Question: I provided the question along with the excel sheet. please help. thanks! 21. (NPV, IRR, EAC, PI, challenging) Your company is considering an investment in

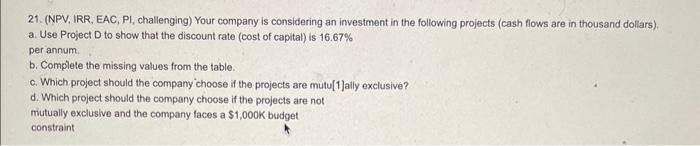

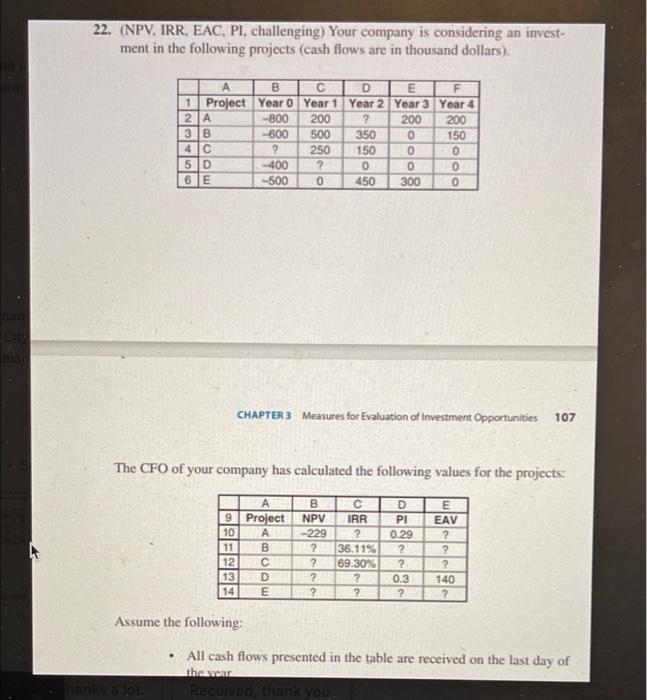

21. (NPV, IRR, EAC, PI, challenging) Your company is considering an investment in the following projects (cash flows are in thousand dollars). a. Use Project D to show that the discount rate (cost of capital) is 16.67% per annum. b. Complete the missing values from the table. c. Which project should the company "choose if the projects are mutu[1]ally exclusive? d. Which project should the company choose if the projects are not mutually exclusive and the company faces a $1,000K budget constraint 22. (NPV, IRR, EAC, PI, challenging) Your company is considering an investment in the following projects (cash flows are in thousand dollars). CHAPTER 3 Measures for Evaluation of Investment Opportunities 107 The CFO of your company has calculated the following values for the projects: Assume the following: - All cash flows presented in the table are received on the last day of the vear 21. (NPV, IRR, EAC, PI, challenging) Your company is considering an investment in the following projects (cash flows are in thousand dollars). a. Use Project D to show that the discount rate (cost of capital) is 16.67% per annum. b. Complete the missing values from the table. c. Which project should the company "choose if the projects are mutu[1]ally exclusive? d. Which project should the company choose if the projects are not mutually exclusive and the company faces a $1,000K budget constraint 22. (NPV, IRR, EAC, PI, challenging) Your company is considering an investment in the following projects (cash flows are in thousand dollars). CHAPTER 3 Measures for Evaluation of Investment Opportunities 107 The CFO of your company has calculated the following values for the projects: Assume the following: - All cash flows presented in the table are received on the last day of the vear

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts