Question: I put in the numbers and got something wrong! Thanks in advance. Required Information [The following information applies to the questions displayed below.] Karane Enterprises,

I put in the numbers and got something wrong! Thanks in advance.

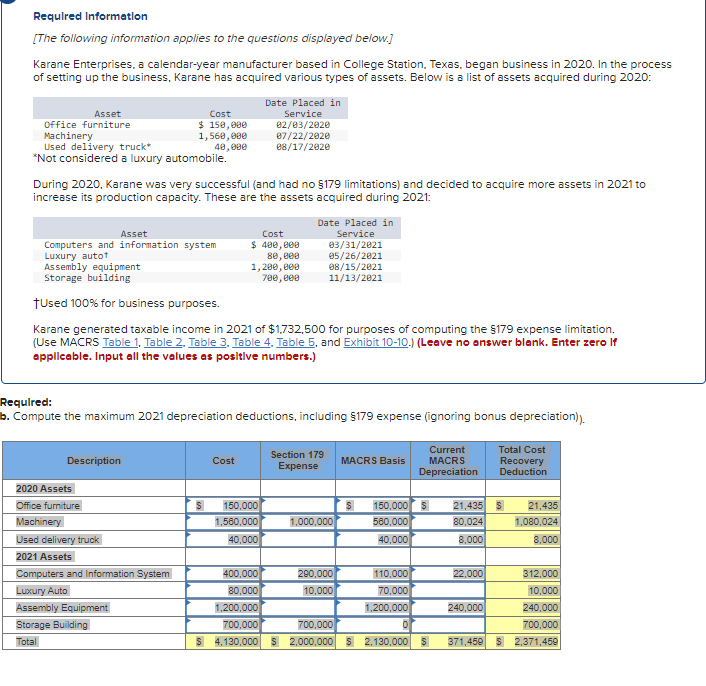

Required Information [The following information applies to the questions displayed below.] Karane Enterprises, a calendar-year manufacturer based in College Station, Texas, began business in 2020. In the process of setting up the business, Karane has acquired various types of assets. Below is a list of assets acquired during 2020: Date Placed in Asset Cost Service Office furniture $ 158,00 02/03/2020 Machinery 1,560,eee 07/22/2020 Used delivery truck 48,000 08/17/2020 *Not considered a luxury automobile. During 2020, Karane was very successful and had no 5179 limitations) and decided to acquire more assets in 2021 to increase its production capacity. These are the assets acquired during 2021: Date Placed in Asset Cost Service Computers and information system $ 480, eee 03/31/2021 Luxury autot 80, eee 05/26/2821 Assembly equipment 1,200, eea 08/15/2021 Storage building 780, eea 11/13/2021 tUsed 100% for business purposes. Karane generated taxable income in 2021 of $1.732,500 for purposes of computing the $179 expense limitation. (Use MACRS Table 1. Table 2. Table 3. Table 4. Table 5, and Exhibit 10-10.) (Leave no answer blank. Enter zero If applicable. Input all the values as positive numbers.) Required: b. Compute the maximum 2021 depreciation deductions, including $179 expense (ignoring bonus depreciation)). Description Cost Section 179 Expense MACRS Basis Current MACRS Depreciation Total Cost Recovery Deduction $ $ 150,000 1,560,000 40,000 1,000,000 150,000 $ 560,000 40,000 21,435 S 80.024 8,000 21,435 1,080.024 8.000 2020 Assets Office furniture Machinery Used delivery truck 2021 Assets Computers and Information System Luxury Auto Assembly Equipment Storage Building Total 22.000 400.000 290,000 110,000 80.000 10,000 70,000 1,200,000 1,200,000 700.000 700,000 0 $ 4,130,000 $ 2.000.000 2,130,000 240,000 312,000 10,000 240,000 700.000 $ 2,371,450 $ 371,450

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts