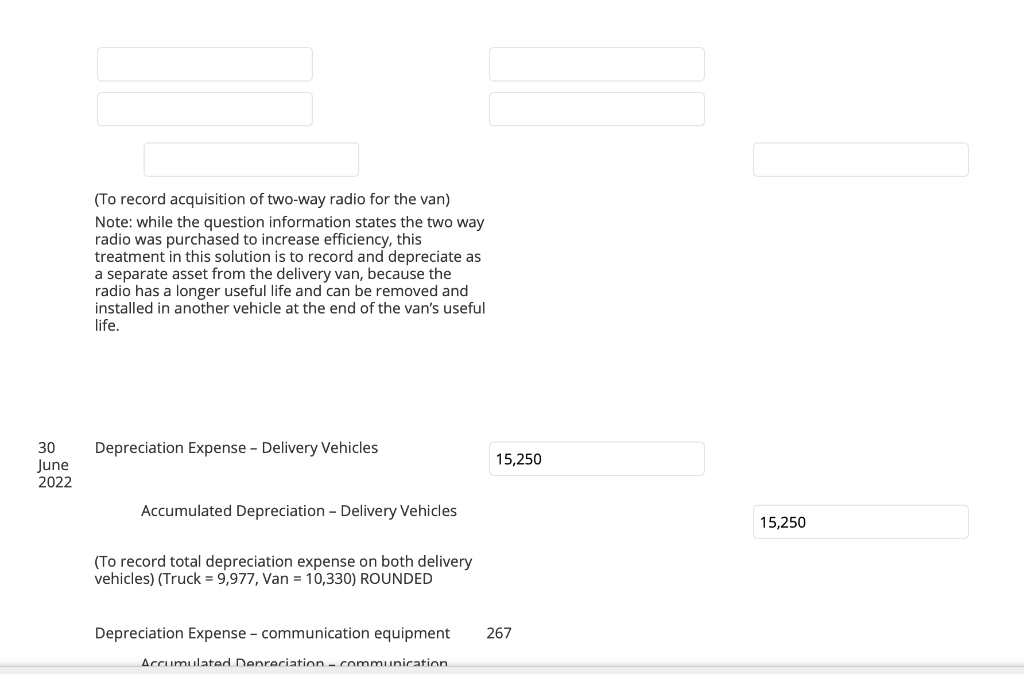

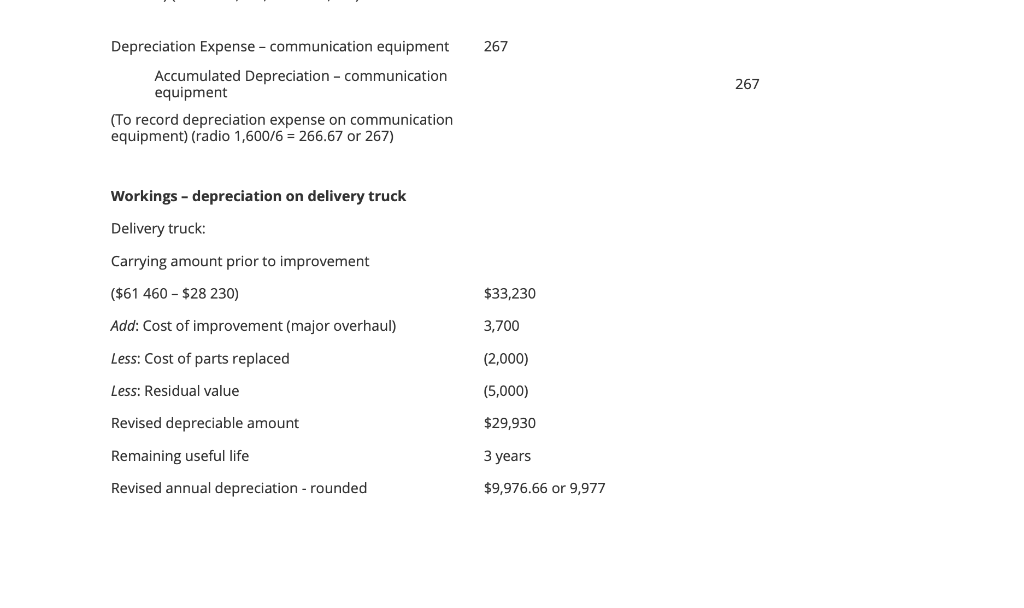

QUESTION 2 Depreciation and overhauls GST version Branson Ltd owns two delivery vehicles (each with a residual value of $5,000 and useful life of 4 years) and uses the straight-line method of depreciation. The business closes its accounting records annually on 30 June. The following events and transactions occurred during the first 3 financial years. 2019-2020: Purchased a delivery truck from Mangrove Mountain Motors for $66,000 (GST Inclusive) plus cash plus stamp duty of $620 (GST exempt), and registration and third-party insurance of $840 (GST exempt). Made minor repairs to the truck for cash at a cost of $462 (GST Inclusive). Recorded annual depreciation. Purchased a delivery van from Northern Motors for cash, $49,500 (GST Inclusive). This van was a used vehicle which was expected to last 4 years from the date of purchase. Fitted four new tyres to the van at a cash cost of $1,452 (GST Inclusive). Recorded depreciation on both truck and van. 1 July 2019 1 June 2020 30 June 2020 2020-2021: 1 July 2020 30 June 2021 2021-2022: 1 July 2021 Paid $4,070 (GST Inclusive) for an overhaul of the motor of the delivery truck. This expenditure is expected to extend the useful life by 1 year. The parts replaced in the truck were considered to have a carrying amount of $2,000. Installed a two-way radio in the delivery van at a cost of $1,760 (GST Inclusive) to improve efficiency. This expenditure will not increase the useful life. 30 June 2022 Recorded depreciation on both truck and van. Required Prepare the general journal entries to record the transactions of Branson Ltd as they relate to both vehicles from 1 July 2019 to 30 June 2022. Instructions: Please include commas in your amounts to separate thousands in your amounts (do not include spaces or dollar signs). Round amounts to whole numbers (nearest dollar). Copy and paste the relevant account name from Table 1 below when completing the general journal entries: Table 1 - Account names: Repair Expense Delivery Vehicles Communication Equipment GST Receivable Accumulated Depreciation - Delivery Vehicles Depreciation Expense Cash at Bank Expense of Parts Replaced Date Particulars 1 July 2019 1 June 2020 30 June 2020 Delivery Vehicles GST Receivable Cash at Bank (To record acquisition of delivery truck) Repair Expense GST Receivable Cash at Bank (To record minor repair work) Depreciation Expense Debit ($) 61,460 6,000 420 42 24,445 Credit ($) 67,460 462 1 July 2020 1 July 2020 30 June 2021 Accumulated Depreciation - I (To record annual depreciation expense) Delivery Vehicles GST Receivable Cash at Bank (To record acquisition of delivery van) Repair Expense GST Receivable Cash at Bank (To record installation of new tyres on van) Depreciation Expense Accumulated Depreciation - I 46,320 4,632 1,320 132 24,445 24,445 50,952 1,452 24,445 1 July 2021 1 July 2021 1 July 2021 (To record total depreciation expense on both delivery vehicles) Repair Expense For Blank 46 Cash at Bank (To write off accumulated depreciation on delivery truck due to overhaul of motor) Expense of Parts Replaced Depreciation Expense Cash at Bank (To record overhaul costs on delivery truck) (To record write-off of parts replaced) 4,070 2,070 2,000 4,070 4,070 30 June 2022 (To record acquisition of two-way radio for the van) Note: while the question information states the two way radio was purchased to increase efficiency, this treatment in this solution is to record and depreciate as a separate asset from the delivery van, because the radio has a longer useful life and can be removed and installed in another vehicle at the end of the van's useful life. Depreciation Expense - Delivery Vehicles 15,250 Accumulated Depreciation - Delivery Vehicles (To record total depreciation expense on both delivery vehicles) (Truck = 9,977, Van = 10,330) ROUNDED Depreciation Expense - communication equipment 267 Accumulated Depreciation - communication 15,250 Depreciation Expense - communication equipment 267 Accumulated Depreciation - communication equipment (To record depreciation expense on communication equipment) (radio 1,600/6 = 266.67 or 267) Workings - depreciation on delivery truck Delivery truck: Carrying amount prior to improvement ($61 460 - $28 230) Add: Cost of improvement (major overhaul) Less: Cost of parts replaced Less: Residual value Revised depreciable amount Remaining useful life Revised annual depreciation - rounded $33,230 3,700 (2,000) (5,000) $29,930 3 years $9,976.66 or 9,977 267

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts