Question: I provided the notes too to help understand what the questions are asking. Please help. Thank you! #5 Distributions and amount of dividend A. Current

I provided the notes too to help understand what the questions are asking. Please help. Thank you!

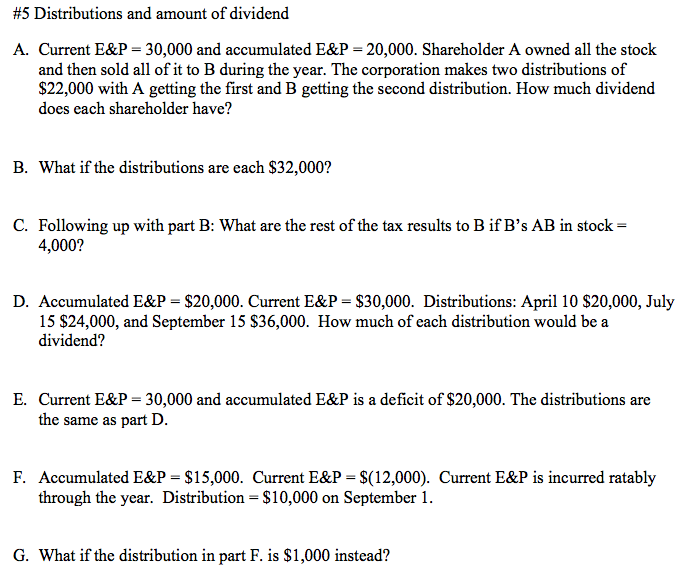

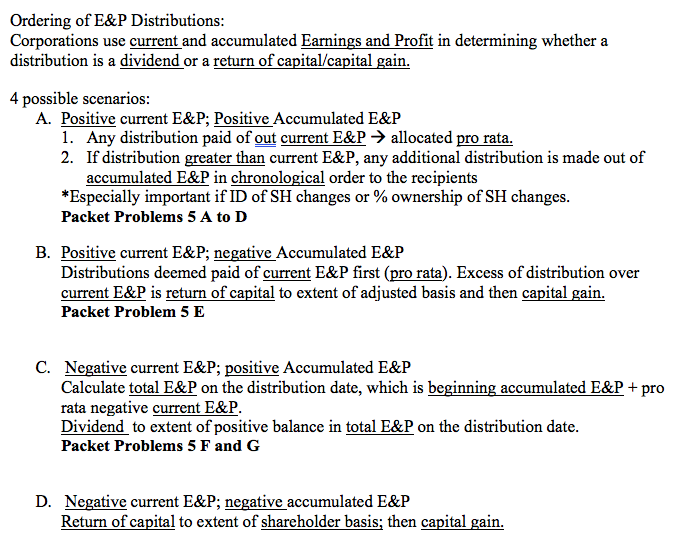

#5 Distributions and amount of dividend A. Current E&P = 30,000 and accumulated E&P = 20,000. Shareholder A owned all the stock and then sold all of it to B during the year. The corporation makes two distributions of $22,000 with A getting the first and B getting the second distribution. How much dividend does each shareholder have? B. What if the distributions are each $32,000? C. Following up with part B: What are the rest of the tax results to B if B's AB in stock = 4,000? D. Accumulated E&P = $20,000. Current E&P = $30,000. Distributions: April 10 $20,000, July 15 $24,000, and September 15 $36,000. How much of each distribution would be a dividend? E. Current E&P = 30,000 and accumulated E&P is a deficit of $20,000. The distributions are the same as part D. F. Accumulated E&P = $15,000. Current E&P = $(12,000). Current E&P is incurred ratably through the year. Distribution = $10,000 on September 1. G. What if the distribution in part F. is $1,000 instead?Ordering of E&P Distributions: Corporations use current and accumulated Earnings and Profit in determining whether a distribution is a dividend or a return of capital/capital gain. 4 possible scenarios: A. Positive current E&P; Positive Accumulated E&P 1. Any distribution paid of out current E&P > allocated pro rata. 2. If distribution greater than current E&P, any additional distribution is made out of accumulated E&P in chronological order to the recipients *Especially important if ID of SH changes or % ownership of SH changes. Packet Problems 5 A to D B. Positive current E&P; negative Accumulated E&P Distributions deemed paid of current E&P first (pro rata). Excess of distribution over current E&P is return of capital to extent of adjusted basis and then capital gain. Packet Problem 5 E C. Negative current E&P; positive Accumulated E&P Calculate total E&P on the distribution date, which is beginning accumulated E&P + pro rata negative current E&P. Dividend to extent of positive balance in total E&P on the distribution date. Packet Problems 5 F and G D. Negative current E&P; negative accumulated E&P Return of capital to extent of shareholder basis; then capital gain