Question: I rate! thank you :) please make sure final answer is correctly numbered Question 19 8 pts Under different market conditions, the performance of U.S

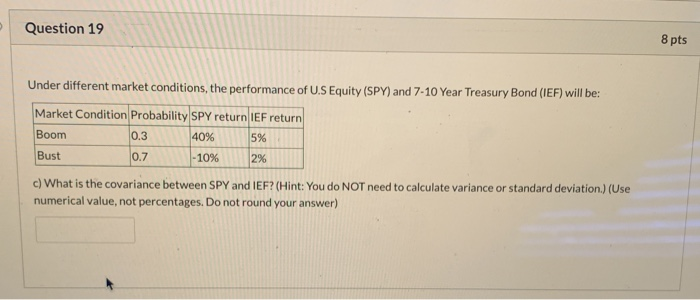

Question 19 8 pts Under different market conditions, the performance of U.S Equity (SPY) and 7-10 Year Treasury Bond (IEF) will be: Market Condition Probability SPY return IEF return Boom 0.3 40% Bust 0.7 -10% 2% c) What is the covariance between SPY and IEF? (Hint: You do NOT need to calculate variance or standard deviation.) (Use numerical value, not percentages. Do not round your answer)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts