Question: I put down $70,000 gain for my answer, but it was incorrect. Josh purchases a personal residence for $278,000 but subsequently converts the property to

I put down $70,000 gain for my answer, but it was incorrect.

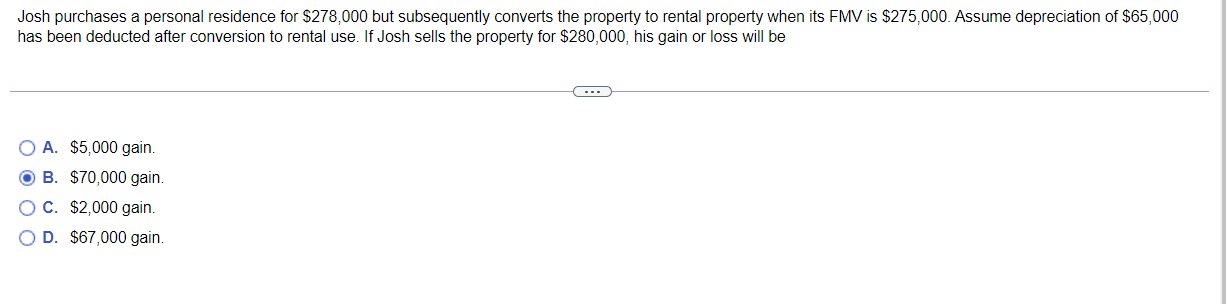

Josh purchases a personal residence for $278,000 but subsequently converts the property to rental property when its FMV is $275,000. Assume depreciation of $65,000 has been deducted after conversion to rental use. If Josh sells the property for $280,000, his gain or loss will be O A. $5,000 gain. O B. $70,000 gain. OC. $2,000 gain. OD. $67,000 gain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts